Chinese Climate Finance Demand and Investment Options Analysis

Abstract

The paper on investigating for funding gap in Chinese market for climate finance and investment was conducted among various professionals to find the current scenario in the country. The climate financing has become an important issue in the country as the majority of the global production occurs in China. The recent scenario has shown that funding gap is high in China for curbing carbon emissions in the country. The country requires huge investment for reducing carbon emissions by 2030 whereas its current investment scenario for climate financing can match the requirement by 25-30% only. Hence, the problem has aroused for the firms in China to accommodate the capital expenditure for adapting new technologies for carbon reduction in production. Moreover, the research problem of this study has reflected that the issue is going to be a headache for China in future. The study is important for the purpose of investigating the objectives of influencing factors such as capital market condition, government and private investment in climate financing and risk of bankruptcy cost due to raising funds from external agencies. The hypothesis of the study has been implemented in the paper with against the funding gap to be influenced by capital market, government investment, private financing and bankruptcy cost.

The study has conducted a positivist approach for investigating the topic and research questions. The deductive approach was used along with the survey strategy to obtain the quantitative data for this study. The survey was conducted among the 50 professionals belong to ESG, environmentalists and capital market expert in China. The questionnaires of the survey were presented through online mode so that the survey can be conducted within short period. The study has created a predictive model on basis of the independent variables for measuring the trend in the funding gap and its influencing factors. The result of the survey has shown that variables of the research model were valid on basis of their significance test and correlation test. The predictive model has shown that funding gap were influenced negatively by government investment, bankruptcy cost and capital market condition in China. On the other hand, private investment actually enhances the funding gap in reality for climate financing.

Acknowledgement

I express my gratitude and sincere thanks to the teachers, family members and my friends for their support and encouragement. I express my gratitude towards my mentor, without whom I would not have been able to conduct this research work. It is only with the guidance I have received from my mentor that I could understand the idea of research work and derive it in the form of this research work.

I would declare that the information as well as the data that I have shared in the form of this research are true to my knowledge. I have maintained all the research ethics which have been essential for this study. No confidential data were included in this research nor there have been any intend wrong interpretation of the ones that are presented.

Table of Contents

Chapter 2: Literature review on climate financing and investment 5

Initiatives of China in climate financing- International Funds 10

Figure 1: Climate fund status in China. 12

Equity and favoured international market 14

Chapter 3: Research methodology. 15

Selected philosophy and Justification. 16

Selected approach and Justification. 17

Selected strategy and Justification. 18

Selected design and justification. 18

Selected method and justification. 19

Data collection and analysis 19

Selected data collection method with justification. 20

Survey method and justification. 20

Chapter 4: Data analysis and findings 24

Data validation: Correlation analysis 25

List of figures

Figure 1: Climate fund status in China. 12

List of tables

Table 1: Descriptive analysis of control variable and dependent variable. 24

Table 3: Validation of variables 26

Table 4: R square value of predictive model 26

Chapter 1: Introduction

Background

The climate finance is a concept that is used practically for improving the climate by reducing greenhouse gases in environment. The principle of usage of this finance is based on curbing carbon emission in the economy for different activities. The climate financing are segmented into two directions – mitigation cost to reduce the emission of carbon from society in a controlled manner and adaptation of technologies related costs for curbing damage from carbon emission in climate. There are several new technologies are available, which might contribute in reducing carbon emissions in climate such as adapting renewable energy production, carbon capture and storage technologies and others. Furthermore, mitigation of risk can be possible by accommodating low carbon technologies and energy efficiency machineries in production. The investment for these technologies is high during the initial period and majority of the private companies require government intervention to finance such huge expenses. The commercial application of these new technologies is not only difficult to finance for the management, but also the raising such funds, which might reduce the profitability, is difficult to manage the shareholders. It is observed that many countries provide different types of assistances to its industries such as carbon credit for adapting low carbon emission technologies, tax rebate on basis of carbon emission, low cost fund to encourage adapting low carbon emitting technologies and special purpose vehicle finance for renewable energy production. However, it is observed that providing funds through energy credit, rebate on tax and mobilisation of energy efficient technologies in production does not reduce carbon emission in industry much. These vehicles of carbon financing is available for many years in many developed and developing countries. The impact of such indirect financing vehicles have not influenced much to reduce the carbon emission in developing countries where rapid economic expansion has contributed high growth in carbon emissions. Therefore, the government has to work on participation based financial market for raising climate financing vehicles such as bonds and equity raising opportunities where private financing for climate control may become easier for the private companies.

Rationale of study

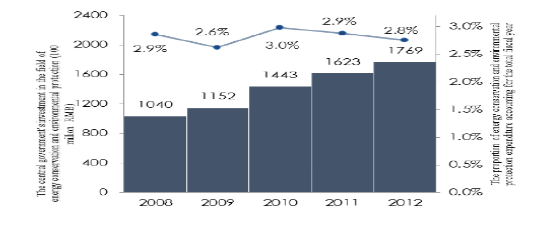

The climate financing on Chinese perspective is highly important as the gap between required fund for climate finance and actual investment is very high in China. The current scenario has shown that China requires almost $453 billion per year for decarbonisation in 2030 for its energy industry. The largest producer of end products has invested $87.6 billion per year from 2008-12 on an average basis (Amin, Shin and Holmes, 2014). The global climate and its financing is highly influenced by Chinese climate financing status. Therefore, this study on investigation on climate financing gap in Chinese industry is very important for global carbon emission as well as global perspective for climate financing stability. The Copenhagen accord in 2009 has prioritised $100 billion private investment and other mode of fund transferring methods for curbing environment pollution and carbon emissions in developing countries. Hence, the current study might find the current status of the carbon financing as well as the policy of the government to allow FDI and foreign investment for carbon emission. Some studies in past have concluded that 70% of foreign investments are mobilised for carbon emission mitigation projects in the industries. Only 25% of the funds are available for alternative technology adaptation for reducing carbon emissions, which is witnessed as a barrier to improve climate and carbon record in China (Steckel et al. 2017). Therefore, this study is important to find the obstacles for the investors for funding the adaptive technologies for curbing environment pollution and carbon emissions in China. The gap between carbon investment and demand of finance in Chinese industry is crucial from both investors and environmentalist perspective. Moreover, this study could bring into light regarding government financing in Chinese industry for reducing carbon emission. Hence, the importance of this study is for investors, encouraging them through inspection of Chinese government’s policies and motive for reducing emissions and to learn the gap between financing and investment. The result of this study might help the analyst, policy makers and industry professionals for raising funds through stable economic condition in future.

Research aim

The aim of the study is to analyse the current climate finance demand and investment options in the capital market of China.

Objectives

The objectives are as follows:

- To investigate the capital market conditions, issues and opportunities for climate financing in China

- To search the difference between government and private investment for climate financing in China

- To investigate the carbon fund flow through different instruments in China and financing cost

- To find the proper asset pricing model for balancing the equity and debt fund in climate financing in China by using predictive modelling

Research questions

The research questions are as follows:

- How much funding gap is observed for China over the past few years for carbon financing?

- What are the issues for drawing attraction of climate funding in China?

- Why China has failed to attract and manage the foreign investment in climate fund properly?

Structure

The paper is structured in different chapters throughout the research for exploring the entire investigation on climate finance and investment gap in China. There are five chapters, which have contributed for this study to explain the researched details as follows:

Chapter 1: Introduction – The chapter 1 has introduced the topic of the paper along with discussing about the background of climate financing and its requirement in the world. The discussion has led to explain the rationale about this study and its importance in Chinese context. The external references of climate finance and investment requirement for decarbonisation of Chinese industry are explained in this chapter. Moreover, this chapter is important as aims and objectives of the study are designed in appropriate manner. Finally, this chapter has provided the research question of this paper.

Chapter 2: Literature review – The second chapter of this paper has discussed the literature on the topic with reference to previous studies related to the topic. The climate finance and investment in Chinese context has been the theme of this critical review from past studies. This chapter has explained the government’s policies such as fiscal and monetary policies in critical manner for climate financing. Moreover, the current policies in Chinese context are also discussed in this chapter.

Chapter 3: Research methodology – the chapter has is very important for this paper as it has designed the methodology to conduct the research. The statistical model is built up in this chapter for this paper to find the importance of climate financing and current gaps in Chinese industry. The chapter has explained the chronological order of method to conduct every stage of this research along with justification.

Chapter 4: Findings and analysis – This chapter provided the exploration of the study by providing the brief data on survey in both descriptive and inferential ways. The chapter has analysed the surveyed data by using appropriate statistical instruments.

Chapter 5: Discussion – this is the final chapter of this study where the analysed data is discussed along with justifying the analysis meeting the research objectives. Moreover, this chapter has also provided discussion on recommendations regarding the research problem as well as objectives. The chapter has provided the future guidance to this research too.

Chapter 2: Literature review on climate financing and investment

There are lots of channels for climate financing in the world such as leveraging, fiscal policies of government, carbon pricing and other private investments. It is the decision of the states to decide which financing methods to be used for climate control and environment resurrection. In changing world of climate, the financing is necessary in several forms – from both government and private finance. The leading global investment bankers and other financial institutions are leveraging many of the institutions of developing nations for using climate protective technologies and other measures for environment protection. In this context, policies of the government required to be evaluated to find the ease of climate financing. Moreover, the literature has to discuss about the climate financing and investment market in China. Government has three types of policies such as fiscal, financial and monetary policies for tackling climate issues. On the other hand, the policies related to China and current situation in the country related to climate financing is been assessed in the literature.

Fiscal policy

The fiscal policy may use Pigouvian taxes for curbing the emissions at the source along with providing subsidies for R&D. there are lot of fiscal tools that might help to control the public spending and investment of the governments. The expression of interest for implementing the same in practice requires to include the carbon tax trajectories and scaling those with the international level (Arezki et al. 2017). The fiscal policies tools can be categorised into three categories –pricing, spending and investment and guarantees, which are inter-linked policies. Price policies are such as carbon tax and cap-and-trade schemes, subsidies for mitigating actions, low carbon investment strategies, interest rate subsidies, freebates, tax breaks and others. Spending and investment tools are like concessional loans and outright public investment. The climate financing might see higher level of private participation due to public guarantees (Dikau, Robins and Täger, 2019).

The private participation could be observed in mitigation actions such as renewable power generation and improving energy efficiency. On the other hand, the public spending on mitigation actions might be witnessed for public transportation, expanding electric grid network for reaching renewables and carbon capture and storage site building. The carbon pricing is designed in appropriate way for mitigating the risk of environment with suitable strategy and implementing the same successfully (Anderson, 2015). The carbon tax level should be determined on basis of the social cost of carbon amounting of damages from emissions. Moreover, removing subsidies may help to curb the carbon emission for the productions. The evidences of carbon emission reduction through carbon pricing tax are obtained in previous literatures. Moreover, it may increase the fiscal revenues for the government bodies (Battiston, 2019). The higher fuel prices for carbon tax makes the firms efficient to curb the emissions from their productions and they use innovative ways to do the same. The low carbon pricing countries have shown low energy efficiency in practice and spending a lump sum portion for energy bills (Aghion, Hemous and Veugelers, 2009). The automotive sector might find it as a barrier and the problem for this sector might not be solved with high carbon pricing. The success probability of carbon tax is low and it requires to obtain socio-political confirmation before implementation in reality (Admati, 2017).

The spending and investment policies may also change the climate financing where the public procurement on such machineries or products might boost up the low carbon innovation. Green public procurement standards might help to boost up the low-carbon products. The urban infrastructure and public transportation might obtain help from the infrastructure investment along with energy mix in use (Dietz et al. 2016). The public-private partnership (PPP) might draw adequate level of investment for climate financing by changing the government policies. The infrastructure projects and procurement management can be improved through PPP model and reduces the public spending. The low carbon financing level can be mitigated by providing public guarantees where the project developers risk can be reduced by this instrument. Moreover, the policy would scale-up the investment in the developing countries through leveraging the development banks (Krogstrup and Oman, 2019).

Financial policy

The private investment mobilisation can be done by stabilising the financial policies of a developing country and making its suitable for green financing. The technological transformation in reduction of environmental emissions is path-breaking way and driver for climate financing. The key to R&D and productive capacity of emission control is private investment to change the large economic activity (Harrison, 2013), fiscal policies might not provide the boost to these investments in a proper way. Moreover, carbon tax might discourage the private investors to participate in low-carbon financing projects.

There are four different types of financial policies as follows:

Redressing possible mispricing and incremental transparency of climate risks

Reducing short-term bias and improving governance

Supporting the development of financial market for green financing

Policy trade-offs for incentivising climate investments

The first tool for financial policy addresses the physical, transition and liability risks of the investments. The climate related risks are systematic, which has the potential to influence the entire economy. The balance sheet of the companies might not show the climate related risks appropriately and the underprice risks may evolve during the materialisation of climate risks (Ball et al. 2016). Furthermore, historical behaviour of the climate risks are not same and it is unprecedented for measuring the future climate risks. The measurement requires to rely on the scientific measurement of change in climate along with new risk-price framework. The companies require to provide enough disclosures about the climate related risks in their report for improving the risk pricing and transparently assessing the climate risks. The capital adequacy risk is not included in Basel III prudential framework reflecting that climate risk might be priced cheaper in new regulation for the banks (Hong, Li and Xu, 2019). Moreover, climate risks can be assessed by stress test where transition and physical tests can be conducted for the insurance and banking sectors.

The second financial policy tool requires reformulation of governing principle in the financial system for rewarding the social investment needs. In this context, the short-term bias happens for the uncertainty and it influences the governance issues. The reporting of the management might lack of internalisation of risk-taking, limited liability, tax subsidies to leverage and others. The institutions should address those issues for accessing long-term climate finance (Adrian et al. 2018).

It is observed that green financial securities have witnessed high demand recently, which has strong regulatory and governance framework. The issuers have to hire independent third parties for certifying green bonds before issuing in the market. The financial authorities in a country should clearly obtain a road map for developing green bond markets through creating platform, information sharing code and active participation in the market. There is another proposal of developing World Carbon Bank and including the SDR in that special low-carbon financing market (Blanchard and Summers, 2019). The international promotion and support of green financing might draw attention of many governments to uplift the obstacles of drawing funds from foreign investors for climate financing issues. The new investor would come for the companies in private ways along with international supports. The green bonds provide less benefits to the issuers compared to traditional bonds as it increases liquidity in the market by means of relabeling and repackaging the traditional bonds.

The climate finance should be promoted actively by the regulatory tools for increasing the demand by investors to obtain climate mitigation investments. It might reduce the price of investment relatively in future. The conventional financial model of the market, the perfect information, asset substitution and demand of specific assets do not change the relative price. The price and return model is based on CAPM model for measuring volatility on basis of covariance without changing the base of investors. The risks and benefits of low-carbon investments is uncertain that makes it eligible for going without conventional model. The demand and supply of unconventional securities changes the friction of relative prices due to preferred habitats and segmented market. The portfolio balance could be increased due to for changing the demand of low-carbon investment demand (Batten, 2018). The performance of green bond works better if the authority has placed the carbon taxation in practice.

The financial regulation may favour the demand increase program of green bonds without taking implied risk in the account. EU high-level expert group has initiated a supporting factor of green for raising the prospect of green bonds among the investors. It has also created a brown penalising factor – a prudential rule for increasing bank’s demand to boost up the financing of climate investment (Blanchard, 2019). The climate-friendly credits may be lowered for the capital requirement in alternative ways (Campiglio, 2016). The climate mitigation is also a regulatory tools for promoting the climate investment in some countries. However, the risks of encouraging to climate finance by using the existing prudential tools does exist in the current system. The capital requirements can be lowered for green bonds along with increasing the risk of macroprudential policy. The financial risk mitigation may fail for applying on the entire firm as the firm may engage in many other activities not matching with the target of lowering carbon level (Cerutti, Claessens and Laeven, 2017). Furthermore, the international prudential norms should not be deviated by any country unilaterally where policy framework might weaken to prospectively taking action for encouraging the international investors to participate in climate financing.

Monetary policy

The monetary policy is not used for long-term climate financing as it is used for stabilising the policies. However, the central banks should account the climate finance risks in its balance sheet for obtaining the defensive parameter on behalf of the desired investors in green bonds. The relevance of adapting the climate change in the financial accounting of the central bank might present the impact of the climate change in the business cycle, and economic growth. The change in temperature might change the demand in some sectors while it may generate different sector’s demand prospective (Krogstrup and Oman, 2019). The climate change mitigation can be adopted in the central bank’s role as supporter by stabilising the price as well as economic welfare. Monetary policy can redistribute the climate change mitigation as its secondary mandates. The central bank’s collateral framework may adapt climate change impact and green financing criteria for purchasing the large assets. In this way, low-carbon economy can be encouraged by central bank through adapting the low-carbon agenda in its monetary policies (Aghion et al. 2016). The central bank should eliminate the high-carbon intensity from its portfolio and should include the green bonds in its balance sheet for reflecting the correct risks of the climate. The quantitative easing of green assets in central bank’s portfolio may change in the collateral frameworks of central banks. The assessment of asset portfolio can be done appropriately for changing the portfolio with green bonds. The rating agencies have the bias towards the carbon intensive assets as they underestimate the climate related risks. Therefore, the central banks should purchase green assets as shift in its monetary policy reflecting the same in its portfolio the exposure of the risk of climate (Aglietta and Coudert, 2019). The reallocation of the financial resources towards the green initiatives is another measure in monetary policy of the central banks. It provides the guarantees to the climate financing investors if the central bank has shifted its assets towards green initiatives (Siciliani, 2019). The funding schemes of the commercial banks can be improved by central bank for those are investing in low-carbon assets.

There are problems with green quantitative easing for the central banks. The politicising of central bank’s policy making has created barrier for the green initiatives. The federal bank may obtain lower returns for shifting its balance sheet towards low-carbon assets. It may affect the consolidated budget of the government and in fiscal policy. The restriction of lawmakers to take initiatives for green bond purchasing of the central banks such as seen for US federal funds. The climate risk integration becomes difficult for the federal bank, USA for this reason as they cannot outright those high-carbon assets from its portfolio (Auffhammer, 2018). Quantitative easing might hamper for purchasing the green assets for price stabilisation in the market for inflation calibration. However, many of the low-carbon asset does not meet the risk standards of financial framework of the central banks as purchasing such assets may alarm the portfolios of central banks. Therefore, many of the low-carbon assets are restricted for the central banks to purchase as it may reduce the effectiveness of quantitative easing. Moreover, the economic downturns may bring the price of these green assets to zero, which may affect the portfolio of the central banks (Ball et al. 2016).

Initiatives of China in climate financing- International Funds

China is believed to be mostly affected by climate change which plays a key role in the environmental protection. Air pollutions has been regularly considered as a central theme for China as the whole northeast cities of China disappear in smog (The Climate Group, 2013). As per the statistics gathered by Centre for Development Research, China requires annual green investment amounting to atleast 315 million USD throughout the period of 13th Five-Year Plan (2016-2020) (Konrad Adenauer Stiftung, 2017). As a result of the financial limitations of the public sector, it is expected that almost 85-90% of all investments must be made by the private sector (Konrad Adenauer Stiftung, 2017). So as to develop a stable sustainable climate change and also to channelize the resources from the private sector, the establishment of an appropriate green financial system is needed.

There has been huge amount of international funds that have been invested in China over the last few decades. China is believed to be one of the recipients of funds raised by the developed nations. Major funds have been received as part of the green initiatives since the public funds are likely to be invested on developing the natural environment in China. Between 2008 and November 2012, the 46 initiatives that have been authorized in China have focused on 294 million USD of weather forecast commitments. The number of initiatives based on the multilateral funds fluctuated over the years with no venture sanctions in 2009. The total number of authorized tasks went down to 130 million USD in 2010 (China’s Low Carbon Finance and Investment Pathway, 2020). The bilateral source has offered USD 1.09 billion to China more up to 2010. Moreover, the European nations had provided USD 607 million in 2009 for undertaking the green initiatives within the country. Between 2006 and 2009, the OECD countries have invested around USD 1.68 billion through DAC countries like Germany, Australia and France. The export trade that has been provided by the developed nations to China between 2002-09 has been used in sectors like energy, transportation and industry. Only 1% of the export credit ensures export insurance, loan provision and investment insurance that are used by the nation in generating renewable energy (Climate Funds Update, 2020). The 12th Five-Year Plan of the nation has been approved through foreign loan amounting to USD 2338 billion from the international institutions and the foreign government. These funds mostly emphasize on forestry, agriculture, water, transportation, environment protection and energy conservation.

The studies have revealed that China has tried to comply with the goals set by Paris Agreement. It has committed to reach the peak of carbon emissions by 2030 in relation to economic performance at this point. In the 13th Five-Year Plan, the Chinese government has also specified “ecological red-line” which cannot be crossed and has to be maintained at all time. The People’s Bank of China along with other governmental departments has published certain directives for the setting up of a green financial system (Bo and Yao, N.A). These directives are likely to serve as a guideline for the establishment of green financial mechanism so as to enable a transformation to an economy. The central government of China has been able to send out positive signals to the financial industry and green companies. As far as mobilisation of private capital is concerned, these capitals would not instantly flow into the green sector without a combination of the government finances as well as the supporting laws (Bo and Yao, N.A). China’s central government finally undertook various measures so as to mobilise green investments within its carbon market which includes green bonds, green certificates and evaluation of creditworthiness of the environmental protection factors. In April 2015, the People’s Bank of China and the United Nations Environment Programme (UNEP) formulated a number of laws and official guidelines regarding the green bonds (Konrad Adenauer Stiftung, 2017). In October 2015, the first green bond from a Chinese provider came within the market. Studies have also indicated that the total green bond issuance in China was around USD 34 billion in 2018 which is two years after Beijing approved the first domestically issued green bond. The state-owned enterprises are considered to be more active in issuing of green bonds as compared to China’s privately-owned enterprises (Bo and Yao, N.A). Currently, bank loans have become the most important funding instruments for the Chinese companies. Within the credit markets, banks are likely to strengthen the credit support for energy-saving as well as ensuring a low-carbon economy. As per the statistics recorded by Energy Research Institute (ERI) financing needs would reach around 2.7503 trillion RMB by the end of 2020 so as to maintain the environmental friendly economy.

Domestic funds

The public funds that are invested within the aspect of weather exchange in China are mainly obtained from the general public monetary budget. Through incentives, direct grants, tax exemption, funding of state-owned assets, coverage budget, coverage banks etc. public budget have been able to support actions to deal with climate trade in China in the early years and also made investments from the capital market. Since the 11th Five-Year Plan, China has constantly promoted emission reduction, energy conservation and weather conditions so as to develop country wide strategy. During the 11th Five-Year Plan, the rate of increase of the countrywide monetary funding in environmental safety and in technology exceeded the GDP growth rate.

In 2010, the investment made on the environmental protection and technology initiatives increased to around 325 billion RMB and 244.2 billion RMB respectively, which also supported the growing rate of investments in the sectors of energy-saving and climate change (Full text: Report on China’s central, local budgets – Xinhua | English.news.cn, 2020). In the countrywide public expenditure made in 2011, total investment on Energy-Saving and Environment Safety (ESEP) increased to 264.1 billion RMB, out of which 43.944 billion RMB and 14.16 billion RMB were invested in energy consumption and development of renewable power respectively. It is important to mention that as compared to the previous practices of publishing total expenditure on ESEP, for the first time the investment monetary expenditure was presented in a detailed format on spending directly on renewable-energy, strength saving and climate change. It indicates the fact that climate finance is a substantial part of the financial budget. Since 2008, the investment made on ESEP by central government has been growing overtime. In 2012, the fiscal budget for ESEP increased to around 179.6 billion RMB. There have been no climate change expenditure states as per statistics launched by Ministry of Finance. It was roughly computed that the central authorities have invested more than 220 billion RMB under the 11th Five-Year Plan within the areas associated with weather finance. In 2011, the central government has invested 60.6 billion RMB on ESEP, a rise of 17% from 2010.

Figure 1: Climate fund status in China

(Climate Funds Update, 2020)

Private capital supply

The private sector is considered to be most important in providing capital to deal with climate change. The United Nations Framework Convention calculated that 80% of the capital need will be fulfilled by the businesses and consumers whereas the International Energy Agency is also likely to make 40% of investment by the end of 2020 (Konrad Adenauer Stiftung, 2017). Hong Kong is believed to be one of the major fund management hubs within Asia and it has been able to develop a dominant offshore RMB center. It has also been highlighted by the researchers that Hong Kong is playing a crucial role in ensuring the growth of the cleantech sectors in China by providing huge capital. In fact, as the city plans to remain a global financial hub, Hong Kong is likely to focus on the guiding investment flows for the cleantech innovation and the cimate friendly businesses.

Both the direct as well as indirect financing policies are considered as part of the traditional financial market where fund is usually generated through institutional and private investors. The domestic policies of China have deeply affected the energy saving and climate changing causes and the local companies in China are likely to attract more funds in this regard as part of the capital investment. The debt financing is the major contributor to climate funding for the Chinese companies. The projects associated with ESEP are expected to be funded through loans from the Chinese banks which increased to 29% from 25% in the previous year. Loan for the emerging industries have increased to RMB 363.46 billion in 2011. These loans have been provided by five banks namely Commercial Bank of China, China Development Bank, Agricultural Bank of China, China Construction bank and Bank of Communication. The loan amounted to more than RMB 1.9 trillion while the ESEP projects were handled (Build A World Class bankin New Era, 2020).

As China has initiated its process of developing its own domestic carbon market, the commercial banks play an important role in strengthening the financial instruments such as options and futures required for effective operations of the market (The Climate Group, 2011). It can also be stated that as institutional investors the insurance companies would also have a direct impact on making investments in the low carbon businesses. There has been a recent development within China’s climate financing regime that is the emergence of China as a donor for the developing nations. In 2011, a ‘South-South’ Cooperation Fund of around USD 31 million was set up for capacity building and donating energy saving products. The Chinese Development Bank had arranged for specific loan facility amounting to USD 774 million for small and medium enterprises in 29 African nations (Konrad Adenauer Stiftung, 2017).

Equity and favoured international market

The traditional as well as international financial markets are usually most opted for climate funding by the Chinese enterprises. The international commercial investment amounted to USD 66.05 billion in 2011. The fund obtained from the venture capital and private equity has also grown overtime. The sector of clean technology has also observed the rise in investment from USD 1.27 billion to USD 1.72 billion. Moreover, the clean energy has also accounted for around 4.27% of the total private equity investment. Insurance funds have also been made available for the low carbon assets from pacific Insurance Company, China. The company has invested closed to RMB 2.7 billion for Wujiang Hydropower Project (OECD Statistics, 2020).

Based on the review of the current government planning scenarios for achieving 2015-2020 emission intensity targets, the NDRC’s Energy Research Institute (ERI) has estimated that the country needs to invest around USD 273-305 billion a year by 2015 increasing to USD 353-385 billion a year by the end of 2020 on migration action (Konrad Adenauer Stiftung, 2017). As per NDRC, the majority of the investment must be made on energy demand side as well as energy efficiency improvements. The study has also depicted that the combined spending on the field of research and development and capacity building would be around USD 1.35 billion a year by the end of 2020 depending on the growth target set under 12th Five-Year Plan (Konrad Adenauer Stiftung, 2017). In fact, investing on the international climate cooperation is assumed to remain within the current levels.

Research hypothesis of this study are as follows:

H0: funding gap in climate financing is influenced by capital market, government financing, bankruptcy risk and private investment

Chapter 3: Research methodology

The methodology is a topic where the specialised approach is used for designing the method to conduct the study and investigation to find the research questions. The research methodology also helps in finding the way to conduct the research in systematic manner. The focus of research methodology provides the importance to philosophy with respect to the research aim and research questions. The research methodology might help the researchers to obtain the guidelines along with the justification for every step (Mackey and Gass, 2015). Without justified research method, a study might fail to provide the answer of the research question in a justified manner. Therefore, research methodology is crucial for every exploratory research where the researchers have to explore all the segments of a topic for deducing the hypothesis from current literature context. The research onion has explained the details about the steps of the methodology for this paper.

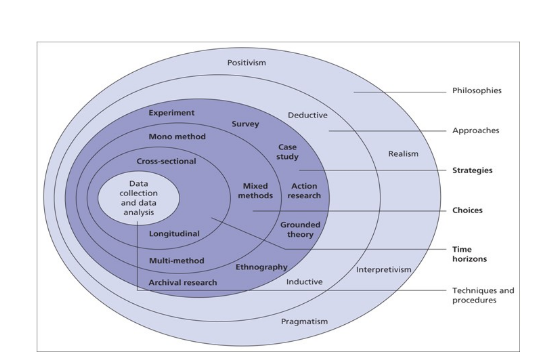

Research onion

The research onion prepares the design of the methodology in a planned manner for the researchers to help to investigate different types of studies. In addition to this, the domains of the research are prepared through onion as it presents the systematic and chronological order of studies. The five stages of a research are provided with the help of research onion for understanding the justification of the methodology. In this context, the five stages are philosophy, approach, strategies, periodical horizon and data collection method are the stages in an onion. The researcher obtains the guidance to conduct the investigation on the researched topic through onion. The model of research onion is the most exclusive and lucid manner of presentation to find the stages and phases of the study in academic. Below, there is a simple diagram on research onion is provided to understand the systematic phases of a study. The onion has suggested to start the research with stating the appropriating philosophy for the study. The selection of approach for a study provides the researcher to understand about the context and limitation of the research. In the third phase, the research strategy should be selected by the researcher as it provides the guidance about method in the next stage. The research choice is the next phase where the researcher has to find which or how many methods to be applied for conducting the research. The time horizon for investigation and data analysis are the next two consecutive stages of a study.

Figure 2: research Onion

(Source: Saunders et al., 2015)

Research philosophy

Philosophy of a research actually provides the guidance to the researchers for conducting a study in which manner. The philosophies such as positivism, realism, pragmatism and interpretivism – these are four types of guidance for the researchers to find the direction to conduct the studies. The past beliefs are not contested as false and making them as true solution for the research problem, the researchers have to conduct the study to find the solution of the gap from past studies. This is known as positivist’s philosophy to surpass the past studies for improvement in the current situation through modifications to reach the goal of the research (Choy, 2014).

Selected philosophy and Justification

This study has selected to conduct the research along with positivism philosophy as the existing knowledge on climate financing and investment gap cannot be ignored for finding the current gap in China. The research objective becomes less broad as philosophy allows to interpret subject topic to be focused through the existing theories. The application of positivism as philosophy is justified for this study as existing theories on climate financing and investment gap is deduced through the theoretical background. The critical discussion on the research gap for climate financing in Chinese industry and capital market is already found in previous studies. The issues and problems of investors for investing in Chinese market for decarbonisation as well as climate improvement are well discussed in past studies for implying the research problems and objectives. Therefore, studying this paper through positivist’s paradigm is justified for investigating the current issues for the policies and capital market situation.

Research approach

The research approach helps the researcher to propagate the study in different ways for reaching the aim of the study. The research limitation is also influenced with the approach of the researcher that allows him to find the limitations of every objective of a study. There are two approaches for any academic research – deductive and inductive. The limitation of deductive research is contextual and the researchers may not be able to interpret outside of the existing literature. The domain and range of the study becomes lower for a deductive approach (Flick, 2015). On the other hand, the researchers have the huge scope for conducting a study through inductive approach as it allows the academics to conduct the study in an experimental manner. The deductive approach suits for those studies where the aim and scope are previously decided by the researchers. The inductive approach does not allow to obtain the limitations of the study at the beginning. The future implication of the inductive approach is to create new theory whereas deduction allows the researcher to improve or modify the existing theories. Thereby, acceptance and rejection approach is presented along with the deduction of the current theories and conditions for deducing the hypothesis.

Selected approach and Justification

The current study has selected to conduct the investigation through deductive approach as it provides the freedom to the researcher to investigate on the current theories and deduce the issues in it. Moreover, it provides the structured manner of discipline to the investigation to find the specific issues for climate financing and investment gap in Chinese context. The deductive approach has also allowed the researcher to be bound the study for specific scope to obtain the specific result at the end. In this context, the deduction of the existing theories and concepts might help to conduct the study in a structured manner. Therefore, applying deductive approach for the investigation regarding the research question is suitable one. Moreover, it is suitable for finding the answer of research question by applying the appropriate research strategy in next phase.

Research strategy

The research design has the most important aspect through finding the appropriate strategy for conducting a research as it shows the right direction to the researcher for finding the answer of the research question. The research strategy shows the path of research method as well as types of data to be used for analysis to the researcher. Therefore, selecting the appropriate research strategy is crucial for the researcher to successfully conduct the study and finding the appropriate solution to the research problems. Moreover, the selection of the strategy depends on the primary idea on the data to be taken and in what form by the researchers (MacDonald, 2012). There are several research strategies such as experiment, survey, case study, action research, ethnography, grounded theory and archival studies. All of these strategies are not suitable for positivism or deductive approach as some of them are suitable for inductive approach.

Selected strategy and Justification

In this context, the researcher has selected the survey strategy for conducting the study as it provides the researcher an edge of conducting the study through primary information as well as quantitative analysis for obtaining the answer of research questions. Hence, it is understood that the researchers have to find the suitable research strategy for selecting the appropriate method in next phase. The survey strategy allows the current study to investigate on the research objectives through primary information. Moreover, survey method allows to conduct both the quantitative and qualitative methods of analyses to the researchers. Therefore, the flexibility is provided with the survey strategy to the researcher, which explains the justification of conducting the study through survey strategy. The opinions or structured interviews – both are allowed in survey strategy, which also maintains the time horizon as set by the researchers in the beginning of the study. Thereby, conducting this study along with the survey strategy is suitable and justified for the research.

Research design

The research design provides the researcher an idea about the data to be used for analysis as well as objective of the study in appropriate manner. There are both primary and secondary methods – these can be used for the study while selecting the appropriate design such as exploratory, descriptive or explanatory designs. The design is well connected with the research strategy as strategy provides the direction to the researchers for selecting the suitable design for conducting the study (Mangal, S.K. and Mangal, 2013).

Selected design and justification

In this context, the survey strategy is selected for conducting the study. Hence, the exploratory and explanatory designs are only possible options for the researchers. The descriptive design of a research is suitable for researching through secondary data where survey strategy cannot be used for designing the methodology. Moreover, the research objective of this case is to find the finding the gap between climate financing and investment in Chinese context in a statistical measurement. Therefore, the explanatory design is not suitable for conducting this study. Thereby, the researcher has selected the exploratory design of study for conducting the study. The exploratory design has allowed the researcher to find the climate finance issue and problems for the investors. The research model is presented in an empirical form that is suitable for exploratory method too. The aim of this research is to make a conclusion for the research question at the end. Therefore, conducting the study through exploratory design suits for investigating the answer of the research questions.

Research method

The research methods are of two types – primary and secondary methods. However, in a complex system, the researchers find a mixed method for conducting a research where both primary and secondary methods are plied for doing the study. The research method can be designed on basis of the design and strategy of the research as selected in the previous portions. The exploratory design and deductive strategy – both are suitable to conduct the research through primary and secondary methods (Moore et al. 2016). Moreover, the deductive strategy allows the researcher to conduct the study with respect to survey for primary research as an essential form of strategy. It is also observed that the researchers should select a research method for fulfilling the objectives of the research.

Selected method and justification

The mixed method is selected for this study as it provides the researcher an arena to use both primary and secondary data. The statistical analysis is dependent on the quantitative analysis whereas the discussion is led by comparing the result with the literature review. The literature review is part of the secondary data analysis where majority qualitative data is provided with the past studies. Further, the selection of mixed method is suitable for this study as the researcher has the ability to compare findings of survey with the past studies.

Data collection and analysis

The survey strategy, mixed method and research design of a study provides the clear direction to the data collection. However, the type of data is already explained in above sections that primary data is necessary for the quantitative analysis of finding the gap between climate financing and investment in Chinese context. On the other hand, the data collection process is not explained in the survey strategy where the sample size and process of conducting survey is justified by the researchers. The survey strategy provides ample of process to conduct the operation for a study. First the target population of the survey has to be declared with clear justification where the researchers might be able to provide enough reasons for selecting that target population for collecting information about the research questions. Further, the sample size requires justified number as without having justified sample size, a quantitative analysis may not provide the desired result.

Selected data collection method with justification

In this context, the targeted population is the Chinese industry personnel who are engaged in capital market for raising funds for various companies and some environmentalists and ESG specialists in Chinese industry. The targeted population is justified as all of these expert people work in climate financing and fund raising activities in China. The capital market experts are engaged in raising money for the industry to finance the decarbonisation programs whereas environmentalists are engaged in overseeing the operations of mitigation and adaptation policies of carbon emissions in Chinese industries. Moreover, the ESG experts in Chinese firms are engaged in fund management of environmental projects along with measuring the reduction in carbon emissions. Hence, selection of the target population for collecting sample for information is appropriate this paper. The sample size for this study is 50 as it might provide enough exposure to the researcher for finding the gap between climate financing and investment issues in China.

Survey method and justification

Data collection process is already discussed above, which is surveying the participants in the process. However, the justification of particular type of survey is required to be explained before conducting one. In survey, the structured interview and unstructured interview – both can be done. The first one requires little time for collecting information and analysing the same. Hence, this study has conducted the structured interview of the participants with the help of questionnaires. The questionnaires are designed in professional manner where options are provided against each one. The participants have to select the most appropriate answer from each option where the questionnaires are built with selective structure for obtaining the structured responses. The advantage of using a structured interview of the participants is obtaining appropriate answer regarding the research questions and the researcher does not deviate from the objectives (Tuohy et al. 2013). Hence, the data collection process through structured interview is justified for this study. Moreover, this process allows the researcher to find the response in short span and low cost budget.

The analysis of a research study is a crucial one where the researcher conducts the analysis of collected data from the survey. The type of analysis can be quantitative and qualitative – both for the quantitative data of a study. In this context, quantitative data is collected for the research, which requires to be addressed with quantitative analysis as quantitative data cannot be analysed in qualitative manner. In this context, descriptive and inferential – both types of statistical analyses are done to find the answer to the research questions. The research model has provided the variables and the predictive model for the inferential analysis of this study.

Model of analysis

The research model is analysed after defining the independent and dependent variables of the study. The variables definition are necessary as these ensure the appropriate outcome along with the research objectives. Carbon financing and investment gap (G) is the dependent variable for this study. On the other hand, the independent variables are defined on basis of the research questions. In this context, the independent variables are capital market condition (C), investment options – government (GI) and private (P), decarbonisation fund instruments and asset pricing through equity and debt funding in climate financing (A). In this context, the descriptive analysis of the captured data is made on basis of the control variable. In this context, the control variable is a demographic parameter – professional type from sample. There are three types of professionals are approached for participating in the survey – environmentalists (E), ESG expert (ESG) and capital market experts (CM). The descriptive analysis has shown the average response on four independent variables through control segmentation in the survey. Moreover, the predictive model is prepared on basis of the relationship between independent and dependent variables of this study. The G is dependent on the independent variables and all of the independent variables are influencing factors for carbon financing or investment. Therefore, the predictive model becomes as follows:

G = constant + β*C + β*G + β*P + β*A

Research limitation

The limitation of the research is a crucial issue and every researcher should mention the same during the explanation of methodology. The limitation of a study may come due to various reasons such as limitation of empirical model, limitation of available data, limitation due to time or money and limitations due to failure in survey to persuade the targeted population to participate. All of these limitations are possible for a study conducted undergo in survey strategy where the participants may not wish to join for office bureaucracy or due to less understanding about the research topic. Further, failure of empirical model to deduce the investigative objective properly is a common issue for a quantitative study. Moreover, data unavailability and resource limitations are also common factor for the academic studies. In this context, the resource unavailability is clearly observed as mentioned earlier stage. The researcher has to conduct the survey within few days as well as the research has not received any sponsorship from any section of the society. Therefore, the researcher has limited resources to conduct the survey in online mode. Further, the empirical model of predictive research is not entirely based on any prior study and there is possibility of failure of the predictive model analysis. Further, availability of data in Chinese context is not available up to date for climate financing and investment. The last data is available of up to 2017-18 for global investment in China for carbon projects and government’s financing of curbing carbon emissions up to 2016. Hence, it makes difficult to conclude the research questions as well as compare the findings with the real-life situation. Therefore, this study has lots of limitations, which may require to change or rectify for future research.

Ethical consideration

The ethical code of conduct is a crucial issue for every research. There are plenty of ethical code of conduct for different studies. In this context, the ethical consideration for studying quantitative analysis of carbon financing and investment gap in China requires to conduct a survey. The survey is a primary research where gathered data is raw information. The primary information gathering is possible by interacting with human being directly. Those participants should be aware of the survey and research topic clearly. The researcher has sent them the brief about the topic and usage of the gathered data from the responded during the survey (Moore, 2012). Further, the researcher has prepared the questionnaire in a sincere manner so that the participants do not find any discrepancy while responding to the survey. The structured questionnaires has not included any column where the participants have to fill up personal details. Moreover, the researcher has ensured that the gathered data could be used in the ongoing research and further academic studies. The gathered data for this purpose only and can be stored in secured place. The non-commercial agreement is a specific requirement for ethical consideration of the researcher to protect respondent s from public humiliation and harassment. The researcher has ensured that no product or bonds of carbon financing in China is not promoted through this study. The disclosures related to confidentiality and reliability of the survey have been provided with the questionnaires to the participants.

Chapter 4: Data analysis and findings

Data analysis is started with the data collection through the questionnaires sent to the participants. The questionnaires is prepared on basis of the proper objectification of the research questions. The first two questionnaires are all demographic where the queries are raised about the nature of experience, period and domain of experience in past for the respondents. The third questionnaire is about the dependent variable of finding gap of financing requirement and investment made in Chinese market for climate financing. The questionnaire 4 – 7 belong to first objective for finding data regarding condition of capital market in China for climate financing. The questionnaires 8 – 11 have fulfil to find data about difference between government and private financing for climate and decarbonisation related projects. Questionnaires from 12 and 13 belong to check the fund flow by different instruments in China and related finance cost. The final two questionnaires are set to check the risk of equity and debt financing for the current situation in Chinese firms due to climate financing.

Findings

Descriptive analysis

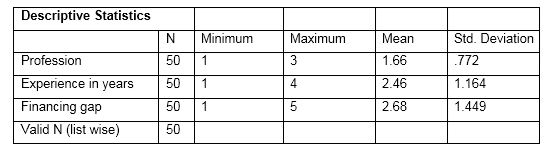

Table 1: Descriptive analysis of control variable and dependent variable

The descriptive analysis has shown that majority of the people either have profession related to ESG or environmentalists. The sample has shown only 9 professionals of financial capital market has participated in the survey. Moreover, the respondents have an average experience of more than 10 years as the average of experience is 2.46 (2= 6-10 years of experience). Further, the financing gap exists as per the responses of the participants in the survey as the average response is 2.68 from the survey. The standard deviation of financing gap is high indicating that major difference is observed due to different professions or experience level of the participants in the survey.

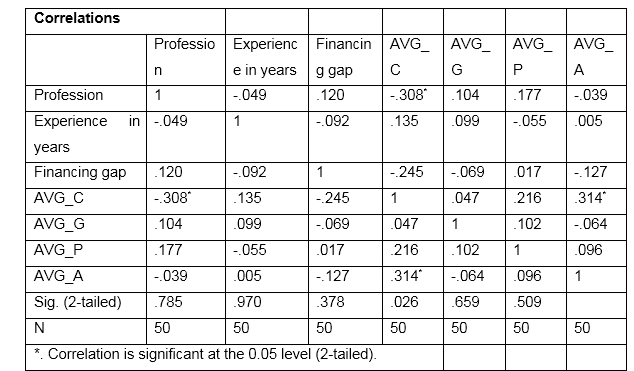

Data validation: Correlation analysis

Data validation is necessary before conducting an inferential analysis. The correlation test between all the responded variables show the collinearity among all the variables. Close to 1 or high collinearity among all the variables indicate that the test result is full of biased data and the researcher has to conduct the survey again for obtaining valid dataset. The table 2 shows the correlation result of the variables. In this context, all the average value of the responses for the independent variables are considered to test the collinearity. The correlation test shows that no variable (independent and dependent and control variables) is collinear and the dataset is valid for conducting the inferential analysis further.

Table 2: Data validation

Variable validation

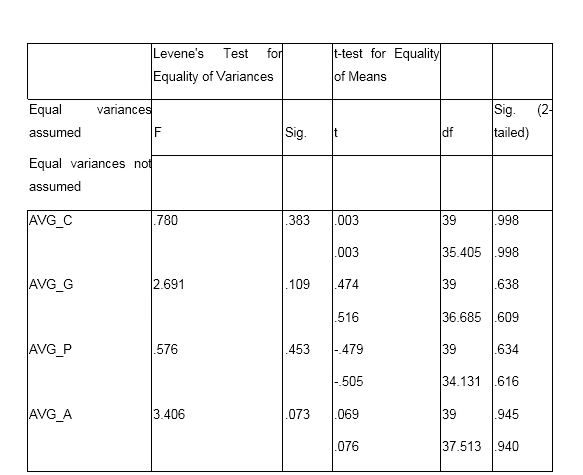

The variables in the predictive model are compared for their means assuming both equal variances and unequal variances for the variables. The below table shows the result of independent t test where levene’s test shows the equality of variances among all the independent variables. The result of Levene’s test is significant for the variables whereas t test results are not significant for the variables. It indicates that variables are not repetitive and valid for the test model. The test result shows that F ratios of all the variables are significant reflecting not much difference for influencing the outcome. Moreover, result of t test also has significant values and those are more than 0.05. Therefore, the two conditions of profession do not influence significantly different results for influencing the independent variables.

Independent T test

Table 3: Validation of variables

Regression modelling

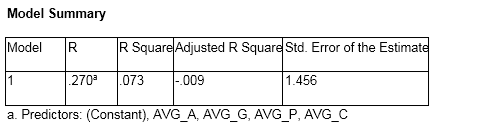

Table 4: R square value of predictive model

The R square value of the predictive model indicates the rate of success and linearity of the regression test of the variables. The value of R square for this predictive test is .073, which is far lower than 1. The result of R square is near to 1 reflecting low success rate due to poor collinearity of the variables. However, the validation of the model becomes high as there is

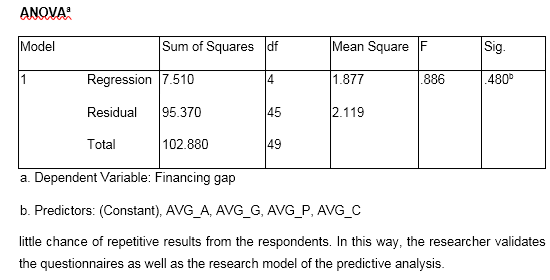

Table 5: ANOVA model

The f ratio of ANOVA model shows that test of predictive model is valid as well as significant. Therefore, the research model for deducing financing and investment gap in Chinese climate financing market is valid for this study.

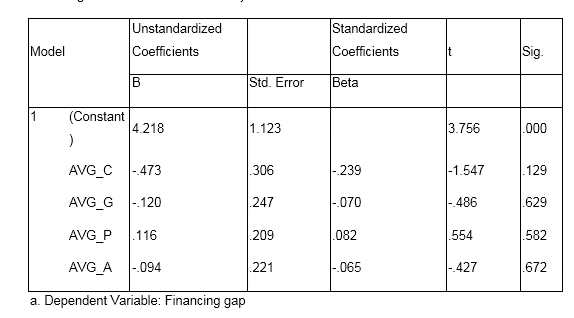

Table 6: regression test

(Created by author)

The regression equation can be drawn from the above table as follows:

G = constant + β*C + β*GI + β*P + β*A

G (financial gap) = .4218 – .473* C – .12* GI + .116* P – .094* A

The predictive model indicates that climate financing in Chinese firms is positive influenced by the private investment only. Other factors such as government investment, risk of the climate financing position and capital market condition (C) in China for climate financing are negative influencing the financial gap. The analysis of such interpretation also indicates that the Chinese firms require to improve the investment and return on investment. The predictive model indicates that coefficient of the regression equation is positive reflecting influence of the independent variables over the dependent variable. Hence, the test result is accepted as the hypothesis are not rejected for the variables selected for the predictive model.

Analysis

The analysis on the investment gap has shown that Chinese climate financing and investment gap is positively influenced by private financing options. Hence, the financial market of China related to climate funding has to open up for the private investors as it has driving power to scale up the climate financing. The gap is actually increased due to not having sufficient private investment as the gap is depending on the private investment for decarbonisation. The capital market condition and government investment over the climate financing are having negative influence over the gap between required financing and approved investment. Moreover, the risk of balancing the asset and debt in the balance sheet for asset pricing of the climate financing has negative impact on the gap of requirement. The results indicate that adequate level of government financing is available for Chinese firms through different instruments. Government provides enough soap to the Chinese firms for adapting new technologies for curbing carbon emissions and mitigating risk of pollution. Chinese government has encouraged the firms by providing low carbon tax, carbon credit and special borrowing capacity for the firms to improve machineries to reduce carbon emissions. In this context, the climate financing techniques applied by the capital market of China is impressive as it has negatively influenced financing needs for decarbonisation. The regulated market has constantly raised money from both the local and international funds whereas the regulation has not created much barrier for climate financing investment. The investors have not any issue for selecting their funds for climate financing as well. The risk of bankruptcy has negative impact on the funding gap for climate financing in Chinese firms currently. It indicates that China requires more climate financing investment in future and the position of debt to equity has not reached the tip of convergence for bankruptcy. Further, the private funding has positive impact on the climate financing indicating level of financing from private investors require much higher return on their investments. The private financing has increased the gap between financing needs and investment available for reducing carbon emissions in China. Moreover, the result has indicated that private financing might increase the gap between climate financing and investment in future as it increases the risk too. The test of hypothesis for this study has shown that capital market condition, government investment and bankruptcy risk of the climate financing of individual companies in China have no significant impact on the gap between climate financing and investment. Thereby, hypothesis 1, 2 and 4 are not accepted as the independent variables do not positively influence the gap between climate financing and investment to grow up. On the other hand, the climate financing and investment gap is increased by employing more private funds in the system.

Chapter 5: Discussion

The study on climate finance and investment has shown that the impact of different factors such as capital market condition, government investment, private investment and debt to equity position on funding gap in climate financing of Chinese firms exist in practice. The funding gap is available in China currently as current bankruptcy risk does not influence the funding gap much. The funding gap can be influenced by bankruptcy risk if the debt raising funds become overburden for the Chinese firms. The research questions on carbon financing is interpreted through the research for finding the critical answer on the same. The funding gap in the country is low again for high government funding as well as strong market participation in capital market. Both the debt and equity raising capacities of the firms are strong and the market participants infuse money in climate financing funds regularly. Further, the second research question on investigating the issues for drawing attraction for climate funding among the private investors. The strong participation and position of the capital market in the country for climate financing has drawn the private investors for investment in the country. Moreover, the private financing is positive in the country for decarbonisation projects as observed form the predicative model. Therefore, the negative impact is observed on the funding gap due to private participation as the current funding gap cannot be mitigated by the private investors only. The future course of action should find other alternatives for investment to reduce the funding gap. In this context, it is observed that China is the largest recipient of foreign investment in the last ten years for climate financing and decarbonisation projects. The private investment in climate financing is the highest in China in the last few years. However, it does not meet the requirement of the country as government funding level requires to be high in future for meeting the requirement and reducing the gap of funding.

Linking to objectives

Linking to objective 1: To investigate the capital market conditions, issues and opportunities for climate financing in China

The market conditions and issues in china for climate financing has shown to be positive as the predictive model explored from the analysis. The research model has shown that the perception of the participants have indicated market condition as a negative factor to influence the funding gap. Therefore, the current issues in regulation of climate financing does not affecting to raise money from the market for the Chinese firms. Further, opportunity for the firms to raise funds for climate financing and decarbonisation projects is high in the current condition as situation allows them to raise money for these projects easily. Further, the firms require to find the different options for financing these projects such as debt and equity, which are also regulated in the country. The foreign funds along with the domestic investors are allowed to invest in the climate financing projects individually in China (Aghion et al. 2016). The result of the predictive model has shown that the current situation in the country is exactly same where the government participation is meagre for climate financing in China. The rebate for carbon reduction and some allowances are not enough for Chinese firms to reduce such huge carbon emissions as the country is the largest producers in the world. Furthermore, government’s funding gap is less than that of the private funding for decarbonisation projects, which has increased the regulation of funding more. However, the capital market condition is strong in China due to government’s allowance for the investors as tax rebate and higher return in long-term.

Linking to objective 2: To search the difference between government and private investment for climate financing in China

The second objective of this study is to find the difference between the government and private investment from various perspectives such as impact and opportunity. The result of the analysis has indicated that private investment for the climate financing is higher than that of the government funding due to high rate of return. The government funding has not created the gap for financing and investment for the firms. Government has produced several measures such as tax rebate, allowances for the investors as well as the firm’s reducing the carbon emissions. On the other hand, the private investors are much encouraged in the country by providing higher return for investing on the decarbonisation projects (Aghion, Hemous and Veugelers, 2009). The private funding has positive impact on the funding gap reflecting that strong condition of the private funding in the market. The large participation of the private investors has created positive fund gap as government has made itself dependent for the climate financing on the private equity. The capital market has ensured the private funding through debt market by issuing specific climate financing bonds to raise money for decarbonisation projects. In this context, the measure is not observed from the government to reduce the funding gap with the private funding for climate financing. The gap is strong as majority of the respondents have negative perception about the government’s funding for climate. The government funding instruments are also different from that of the private funding, which has created such different impact on the fund gap. The allowances and tax rebate schemes are the major funding capacity for Chinese government, which are indirect financing for such projects (Arezki et al. 2017). On the other hand, private funding has selectively generated funds as investors with particular vehicles such as equity and debt market. The direct funding has created the positive impact on the funding gap in the market.

Linking to objective 3: To investigate the carbon fund flow through different instruments in China and financing cost

The investigation of carbon fund flow in China and the financing cost of those funds in China is the third objective, which is literally presented with the private funding only as the positive impact. The funding gap model has shown that the different instrument have different cost of funding in China. The private funding has the positive cost of finance whereas government funding has negative cost of funding. The result is conclusive as Chinese government does not have any chance to take the return of their investments for the carbon emission reduction (Aglietta and Coudert, 2019). On the other hand, the private investors participate in the climate financing projects against the return on their investment. In this context, the carbon fund flows are coming from both debt and equity funding through private participants. The government funding is limited as financial soap as well as allowances to the producers. Moreover, the energy producers avail such soaps the largest in the country along with the government’s direct funding. However, the carbon funds in China is flown directly in major cases where the channel of those funds is market participation. Both the foreigners and domestic investors have the chance to invest for those projects and the regulatory issues do not disapprove such investment either. The instruments such as financial derivatives and clean energy derivatives are not available in China for the private participants. Therefore, the impact of private investment is positive for funding gap as climate financing requirement is more than that of the investment available in the country. The instruments of direct funding has improved the scenario in the country as it has provided the physical fund flow for curbing the carbon emissions (Anderson, 2015).

Linking to objective 4: To find the proper asset pricing model for balancing the equity and debt fund in climate financing in China by using predictive modelling

The asset pricing model of the climate financing is a strategy to find the balance between the debt and equity funds, which are raised for the projects of carbon emissions reduction. Moreover, the asset pricing shows a healthy balance sheet for low risked balance sheet of a firm. The result from the survey has shown that balance sheet risk is not much or it is almost nil for the companies. The coefficient of predictive model for this variable is negative compared to the funding gap. Hence, it indicates that the bankruptcy cost of the firms engaged in climate financing and decarbonisation projects are well positioned in the market. The firms are having balanced equity funding against the borrowing for climate financing from the debt market. Such result also indicates that foreign fund and domestic investment – both are available in balanced manner in China for reducing carbon emission projects (Cerutti, Claessens and Laeven, 2017). The bankruptcy risk factor has negative impact over the funding gap reflecting that Chinese firms are having no influence over its decarbonisation projects due to current balance sheet position. The sustainability of the debt and equity investment are retained by these firms as they have balanced the debt and equity funding for the carbon emission reduction projects. This is also an example of risk neutralisation of external funding for costly projects, which is prioritised in Chinese market for climate financing. The asset pricing of debt and equity fund is improved due to presence of both the instruments in market participation unequivocally.

Recommendations

The study has conducted the research on the Chinese climate financing environment as well as the funding gap in a statistical manner. The investigation is carried out against the variables such as market condition for climate financing, investment from government and private participants and risk of bankruptcy cost for borrowing externally to finance the decarbonisation projects. However, all of these variables have limited influence over the funding gap measurement as seen from the results. Hence, the project has missed some of the crucial variables of finding relationship with funding gap measurements. The future research on this topic should find more variables in this regard, which have significant impact over the funding gap such as cost of tax, regulatory eases for foreign investors and carbon credit for the Chinese firms for reducing carbon emissions. Moreover, the Chinese firms’ attitude and behaviour to address the issues of carbon emissions with respect to their sizes, profitability and presence in the market should be investigated for finding the funding gap measurement. The negative attitude towards carbon emission reduction of the firms might negative influence fund flow for carbon projects. Therefore, it is an important factor for this project to check the management’s behaviour to address the carbon emission issues in reality. In this context, the funding gap for different sectors or sizes of Chinese firms should be measured in a distinct way for having exact conclusion about the funding gap. in this context, the investigation is carried out for all types of Chinese firms regardless to their size, profitability and sector of operation. Therefore, the funding gap observed for the Chinese firms cannot conclude the same for all sectors and companies and implement any rigid solution for them. Hence, segregating all the sectors regarding availability of investment for carbon mission reduction and climate financing requirement might show the true picture of the funding gap. Further, the government’s allowances and tax rebate should be measured along with different sectors as encouraging tool and finding the necessary steps for curbing the funding gap.