Analysis On External Judicial Practice And Internal Governance Mechanism

The Attitudes in Adopting Or Abandoning Poison Pill: Analysis On External Judicial Practice And Internal Governance Mechanism

Table of Contents

Section One: Poison Pill Scheme Basic Introduction. 4

Section Two: Adoption or Abandon: Some hypothesis. 6

3. Concept of corporate governance. 8

3.1 Corporate Governance: Monitoring devices; Incentive systems. 9

4. Managerial Entrenchment Hypothesis. 9

5. Shareholders interest hypothesis. 10

6. Managerial incentive alignment 10

7. Board composite: independent director 11

9.1 Disputations on existing or abolishing of poison pill 12

9.2 Pros and cons of a poison pill 13

Section Three: UK vs the US poison pill cases. 13

1. Merger and acquisition law, such as Delaware law.. 15

2. Value of poison pill system from the perspective of corporate governance. 15

Section Four: Findings and Analysis. 20

1 Importance of Poison Pill for the Corporate World. 21

2 Poison Pill as an Anti-Acquisition Tactic. 23

3 Negative Impact of Poison Pill on Corporate World. 24

4 Prominent Role of Poison Pill In The Corporate Governance. 27

Conclusion and Recommendations. 30

Introduction

In the contemporary business world, merger and acquisition are a common phenomenon. However, there are different types of mergers and acquisitions, and hostile takeover is an example of such merger and acquisitions. A hostile takeover is the acquisition of a company by another company without undergoing any legal channels or without getting the acquisition approved by the existing shareholders of the target company.[1] The common or key characteristic of a hostile takeover or acquisition is that the management of the target company is unwilling towards the acquisition deal. This is why the management of the target company undertakes certain mechanism or preventive measurement in order to discourage the hostile takeover. This discouraging or prevention mechanism is widely known as the Poison Pill.[2] Poison Pill tactic is utilized to illustrate the company as a less attractive investment to the potential acquirer. This method or tactic has been widely used and regarded because of the effectiveness of this method at defending the company from hostile takeover threats. This is because poison pills allow the existing shareholders with the right to purchase additional shares of the company in order to dilute the ownership interest of the investing company or investors.

This study has been proposed by the author to investigate this anti-takeover methodology named poison pill in order to evaluate if this anti-takeover tactic still plays an active role in the preservation of effective corporate governance. In this study, the researcher has investigated this mechanism in order to gain insight into the pros and cons of this tactic. This is because there has been a plethora of study on this tactic, and different scholars have expressed different views indicating both effectiveness as well as adverseness of this tactic. Hence, the researcher has carried out a study to ascertain the actual effectiveness of the anti-hostile takeover mechanism.

Hostile takeovers of firms have long been discouraged using anti-takeover strategies such as the poison pill tactic. Poison pill tactic focuses on the transformation of the firm or company as an unattractive target to the potential investors or buyers. This tactic ensures that the increase of cost of acquisition, making the potential investors uninterested in the takeover deal. Now, there two kinds of poison pill mechanism, flip-over poison pill and flip-in plan poison pill [3].[3] Flip-in plan offers the company share at a lower or discounted price to the existing shareholders of the target company to dilute the ownership percentage of the potential buyer, whereas, a flip-over poison pill plan is allowing the shareholder of the target company to purchase shares of the acquiring company at a discounted rate in order to dissuade the potential buyer [4].[4]

Poison pill tactic was first invented in the 1980s to deflect any unwanted takeover aimed towards an organisation. In the US poison pills can be passed by the directors of the company without any discussion with the shareholders in some states, whereas in European countries poison pills can only be passed if the shareholders agree or votes for.[5] This difference of legislation is present regarding the poison pill tactic because there are arguments related to the interest of the board of directors as there were developments which doubted whether the board of directors were aiming to protect their position in the company or whether they were actually acting in the best interest of the shareholders. As a result, there are different views regarding the poison pill tactic as there are different point of view and outcome examples regarding this tactic.

Section One: Poison Pill Scheme Basic Introduction

The usage of a poison pill as a deflective mechanism can either be beneficial, or they can also have an adverse effect. Historically in the business world, this tactic has demonstrated itself to be extremely effective measurement against the hostile takeover events.[6] This can be stated because of the high rate of success of this tactic. However, there are continued argument and discussion about the legal validity of a poison pill. This is because while the poison pill is praised for its effectiveness, the adverse impact of this tactic can be perceived on the stock valuation of the company.

There are other examples which raise the question of legal validity can be perceived in the case of Yucaipa v. Riggio.[7] In this case, Ronald Burkle, who was an investor through Yucaipa Funds, sued B&N or Barnes and Noble, which was a public company. Ronald Burkle argued that his increasing ownership in the B&N stock had been seen as a hostile takeover incident and B&N without any valid legal ground implemented poison pill strategy. Although Ronald Burkle denied his intention to takeover B&N and stated his intent as a lucrative investment, court’s decision was against Ronald and to which he questioned the legal validity of poison pill tactic in corporate governance law.

This example, as a result, demonstrates the utilisation of poison pill as an unclear and uncertain tactic as it is not possible to clearly ascertain hostile takeover from mere investments. This, as a result, raises question against the validity and viability of this tactic.[8] However, in the case of Air Products v. Airgas Inc., Delaware court found the managements poison pill decision to be a reasonable response against the hostile takeover of Airgas Inc. at an inadequate share price. This study, as a result, investigated the suitability, viability or effectiveness of this corporate tactic.

The researcher had proposed this study because there is a grey area in the context of a poison pill. This is because the initial exploration of poison pill tactic in the deflection of hostile takeover initiatives suggests that there are arguments which support this tactic, whereas other arguments also question the legal validity of this discouragement tactic. Furthermore, there is also evidence which suggests advantages to firms such as protection against internal disruptions from unscrupulous buyers as well as the opportunity to create a bidding war among other interested investing parties. On the other hand, some disadvantages of poison pill suggest that this tactic dilutes the stock value of a firm as well as also discourages institutional investors when it is not necessary. Therefore, there is a scope to carry out a study on this corporate tactic.

This study, as a result, proposed to investigate the identified grey area in the concept of a poison pill. Furthermore, the study of poison pill will allow the researcher to explore the corporate governance-related legislation environment as well. Moreover, this study or research will examine the characteristics of a hostile acquisition deflection mechanism and how managerial behaviour aligns itself with the preservation of the organisation’s identity and control. Therefore, the intent behind this study is justified as there is a wide scope for further study. A poison pill is an excellent deflecting mechanism which helps a company to discourage hostile acquisitions. Findings suggested that there are scholars or larger organisations repeals the poison pill adoption because there is evidence of adverse impacts. However, the poison pill tactic also helps facilitation of effective corporate governance as well. Hence, it is important to carry out a study to find out if the poison pill is an effective mechanism against hostile acquisition or it is effective is on paper. Therefore, this study has significance because of the wide utilisation of this tactic in the contemporary corporate or business world.

Section Two: Adoption or Abandon: Some hypothesis

The aim of this study was to determine if the poison pill is necessary for the current wave of anti-hostile takeover and whether it can still play an active role in corporate governance.

In this study, the researcher is aiming to explore the vast topic of anti-hostile takeover mechanism, poison pill. Initial exploration of the poison pill and hostile takeover suggests that there are more than just benefits to this mechanism as there is evidence which indicates both effectiveness and adverseness of this tactic. Furthermore, there are various legal battles which demonstrate the benefits while other cases question the legal validity of this tactic. Hence, the following are the objectives which were undertaken to carry out this study:

- To ascertain the prevalence of the implementation of a poison pill tactic in the contemporary corporate world

- To explore the effectiveness of a poison pill as an effective anti-acquisition tactic

- To investigate the adverse aspects of poison pill from the case-based evidence

- To identify if a poison pill plays an active role in the corporate governance

In order to ensure the attainment of the goals or objectives of this study, the researcher also formed various questions for this study. Research questions forms from the hypotheses undertaken by the researcher or the objectives undertaken to conduct a study.[9] As a result, determination of the research questions is an essential element for both quantitative or qualitative pieces of research. The formed research questions help with the determination of research methodology as different data, or knowledge collection methods can provide the researchers with adequate research data to carry out their study. Following are the research questions which were undertaken by the researcher in order to conduct this study:

| Research Questions | Rationale |

| Q1. Is poison pill tactic widely being used in the corporate world as an anti-hostile takeover measurement? | Investigation of this question is essential because this question has allowed the researcher to ascertain the prevalence of this tactic in today’s corporate or business world. |

| Q2. What is the general acceptance about the poison pill tactic? Is this tactic being effective in the current corporate world in-comparison to the 20th century? | This question formed in order to understand the adoption rate or acceptance by the leaders towards the poison pill tactic. Such understanding, as a result, allowed the researcher to identify the effective factors in order to identify the value of this tactic. |

| Q3. What are the disadvantages of this poison pill tactic? | This question was formed by the researcher in order to attain the third objective of this study, as this question allowed the researcher to identify the disadvantages or adverse impacts of this tactic. |

| Q4. Do poison pill plays an active role in the domain of corporate governance? | Development of this question allowed the researcher to ascertain if this tactic is viable in contemporary business or corporate world. |

| Q5. What is the final justification from the findings of the study? Should poison pill continue to be adopted or needs to be abandoned? | This final question was formed by the researcher in order to perceive the validity or viability of a poison pill as an anti-hostile takeover tactic based on the findings from the prior questions. |

The above table has discussed the questions which were adopted by the researcher in order to conduct this study and justification or rationale behind the formation of those questions.

1. Shareholders’ Wealth

Primarily, shareholders’ wealth is the present value from the estimated future returns to the owners of a business firm. Regarding this, it can be mentioned that shareholders wealth refers to the shareholder’s equity or their value in the company and this value defines the net income and capital that business firms achieve every year[10]. Poison pill reduces the shareholder’s wealth by a significant amount[11]. Business firms maximise the shareholder’s wealth in order to achieve long term goals with the help of short term decisions as by serving the stakeholder’s interest it is possible to achieve high profitability and generate value for shareholders. In order to maximise the shareholder’s wealth, there are majorly four fundamental ways which business firms utilise such as by increasing the unit price, by increasing the fixed cost, decreasing the unit cost, selling more units and others.

2 Agency theory

In corporate governance, Agency theory is majorly utilised to define the relationship between agents and principles[12]. In other words, Agency theory explains and resolves the issues of shareholders and company executives which is why this theory has great importance in corporate governance[13]. Therefore, the major purpose of Agency theory is to represent the value and principle of a business transaction. Agency theory defines the issues between principal and agent. Therefore, business firms have to adopt a solid corporate policy to tackle the situation. However, Agency theory has a major limitation as it emphasises only on opportunistic human behaviour. In this way, a number of human motives are avoided in Agency theory. However, Agency theory considers the separation of property and control issue mainly if stakeholders have different interests in the company, therefore, in the area of Poison pill system, it has great importance as in the hostile takeover of the company, and the conflict arises majorly between the shareholder and management.

3. Concept of corporate governance

Corporate governance refers to the rules and regulations, laws through which the business operations are maintained. In other words, corporate governance can be described as a collection of business mechanism which encompasses the business factors that affect the stakeholder’s interest[14]. In the area of business, corporate governance facilitates effective and prudent management, which ensures the long-term success of business firms. Therefore, it could be stated that good corporate governance is one of the causes of economic growth and success of the organisations. Through the proper execution of corporate governance, organisations can avoid the scandal, fraud cases, unethical issues and criminal liability as well. Along with that, in order to reduce the capital cost of the organisation, corporate governance is effective. Due to proper corporate governance, investors can maintain their confidence; in the consequences, organisations can raise there can raise their capita effectively in the business.

3.1 Corporate Governance: Monitoring devices; Incentive systems

In corporate governance, independent directors have great importance as they develop corporate credibility and maintain the governance standard. Independent directors act as a monitoring device as they protect externally by identifying the possible risks[15]. However, in the theory of market control it has been observed that in a market, the takeover of any company and threat of takeover, these two are external control mechanisms that have the ability to reduce the costs of the agencies[16]. Along with that, an external market for corporate control can be defined as a critical component in the business takeover[17]. Takeover develops the performance and efficacy of the business firms by aligning the managers’ incentives.

4. Managerial Entrenchment Hypothesis

Managerial entrenchment defines the situation when the managers of business firms achieve immense power that they can use in the firm for their own interest rather than the interest of stakeholders. In research work, it has been observed that Managerial entrenchment is a type of hypothesis for anti-takeover in the area of the corporate business world. However, in order to prevent the managerial entrenchment, there are few corporate mechanisms such as regulatory mechanisms, shareholder rights, board monitoring and other[18]. Managerial entrenchment hypothesis is related to the poison pill system also the business firms who have managers of long tenure have a tendency to adopt the Poison pill system, and it has occurred mainly that the performance of the organisation decreases. Therefore, it could be stated that the poison pill is a type of Managerial entrenchment practice. In this way, the managerial entrenchment hypothesis assumes the relationship between management and performance.

5. Shareholders interest hypothesis

Shareholders interest hypothesis is the contrary of managerial entrenchment hypothesis. On the other hand, Stakeholder interest hypothesis defines that shareholders value raises when the management of the organisations take necessary action to prevent changes in control [8]. Along with that, shareholder interest hypotheses can be defined in other ways by showing that anti-takeover defence could be utilised in order to maximise shareholder value with the help of the bidding process. Shareholder interest hypothesis theory also states that managers of organisations are less likely to create long-term capital investment as the investments have a longer payment period.

6. Managerial incentive alignment

Managerial incentive depends on the overall performance of the business firms. Managerial incentives impact highly on competitive outcomes[19]. However, in the area of corporate governance, the major challenge of business firms is to align the manager incentive in such a way which ensures that the managers act in the owner’s interest, not to achieve their own goals. Regarding this matter, it could be stated that incentive alignment enables an individual to achieve the actual outcome from the team[20]. It has been observed that the agency issue is normal when any owner recruits another non-owner to maintain business operation. Therefore with the help of incentive alignment, organisations provide benefit to the managers in order to achieve the target goal of the organisation. Managers achieve better insight into reward; therefore, it motivates them to lead the organisation towards success. In this way, incentive alignment depicts that a high level of incentive needs to improve the manager and shareholder interest. Incentive systems are a mechanism which is used by the board of directors to motivate the senior executives to develop their performance in the interest of the organisation.

7. Board composite: independent director

Independent directors are the non- executive directors of companies who do not have any material relationship with the organisation or with the related persons. However, independent directors develop corporate credibility and the standard of corporate governance. Organisations where the board chairman belongs to the non-executive director category, there one third board directors can make up independent directors. On the other side, if board directors are an executive director, then, minimum half board directors can make up independent directors. It has been observed that independent directors or outside directors are important in the alignment of boards interest and stakeholders interest. Independent directors do not have any monetary relationship with the organisation except their remuneration. However, an Independent Director guides the organisation’s external efforts and provides information about the potential risk. In the poison pill strategy, independent directors play a defensive role in the organisations.

8. Ownership

Ownership can be defined as the state of exclusive control over any property which can be asset, land, or can be a human being to[21]. In the area of corporate governance, Ownership refers to the distribution of equity and the identity of the owner of equity too. In corporate governance, proper ownership structure has great importance as it affects directly on the incentives of the managers and along with that, it impacts on the efficiency of the business organisation. In shareholders rights plan or poison pill strategy, the primary aim is to dilute the interest of the ownership from the organisation.

9. Concept of poison pill

Poison pill can be defined as a defense tactic which is mainly used by the target companies to discourage any hostile takeover. Along with that, the poison pill provides the right to the external shareholder to purchase the additional shares of the business firms at a high discount[22]. Thus, the poison pill eliminates ownership interest from business partly through new and hostile parties. Therefore, poison pill provides the ultimate benefit to the existing board of directors of business firms when an acquisition might be harmful to the long term stock value of the company. However, despite the poison pill or shareholders’ right plan is effective to discourage the monopolistic takeover. Still, it cannot be considered as the first line of defence. The strategy cannot ensure the prevention of hostile takeover because it works only if the acquirers are persistent.

9.1 Disputations on existing or abolishing of poison pill

The poison pill stands as a powerful tool with ethical and legal viability to protect a target company from takeover. This can be considered good for a target organisation’s shareholders if it allows this target organisation to pressurise the acquiring organisation to make more offers in terms of amount in relation to the acquisition[23]. On the other side, this can be considered bad for a target organisation’s shareholders if the management of that organisation uses them for their own benefits, not for the shareholder’s benefits[24]. This leads to the abolition of poison pills. These pills are also considered very effective while dissuading a corporate purchase. These are not often considered as a company’s defence in the first line. Therefore, the strategy related to the poison pill is entirely not guaranteed to effective and work properly because it is not necessarily capable of preventing a company’s acquisition of the other company which is the acquirer company remains persistent.

Several pieces of research have been developed which indicate that when an operating entity adopts poison pills, it is common to found a reduction in such an entity’s value. Institutional investors are increasingly apprehensive in relation to poison pills because these pills help management in making selfish decisions without thinking about the interest of shareholders or say at the cost of shareholders. Also, since premiums of takeover sometimes provide the highest return to shareholders, it often leads to the reduction in institutional interest in an entity which in turn can hurt the prices of stock since institutions stand the largest purchasers. Ultimately, institutional investors become less interested in making an investment in an entity that purposely seems to threaten potential suitors[25]. Despite the good sides, these negative sides of poison pills become the reason for welcoming the abolition of these pills.

9.2 Pros and cons of a poison pill

The utilisation of the poison pill stands beneficial for a company’s management and shareholders both. It is extremely effective as it includes a high success rate and a most useful tactic to fight against a takeover. It is good for investors, more specifically, if they think takeover is not beneficial or good to the company they have already invested in. It includes an informal structure that says that it stands as a flexible system that can be customised or tailored to an entity’s needs. It protects a company against buyers who are unscrupulous in nature. A company is initiating a hostile takeover use to do so to gain its own benefit. It may intend to dismantle its target as well as sell it by dividing it into pieces, or it may not have experience and industry insight required for running a company effectively. Due to this, the company targets to create a poison pill for protecting itself from a purchaser that would hurt its management as well as the existing shareholders ultimately[26]. It gives management the required time to search for other offers or creating a bidding war rather than preventing a takeover.

Poison pills are disadvantageous because it dilutes values of stock which makes shareholders purchase new equity shares often to keep a balance. It discourages institutional investors from purchasing into corporations having aggressive defences. It provides protections to poor performing managers and helps managers to protect their jobs.

Section Three: UK vs the US poison pill cases

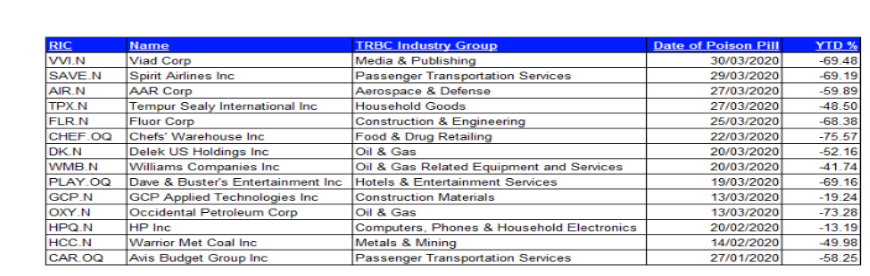

Companies utilise poison pills considering these as a tool of takeover defence and make it more expensive and difficult for an intended acquirer in gaining control over a company. Every poison pill includes its own conditions and terms but is triggered often if a shareholder uses to accumulate 15 per cent of outstanding shares. According to the Screener and Excel add-in apps by Refinitiv Eikon, so far in 2020, 14 poison pills have been issued by the U.S. companies covering market capitalisation more than $300 million. Figure 1 represents poison pills the U.S companies have been issued in March. The companies issued these pills include airlines, transportation, and energy[27].

Figure 1: Poison Pills Issued by the US Companies[28]

There is a striking contrast between the UK and the US in terms of the utilisation of the poison pill due to its procedural impediments as well as the marginal effectiveness when it gets operated under the City Code’s provisions.

The target company is clearly prohibited by the City Code from granting any kind of options over the company’s unissued shares after launching a bid unless obtaining approval from the shareholders of the company. Thus, the target company cannot apply a poison pill as options. However, before making a bid, poison bills can be utilised only by showing a proper purpose or satisfying the criterion related to a proper corporate-oriented purpose. Following this particular rule, the board of directors of a target company has the only purpose of attempting to use a poison pill in the entrenchment of office which is obviously not considered as a ‘proper corporate purpose’[29]. Moreover, no such cases have agreed yet towards the continuation of the company’s independence as well as strategies of business as proper justifications for adapting defensive tactics as it happened in the courts of the United States. Under the law of the UK, the prerogative related to deciding business strategies of a company, as decided or set by its directors, is that of its shareholders. It is seen that the approval of shareholders is crucial for adopting poison pills in the UK. Here, it is mentionable that, so far, no such cases have tried to utilise poison pill after or before a bid as restricted by the provisions under City Code.

1. Merger and acquisition law, such as Delaware law

In 1988, the Delaware Supreme Court of the US had adopted a law it has developed on the business combination which leads to a drop in the frequency of takeover[30]. This law has reinforced a notion of corporate bastion and allowed special dividend as well as rapid purchase on open-market for blocking takeover bids. The court has found it very significant that all these actions are not capable of constituting abandonment of a corporation’s continuous existence[31]. With this law, the court has ruled that a company’s boards of directors of a target company are able to reject the premium offered by an acquirer company if they found there is no such basis of sustainable corporate strategy.

2. Value of poison pill system from the perspective of corporate governance

The poison pill helps the management of a target company from an undesirable takeover. One of the aims of good corporate governance is ensuring shareholders’ interests and increasing their wealth. Corporate governance involves ensuring a balance between a company’s different stakeholders’ (shareholders, investors, senior management executives, suppliers, financiers, customers, the community, and the government) interests. The adoption or use of poison pills is considered in the shareholders’ interests[32]. Poison pills prevent hostile takeovers and thus, protect shareholders’ interests to a large extent as well as ensure a balance between their own interests with the company’s interests to ensure good corporate governance. There are benefits attached to poison pills for a company’s directors, but for its shareholders also benefit when a takeover can damage the long-term value of the stock. The more a company becomes able to enhance its stocks value the great it becomes able to take initiatives to develop its stakeholders which is the major part of its corporate governance[33]. In this way, poison pill system is valuable from the perspective of corporate governance which aims to enhance stock’s value for enhancing the company’s and its shareholders’ wealth in the long-term.

Figure 2: Conceptual Framework

(Source: Created by the author)

At the time of collecting the required information from various sources that are relatable to the current research topic, the researcher faces some problems. These problems are responsible for creating a gap in the current literature review section. Despite all, this literature review section is developed by reviewing several relevant articles, journals, and case studies on the current research topic. Lack of budget and time has created restrictions for the researcher in checking the validity as well as reliability of collected data and information. Also, the researcher also faces restrictions for the absence of strong literary works while collecting more data and information on the research topic. The researcher’s inability for the above-stated restrictions has generated barriers to increase this research’s standard and caused less reliability of this chapter.

In the corporate world, a poison pill refers to a tactic of defense used by a company targeted by another company to discourage or prevent other company’s attempts of a hostile takeover. Poison pills use to allow a company’s existing shareholders to have the power or right to buy additional shares at a discount by diluting their ownership interests of a hostile party effectively. In this chapter of the current study, the poison pills’ distortions, advantages and disadvantages, and its values in the perspectives of corporate governance are discussed. The issue of poison pills in the US is shown by statistical data along its use in the UK along with a discussion on Delaware law is also provided in this chapter.

Section Four: Findings and Analysis

In Today’s competitive world, business organizations are emerging rapidly at a steady rate. Among them, the smaller enterprise constitutes a substantial proportion as compared to the other multinational firms. The small business firms are the worst sufferers of the merger and acquisition process, which is commonly prevalent in terms of improving the operational efficiencies of the acquiring company. The hostile and aggressive domination of one firm by the other without the legal procedures or without the consent of the shareholders is a violation of legal acquisition. Thus, this section of the chapter will analyze the key variables from the discussion that arises from the chapter of literature review. This particular chapter will evaluate the concept that has been determined by the opinion of various scholars and researchers. Through this chapter, the researcher have reflected the concept of poison pill very precisely based on the findings of the literature review[34]. It has analyzed all the data that has been gathered from the qualitative research study. As the researcher has employed the secondary data analysis process, the views of various scholars have been considered for analysing the concept of the poison pill, and its importance.

1 Importance of Poison Pill for the Corporate World

From the qualitative research study, it can be ascertained that corporate governance is stated as the ethics or standards, whereby the company’s internal functions are maintained. Corporate rules plays a major role in the business firms that are associated for the betterment of the company’s overall performance. It assures the long-term management of the firms which gives success to the organization. Hence, the business firms with effective rules and regulations are worth necessary for the economic privilege of the company which is important attribute for the success of organization. In this contemporary business world, the process of acquisition and merging is widely prominent for the protection of the firm. The companies are highly interested in the globalization of the firm which can be done having the control over those firms who have lack of organizational efficiency. However, the smaller firms are putting their best efforts to secure from the threats of the outside companies. It is due to the poor management of the firms especially the smaller one. The smaller enterprises are the victims of acquisition process. In this context, the poison pill is one of the strategic moves employed by the small or the medium firms who faces the acquisition threat from the big enterprises. It is considered as a defence measure to prevent the occurrence of any hostile control[35]. It resolves the internal disruptencies of the organization. It is a good step towards increasing the value proposition of the firm. The utilization of the poison pill can prevent the undesirable control. Considering the importance of poison pill, it can be stated that the poison pill is a worthy initiative to considerably enhance corporate performance. It not only gives power to the board, but also provides the discount to the shareholders. The aggressive party is always hostile towards the acquisition of smaller firms, which is quite intolerable to prevent such activities of purchase. It is a valuable aspect for the system of corporate governance with a strategic decision. It results in the growth of the firm’s ability to improve its stock value in the long-term process[36]. In this competitive era of business world, the takeover process can be controlled by managing the assets of the firm on long term basis. The takeover by the hostile company will lead to many damage for the company’s survival and especially its stock exchange. The enacting of one poison pill has the capability to reduce the ownership percentage. It aims at the protection of the shareholder interest at a higher position[37].

On the other hand, one of the most effectual benefits of this tactic method, that it discourages the takeovers of monopolies. From the undertaken views of the scholars regarding the concept of poison pill, it can be understood that it can give the companies a high rate of success. In order to make the market structure more dynamic, the poison pill can drop-down the interest of the overpowering nature of the companies. Thus, it can be defined as a tactic measure which is essential to eliminate the unwanted interest of the companies. As compared to the 20th century, the current business world requires more strict compliance. At prior times, the number of business firms were insignificant in number as compared to the present situation where there are huge number of firms[38]. Nowadays, the firms are actively involved with the process of gaining competitive advantage which compels the firm to acquire the small firms. Meanwhile, the small firms are imposed with such challenges that leads to in the fragmentation of its internal efficiency. In this condition, the smaller firms needs more efficiency and strategic decision that can protect their interest of the shareholders by giving them rights to buy the shares. Thus, in the domains of the corporate governance, it is prominently active to support the firm from the greedy nature of the acquiring companies. It should not be abandoned and should be practiced for the development of the firms. It is excellent process that can be properly executed for the outsider companies[39].

It has been found from the discussion of literature review that large number of business firm are involved with the utilization of this corporate tactic called the poison pill[40]. This is widely acceptable by today’s organization to demonstrate the company as the less effective firm before the other broader firms. It is done because the firm may get indulged with the process of acquisition soon. Thus, this prevention mechanism tool of discouraging the external threats is one of the efficient initiatives to defend the threats of takeovers[41]. With the passage of times, the concept of poison pill is important for today’s organizational structure by providing flexibility to the corporate needs. Hence, from the above findings it can be said that the poison pill should be applied for the fighting against the rebellion buying intention of the firm[42].

2 Poison Pill as an Anti-Acquisition Tactic

The concept of the poison pill is very active in terms of improving the corporate governance. Considering upon the data of the secondary research it can be analyzed that the poison pill acts as anti-acquisition tool for preventing the occurrence of the takeover. The shareholders have the right to employ such tools for destroying the intention of the acquiring companies who take interest on the ineffective weaker firms[43]. Each pill includes the conditions and the regimes which are important for stopping the acquisition process. It is considered as the right of the shareholder to eliminate the intention of the potential parties to takeover the smaller and medium companies[44]. To be more precise, it can be said that it is an efficient technique to avoid the capture of the intended companies. It is designed in such a way that has the capability to dilute the equity and shares of the owners. The companies in this era of competitive market can employ this technique as an answer to the acquisition procedure. This particular pill was originated after witnessing the numerous captures of the companies. The poison pill is an effective way to determine the intentions of the hostile party who are involved with the acquisition process. The companies of today’s modern world can use this as a corporate tactic which the intentions of acquiring more expensive as well as complicated in ruling over the company[45].

It is important for the corporate maintenance and efficiency. From the qualitative research analysis it can be described that modern business world needs to adopt this model for greater benefits which will give long term success for the development of company[46]. The concept of this tactic was issued after the smaller firm’s capture by the larger one, which is frequently observed in the business practices. In this regard, the merger as well as the acquisition law has been adopted to minimize such hostile takeover of the companies by the third parties. Thus, in the year of 1988, the Delaware supreme court of the United States has enacted a law which shows the possible result in minimizing the frequent level of the illegal takeover. It has granted an exceptional dividend and the rapid buyer on the open market for the offer on bids takeover. The court claimed these laws an efficient measure to maintain the sustainability of the corporation existence in the dynamic market structure. It can also be analyzed from the secondary sources that the supreme court of US have ordered that company’s board of the targeted company have the right to reject the premium given by an acquiring company[47].

On the other hand, it can also be evaluated from the qualitative data collection that this anti-acquisition tactic is essential for the corporate governance system by increasing the company’s stock value and shareholders’ wealth on a long-term basis. Thus, it can be identified from the secondary data that the poison pill is an efficient measure for preventing the aggressive takeover[48].

3 Negative Impact of Poison Pill on Corporate World

The poison pill acts as a robust defense mechanism against the unwanted greed of the larger firms. The unusual takeover is always experienced by the smaller firms who wants to secure their firms from the hunger of the acquiring organization. This tactic of poison pill was implemented after the increase in the hostile control of the one firm by the other. It gives additional time to the shareholder of the organization to analyze the proposed bid of opposed takeover and gives facility to the management for the implementation of better business decision[49]. It gradually slows down the acceleration of the potential companies. Moreover, the strategy of poison pill has the capability to minimize the value of shareholder. Despite such efficiencies, it also has some inefficiencies in its system which injures not only to the bidder but the shareholders as well[50]. A buyer who has the intention to acquire the small firm is unlucky if the actions are locked by the poison pill strategy[51]. From the learning of the literature review it can be said that although the poison pill serves as a great tool which has multitude of benefits for the effective corporate governance. This process can be risky at the same time[52]. The process of deploying the poison pill to fight against the attempts of control has come under the procedure of scrutiny in the courts. it is termed as the dilute of the stock value of the company. When the companies launches number of shares at discount price, they saturates the stock supply. Ultimately, it ends up with the value of the current shares and as a result the investors are compelled to buy new shares for the maintenance of the previous percentage of ownership[53].

It is revealed from the collected data that the poison pill assumes to secure the company poor management. The firms that are the target of the particular takeover are often the victim of the poor corporate governance. The acquirer who has intended to buy a small firm realizes the significance of the management development of the firms. To be more precise, the poison pill is the strategic tool which makes the firms pretend to look less mesmerized or efficient in front of the broader firms[54]. Therefore, it becomes an attributing factor which becomes a influential room for the improvement in the poor corporate governance system. The acquiring firms believe that the firms which are inefficient to perform well need more management properly[55]. As a consequence, poison pill are constituted for protection of the firms, but at last it deprives the investors from the effective performance of the firms[56].

On the other hand, it also discourages the investors of institution. The institutional investors have constantly apprehensive regarding the poison pills, they can make it more easier for the management to initiate selfish decision at the expenditure of shareholders. However, the takeover discounts often provide the higher return for the shareholders but, it may lead to a reduction in the institutional interest, which can harm the stock prices to great extent. Therefore, the institution are not likely to invest in a particular company that intentionally looks to the potential suitors. It is one of the controversial act that the investors forgo profit from the hostile control. When a takeover is commencing, the investors are sometimes paid a discount for their stock[57]. Thus, due to this reason, the implementation of the poison pill may eliminate the investors from profits[58]. Regarding this, the investors would have thought to go through the takeover efficiently will not have the strength to combat the poison pill[59].

Moreover, from the opinions of various scholars it can be understand apart from the dilutes of the stick value, the poison pill gives too much power to the boards. The boards at this condition having so much power can deny the access of the shareholder in terms of fair offers. It can lead to the misuse of power by the boards without the consent of the shareholder. The boards can easily implement a poison pill. The boards in this regard, can repel the acquiring firms by creating the process of acquisition more expensive. It also leads to the downfall of the companies and the interest of the shareholders very negatively[60]. Ultimately, it increases the unemployment of the individuals. Along with that the boards of the company through the use of poison pill can use it as pa bargaining material to occupy excessive packages of compensation. The associated shareholders of the company has the right to give their purchase shares. For this reason, this particular right should not be overlooked and protected[61].

It is further important to state as analyzed in this chapter that the boards of the company have no right to interrupt this. It decreases the value proposition of the firm. It affects the corporate governance system, consequently[62]. Among the other variables, the most noticeable impact is witnessed by the shareholders and their returns. It gives the positive results which restrict the development of the firms[63]. The boards and owners act as an independent body by employing this strategic move of poison pill. It has been observed that because of its independent nature, the corporation and the shareholders may face inevitable conflicts. The policy of organization development may dissolves if the boards started acting only for its own benefits. Thus, having plenty of facilities, the concept of poison pill also has disadvantages which is a threat for the survival of the company especially the smaller ones. It leads to the misbalances the firm management at the same time. All the active participants of the corporation like the shareholders are the worst sufferers in this context. Therefore, the implementation of poison pill may lead to the occurrence of many complications which is considered as potential risk for the corporate management[64].

4 Prominent Role of Poison Pill In The Corporate Governance

The answer to each objective is being analyzed from the collected data for making the study more effective and understandable. In the era of corporate governance, the concept of a poison pill is emerging as a defense tactic utilized by potential companies to stop and demotivate the acquired company’s hostile takeover. The targeted firms employ this tactic to make themselves look less alluring the company in front of the larger companies. It is the best and efficient method to defend a particular company. Moreover, it grants the right to borrow shares at an affordable price to all the associated shareholders. Meanwhile, through this process, the interest of ownership can be dissolved who has interest to attempt the new aggressive party. The poison pill work removes the interest of the owner from the business activities. It can be understand from the whole discussion that it is strategic decision that help the effective management of the corporate governance. In this world of competitive market, takeovers are widely prevalent where the larger firms are trying to control over the small firms which are incapable to operate it function effectively[65]. The larger companies are always pretending to operate the smaller firms, for the purpose of entering in a new market. By following the acquisition process, the bigger firms can earn additional benefits such as the operational efficiency. For an instance, if the particular acquirer has the interest to remove the level of competition, then it the process of takeover is highly beneficial for it. Although, the takeover is not easier as well as harmonious, if often leads to aggressiveness when the target firm does not want to involve in the circle of acquisition. When a particular small or medium enterprise becomes the target of a larger potential firm, the targetted company tries to look as if it is an unworthy company before the larger ones. As this particular name depicts, the poison pill works as an analogy that is hard to accept and swallowed. The company targeted for the purpose of unwanted control can employ this strategic move in order to make all the relevant shares unsuitable towards the acquiring company[66].

Subsequently, from the analysis of the study and from the accumulated data it is noted that One of the important aspects of poison pill is that is profoundly raises the revenue of the acquisition process and makes huge disincentives to terminate such takeover attempts entirely. As per the understanding from the literature review chapter it can analyzed that the mechanism of poison pill secure the shareholder groups of minorities and eliminates the changes in the domination of firm management. By enforcing and implementing the strategy of poison pill it does not signifies that the company has not the willingness to get involved in acquisition. At times, it is enacted according to the condition of the present market and to receive potential valuation for the preferred terms of acquisition[67].

The shareholders are the real owners of the company, and they have the right to vote by majority to follow the acquisition. In this regard, the shareholders right plan decides the attempt of takeover. The management of the target company management the moves ahead with the poison pill, under certain terms reflected in their plans. It has developed as an specific answer to the hostile domination question. It serves a facility for the corporate governance, as well as the investors[68].

Thus, the poison pill acts as an anti-takeover deafens strategy of the corporate firms. It is one of the most significant aspects of improving the management of the corporate governance. It is formally considered as the shareholder plan which determines the acquisition of the firms. On the other hand, the pill of poison can equally establish or destroy the value for the shareholder. The outcome always depends on the maintenance of associated countervailing impacts. Implementing a pill may detect the intentions of the other larger firms and protects it from the outsiders to provide their bids for the company. The adoption of the poison is exercisable under certain situation which is against the hostile offer of tender. It can be ascertained from the opinion of the scholars that the shareholder interests are indirectly or directly influenced by the implementation of the strategic pill of poison. It may facilitate the business firm or have a negative effect on it. Thus, it can be analyzed from the literature review that in the contemporary business era, this tactic has been represented as the efficient measure against the events of hostile acquisition process. It has helped the business firm to achieve success in the long run. It is a praiseworthy step which offers effectiveness and stability in the corporate governance system. It is identified from the analysis section that The threats from the outsider company are always prominent for the small firms those who lack inefficiency. Therefore, there is still a protest over the anti-takeover practices, that is playing an active role in the maintenance of the corporate governance. In this regard, the hostile takeovers have become dangerous for the smaller firms whose existence is complicated in front of the larger acquiring firms. To be more precise, it can be understood that the tactic or the strategy of poison pill acts as a remedy that transits the firm or the company as a less tempting target of the particular investors who are interested for the acquisition[69]. Furthermore, this tactic raises the cost of merging which often terminates the decision of the acquiring companies. There are flip as well as flip-in plan poison pill. Each one of the pill is differentiated from the other. The flip-over pill is a granting the shareholder of the company that has been targeted to buy the existing share of the acquiring enterprise at a favourable rate for the purpose to dissuade the buyer’s intention. Whereas the flip-in plan gives the company share at a specific price to the relevant shareholders of the firm which is being targeted for diluting the percentage of the ownership of the potential investors. Thus, the mechanism of poison pill is performing for the best interest of the company and its shareholder groups. Not only this, it can be evaluated that it avoids the unwanted domination or the control which aims towards the firms. In the current span of corporate governance regimes it is the effective step towards the betterment of the organization by monitoring the check of outside organization interested for the acquiring deals.

In this chapter, the secondary data research’s key findings have been analyzed to portray the effectiveness of the poison pill in the modern business world of corporate governance. After reviewing the secondary data and the opinions of various scholars, it can be analyzed that a poison pill acts as a defence tactic which is used by the corporate business world to prevent or to discourage the aggressive acquisition of the firms by the another company especially the multinational corporations. It is a dynamic measure against the greedy intention of the acquiring companies to rule over the smaller firms which are less effective to function. It can be asserted that smaller firms apply this strategy for securing their firms from the takeover process. In the world of merger and acquisition of the business firm, the poison pill not only protects the company from illegal takeover, but at the same time offers number of facilities to the shareholders group associated to the organization. It offers right to the shareholders to purchase the shares and it dissolves the interest of ownership of a purchasing company. Along with that, the drawbacks of poison pill also creates adverse impact on the business firms to operate its function.

Section 4: Conclusion and Recommendations

For strengthening the market sustainability tendency, merger and acquisition is the common path for every business firm in the competitive arena. The poison pill is one of the acquisition methods, which has preferred by most of organizations because this method has the ability to defend the threats of the hostile takeover. Along with this, it can be observed that the poison pill gives chances for shareholders to purchase shareholders for having a motive to dilute the ownership of a company. Through flip-in tactic, a company can offer its remaining share at discounted prices to its shareholders for dividing the ownership among potential shareholders or buyers. Besides, it can be asserted that by employing the flip-over poison pill mechanism, an acquiring company can allow its target company’s existing shareholders to purchase the share at minimum possible rates to distribute the company’s ownership among shareholders. For defending unwanted acquisition, the concept of poison pill strategy had been introduced in the year 1980. Moreover, it can be observed that without having conversations with shareholders, directors of a company can implement the poison pill tactic in the USA, but in other European countries, directors of companies should take consent from shareholders while incorporating this method of acquisition. This dissertation analyses the role of the poison pill as the anti-hostile takeover and its impact on corporate governance. For the conduction of in-depth analysis, this report also critically explains the significance of the poison pill strategy in the corporate business environment. Moreover, the contribution of this research paper in the investigation of the effectiveness of the undertaken method as the anti-hostile is also amended in this research work. Through this dissertation, the author states the negative consequences of the poison pill and the effects of this tactic in the corporate governance of companies.

From the literature review, it can be comprehended that corporate governance includes regulations, rules, and a collection of business mechanisms, which has an impact on the interest of shareholders. If a company has strong corporate governance, then the firm can enhance its performance economically. Independent directors of a company are accountable for monitoring the corporate governance of the business. Besides, the poison pill allocates the power to the external shareholders of a firm to purchase shares at low prices. Limitations of this method are also described here. Management generally looks after their benefits; they do not want to concentrate on the shareholders’ interest while implementing this tactic. Because of the informal structure of this anti-acquisition scheme, this mechanism can protect the interest of both company and shareholders. Moreover, this tactic gives sufficient time to the management body for searching adequate offers and conducting the bidding process efficiently. This paper also defines the US and UK poison pill cases for attaining the research paper’s objectives.

For this research work, interpretivism research philosophy is the most appropriate research method because the qualitative strategy is applied in this paper. For set assumption analysis, the deductive approach has been adopted, which also helped the researcher to structure the data gathering process. Secondary sources are the main resources of this paper because this study preferred to accumulated data from published research articles, web journals, business magazines, official websites, journals, and etc. Descriptively and thematically, the associates interpret the gathered secondary information.

Based on the finding portion of the dissertation, proper corporate governance helps an organization to maintain the internal operations. For reaching the long-term goals, a company should efficiently follow the corporate rules. For strengthening position in the corporate market, every organization preferred to adopt the merging and acquisition process. Focusing on the company’s survival, the poison pill is the most effective and flexible method of sharing ownership rather than a hostile takeover because it damages the brand reputation. The undertaken method of this study discourages the takeover attitude of companies because it negatively affected the performance of an organization. This method has a direct impact on the corporate governance of a business firm, which is beneficial for protecting the interest and concern of shareholders and acquiring company. By acquiring small companies, large-sized organizations can increase their market share, which effects on their profitability. The research study has been completely done on the basis of the opinions reflected by renowned scholars. For this reason, the secondary data has been accumulated by the recognised articles and the journals, which has helped the researcher to describe the concept of poison pill more precisely. Through the descriptive and the thematic tool the researcher has been able to underline the importance of poison pill which acts a Anti-acquisition tool for the smaller companies. The qualitative research study has further helped the researcher to identify the advantages of the poison pill which is tactic to control the intentions of the bigger corporation. Moreover, this undertaken research study has been done by maintaining the ethics and the rules. The researcher has collected all the data from the valuable sources which are highly authentic[70]. No Violations of research rules has been commenced by the researcher for making the study look more tempting to the readers. According to the findings chapter, it can be analysed that poison pill is necessary for every firm especially the smaller firms who are mostly the victims of unwanted acquisition. The findings has been done after reviewing and analysing the secondary data. From this secondary data, it can be analyzed that the poison pill is a shareholder right to remove the share of the ownership. It is the right of shareholders to purchase and buy the shares of the company without the interference of the board. The board of the organization does not have the right to approve the acquisition. Every acquisition process requires the consent of the shareholders who are the prominent members that look after the firm’s success and development. The particular research study has been conducted on second research approach. For this reason, the researcher has taken the qualitative strategy to determine the concept of poison pill very effectively.

From the views of various scholars it can be said that poison pill is a measure to control the undesirable intentions of the larger companies to takeover. The scholars have opined that it increases the value of corporate governance considerably.

As a recommendation, it can be stated that the corporate firms should implement the poison pill for enhancing the organizational governance system. The firms should apply this as a measure to control the intentions of the greedy owners interested in the hostile takeover. Surviving in such an era of a competitive market is decidedly tougher, and in this race, the smaller firms always receive the last position because of their operational defectiveness. It leads to several disturbances for the weaker companies. Thus, as a suggestion, it can be said that the poison pill is arguably a most efficient process that can prevent the commencement of aggressive acquisition[71]

The overall forced process of acquisitions can be provoked if such pill of poison for the purchase company is enacted. Not only the smaller and the weaker firms, the bigger companies are also sometimes the victims of this phenomenon of merging and acquisitions. It is due to internal conflicts which arises in the organisation and that allures the other company to takeover because of its lack of efficiency. Therefore, before the sucess of such acquisition the modern corporate business world should look it as a strategy for not succeeding the plan of purchasing[72].

On the other hand, it can also be recommended that every firms should maintain and set the rules for the firm maintenance It has been observed that the internal disputes and the inefficient rules of corporate have always been the reason behind the hostile domination. Therefore, the corporate rules are very essential for the improving the functions of firm positively. However, it is inevitable to determine the external threat by the strongest companies who are intending to expand their firm by following the control over the weakest one. In this regard, the poison pill is significant which transits the firm look as merely nothing but a poor company.

This condition of unfavourable purchase of the company can be provoked if the the strategy of poison pill is incepted by the companies. Surely, this will lead to fruitful results for the company protection from external threats which harms their position in the dynamic Market environment[73].

The existing shareholders of the company should employ this not as a tool but as strategy through which the corporate internal and external advantages of the other companies can be restricted. Hence, it can be proclaimed that poison pill should be enforced by every companies of every world in order to get rid from the rival companies unfavourable attitude of merging and acquisitions[74].

It is a worthy solutions to diminish the desire of large companies. With the formulation of this measure, the firm’s can recognise their superiority and individuality. Thus, at the end of the research Study it can be asserted that in order to secure the firm from illegal domination of the purchasing company, the tactic measure of poison pill is effective and secured.

For the formation of this study, the author employed a secondary approach, which assisted in determining the significance of the poison pill in improving the effectiveness of corporate governance. Along with this method, future researchers can use primary data of a particular company to relate the secondary fact efficiently. Therefore, it creates a promising opportunity for other researchers to plan their research study for acquiring an optimal result. On the other hand, this study puts the focus on the poison pill anti-acquisition scheme in defining its impacts on corporate governance. There are other anti-acquisition tactics, which are not discussed here, so future researchers can choose other ways for their thesis to generate fruitful end result of their studies.

References

Aguilera, R.V., Judge, W.Q. and Terjesen, S.A., . Corporate governance deviance.Academy of Management Review, 43(1), (2018) pp.87-109.

Al-Dah, Bilal. “Director interlocks and the strategic pacing of CSR activities.” Management Decision (2019).

Audia, Pino G., and Fiona Kun Yao. “The Spatial Diffusion of an Invisible Corporate Practice: Revisiting Stock Backdating, 1981–2005′, Geography, Location, and Strategy (Advances in Strategic Management, Volume 36).” (2017): 309-339.

Azar, J., Schmalz, M.C. and Tecu, I., . Anticompetitive effects of common ownership. The Journal of Finance, 73(4), (2018)pp.1513-1565.

Belgraver, Herman, and Ernst Verwaal. “Organizational capital, production factor resources, and relative firm size in strategic equity alliances.” Small Business Economics 50, no. 4 (2018): 825-849.

Bergh, Donald D., Herman Aguinis, Ciaran Heavey, David J. Ketchen, Brian K. Boyd, Peiran Su, Cubie LL Lau, and Harry Joo. “Using meta‐analytic structural equation modeling to advance strategic management research: Guidelines and an empirical illustration via the strategic leadership‐performance relationship.” Strategic Management Journal 37, no. 3 (2016): 477-497.

Bosse, D.A. and Phillips, R.A., . Agency theory and bounded self-interest. Academy of Management Review, 41(2), (2016) pp.276-297.

Boyson, N., and Pegaret Pichler. “Obstructing shareholder coordination in hedge fund activism.” Unpublished working paper. Northeastern University (2016).

Bracken-Roche, Dearbhail, Emily Bell, Mary Ellen Macdonald, and Eric Racine. “The concept of ‘vulnerability’in research ethics: an in-depth analysis of policies and guidelines.” Health research policy and systems 15, no. 1 (2017): 8.

Buch-Hansen, H. and Henriksen, L.F., . Toxic ties: corporate networks of market control in the European chemical industry, 1960–2000. Social Networks, 58, (2019) pp.24-36.

Chalupa, Radek, and Karel Nesměrák. “Chemophobia versus the identity of chemists: heroes of chemistry as an effective communication strategy.” Monatshefte Fur Chemie (2020): 1.

Comment R, Schwert GW. Poison or placebo? Evidence on the deterrence and wealth effects of modern antitakeover measures. Journal of financial economics. 1995 Sep 1;39(1):3-43.

Cremers, KJ Martijn, Scott B. Guernsey, Lubomir P. Litov, and Simone M. Sepe. “Shadow Pills, Visible Pill Policy, and Firm Value.” (2020).

de Souza F, Neri D, and Costa A, ‘Asking Questions In The Qualitative Research Context.’ (2016) 21(13) The Qualitative Report <https://www.researchgate.net/profile/Francisle_De_Souza2/publication/303999090_Asking_Questions_in_the_Qualitative_Research_Context/links/57628f3b08ae5d145f361a58/Asking-Questions-in-the-Qualitative-Research-Context.pdf>

Diamond, David J., Nicholas R. Brown, Richard Denning, and Stephen Bajorek. Phenomena important in molten salt reactor simulations. No. BNL-114869-2017-INRE. Brookhaven National Laboratory (BNL), Upton, NY (United States), 2018.

Eja, I.E., Inah, G.M. and Itu, P.C.,. Customer Trust: An Indicator to Measure Hotel Financial Returns and Stakeholders Interest in Hotel Industry, Calabar, Cross River State, Nigeria. European Journal of Social Sciences, 58(3), (2019) pp.223-233.

Eleftheriadou, Ioanna. “Hostile Takeovers and Defence Strategies.” (2018).

Faraone, Stephen V., Anthony L. Rostain, C. Brendan Montano, Oren Mason, Kevin M. Antshel, and Jeffrey H. Newcorn. “Systematic review: nonmedical use of prescription stimulants: risk factors, outcomes, and risk reduction strategies.” Journal of the American Academy of Child & Adolescent Psychiatry 59, no. 1 (2020): 100-112.

Farrukh, K., Irshad, S., Khakwani, M.S., Ishaque, S. and Ansari, N.Y., . Impact of dividend policy on shareholders wealth and firm performance in Pakistan. Cogent Business & Management, 4(1), (2017) p.1408208.

Fernández‐Gago, R., Cabeza‐García, L. and Nieto, M., . Independent directors’ background and CSR disclosure. Corporate Social Responsibility and Environmental Management, 25(5), (2018) pp.991-1001.

Ferraz, Duarte Pitta, Ilídio Tomás Lopes, and Simon Hitzelberger. “The use of poison pills by US firms over the period 1997-2015: what has been their impact on shareholder value?.” International Journal of Business Excellence 18, no. 1 (2019): 98-119.

Fowlkes, Katherine G. “Poison Pills and Their Effect on Shareholder Return.” (2019).

Gine, Mireia, Rabih Moussawi, and John Sedunov. “Governance mechanisms and effective activism: evidence from shareholder proposals on poison pills.” Journal of Empirical Finance 43 (2017): 185-202.

Harvard.edu, ‘Air Products & Chemicals, Inc. V. Airgas, Inc.’ (H2o.law.harvard.edu, 2011) <https://h2o.law.harvard.edu/cases/5452> accessed 22 July 2020b

Harvard.edu, ‘Yucaipa American Alliance Fund II V. Riggio’ (H2o.law.harvard.edu, 2011) <https://h2o.law.harvard.edu/cases/3428> accessed 22 July 2020a

Hayes A, ‘Poison Pill Definition’ (Investopedia, 2020) <https://www.investopedia.com/terms/p/poisonpill.asp> accessed 22 July 2020

Hitzelberger, Simon. “What effect do poison pills have on shareholder value? an empirical research on the adoption of poison pills.” PhD diss., 2017.

Hurt, Christine. “The Hostile Poison Pill.” UCDL Rev. 50 (2016): 137.

Jiang, Wei, Felix Mavondo, and Weihong Zhao. “The impact of business networks on dynamic capabilities and product innovation: The moderating role of strategic orientation.” Asia Pacific Journal of Management (2019): 1-28.

Johnson W, Karpoff J, and Wittry M, ‘The Consequences To Directors Of Deploying Poison Pills’ [2019] SSRN Electronic Journal

Kara, Helen, and Lucy Pickering. “New directions in qualitative research ethics.” (2017): 239-241.

Kimball, Daryl G., and U. S. Smart. “Trump Arms Control Gambit: Serious or a Poison Pill?.” Arms Control Today 49, no. 4 (2019): 3-3.

Koh, Alan K., Masafumi Nakahigashi, and Dan W. Puchniak. “Land of the Falling’Poison’Pill: Understanding Defensive Measures in Japan on Their Own Terms.” (2019).

Kwak, Kiho, and Wonjoon Kim. “Effect of service integration strategy on industrial firm performance.” Journal of Service Management (2016).

Li L, ‘Power Differentials And Bargaining Positions In Poison Pill Negotiations’ [2016] SSRN Electronic Journal

Lidén, Kristoffer, and Kristin Bergtora Sandvik. “Poison Pill or Cure-All?.” The Good Drone (2016): 65-88.

Lidén, Kristoffer, and Kristin Bergtora Sandvik. “Poison Pill or Cure-All?.” The Good Drone (2016): 65-88.

Luo, Junlin, Cui Guo, and Shenshen Hu. “Defense Strategies of Listed Companies under Hostile Takeover: A Case Study.” Journal of Economics, Management and Trade (2017): 1-10.

Luo, Junlin, Cui Guo, and Shenshen Hu. “Defense Strategies of Listed Companies under Hostile Takeover: A Case Study.” Journal of Economics, Management and Trade (2017): 1-10.

Madanoglu, Melih, Murat Kizildag, and Ozgur Ozdemir. “Which bundles of corporate governance provisions lead to high firm performance among restaurant firms?.” International Journal of Hospitality Management 72 (2018): 98-108.

Maher, Carmel, Mark Hadfield, Maggie Hutchings, and Adam de Eyto. “Ensuring rigor in qualitative data analysis: A design research approach to coding combining NVivo with traditional material methods.” International Journal of Qualitative Methods 17, no. 1 (2018): 1609406918786362.

Malatesta PH, Walkling RA. Poison pill securities: Stockholder wealth, profitability, and ownership structure. Journal of Financial Economics. 1988 Jan 1;20:347-76

McDonald, Rory, and Cheng Gao. “Pivoting isn’t enough? Managing strategic reorientation in new ventures.” Organization Science 30, no. 6 (2019): 1289-1318.

Mikos, Robert A. “Making Preemption Less Palatable: State Poison Pill Legislation.” Geo. Wash. L. Rev. 85 (2017): 1

Nartey, Lite J., Witold J. Henisz, and Sinziana Dorobantu. “Status climbing vs. bridging: Multinational stakeholder engagement strategies.” Strategy Science 3, no. 2 (2018): 367-392.

Nguyen D, ‘The Endogeneity Of Poison Pill Adoption And Unsolicited Takeovers’ (2018) 14 International Journal of Managerial Finance

Nguyen, Duc Giang. “The endogeneity of poison pill adoption and unsolicited takeovers.” International Journal of Managerial Finance (2018).

Oh, Bryan. “The value effects of low threshold poison pills: Evidence from a quasi-natural experiment.” (2019).

Oh, Won-Yong, and Vincent L. Barker III. “Not all ties are equal: CEO outside directorships and strategic imitation in R&D investment.” Journal of Management 44, no. 4 (2018): 1312-1337.

Olson, Bradley, Satyanarayana Parayitam, Bradley Skousen, and Christopher Skousen. “How to strike a balance between CEO compensation and strategic risk? A longitudinal analysis.” Journal of Strategy and Management (2018).

Panda, B. and Leepsa, N.M., Agency theory: Review of theory and evidence on problems and perspectives. Indian Journal of Corporate Governance, 10(1),(2017) pp.74-95.

Priyatosh, Sarkar.”Takeover Intentions and Takeover Defences-A brief study.” Asian Journal of Multidisciplinary Studies 5 (2017): 6.

Rock, Edward, and Marcel Kahan. “Anti-Activist Poison Pills.” (2017)

Roth, Wolff-Michael, and Hella von Unger. “Current perspectives on research ethics in qualitative research.” In Forum Qualitative Sozialforschung/Forum: Qualitative Social Research, vol. 19, no. 3. 2018.

Ryngaert M. The effect of poison pill securities on shareholder wealth. Journal of Financial Economics. 1988 Jan 1;20:377-417.

Sanders S, ‘Firm Mergers And Acquisitions (M&As)’ (2019) 45 Managerial Finance

Sarkar, Priyatosh. “Takeover Intentions and Takeover Defences-A brief study.” Asian Journal of Multidisciplinary Studies 5 (2017): 6.

Schepker DJ, Oh WY. Complementary or substitutive effects? Corporate governance mechanisms and poison pill repeal. Journal of Management. 2013 Nov;39(7):1729-59..

Schepker, Donald J., Won-Yong Oh, and Pankaj C. Patel. “Interpreting equivocal signals: Market reaction to specific-purpose poison pill adoption.” Journal of Management 44, no. 5 (2018): 1953-1979.

Scholten, V. E., and Geerten van de Kaa. “Achieving technology dominance for start-ups: illustrative evidence of the importance of establishing inter-organizational networks.” Journal of Business and Management 5, no. 1 (2016): 1-7.

Shaikh, Ibrahim A., Mohamed Drira, and Sana Ben Hassine. “What motivates directors to pursue long-term strategic risks? Economic incentives vs. fiduciary duty.” Journal of Business Research 101 (2019): 218-228.

Sharfman, Bernard S. “The importance of the business judgment rule.” NYUJL & Bus. 14 (2017): 27.

Simon, Hitzelberger. “What effect do poison pills have on shareholder value? an empirical research on the adoption of poison pills.” PhD diss., 2017:94

Singh A, ‘Understanding Mergers And Acquisitions Strategy Through Corporate Governance Perspective’ [2019] SSRN Electronic Journal

Singh, Ananya. “Understanding Mergers and Acquisitions Strategy Through Corporate Governance Perspective.” Available at SSRN 3619244 (2019).

Steinbach, A.L., Holcomb, T.R., Holmes Jr, R.M., Devers, C.E. and Cannella Jr, A.A., Top management team incentive heterogeneity, strategic investment behavior, and performance: A contingency theory of incentive alignment. Strategic Management Journal, 38(8), (2017). pp.1701-1720.

Velasco J. The enduring illegitimacy of the poison pill. J. Corp. L.. 2001;27:381.

Woods, Keegan, and Kelvin Jui Keng Tan. “Labor Unions and Strategic Corporate Governance: A Balancing Act of Managerial Power and Entrenchment.” Available at SSRN 3172610 (2018).

Wu, Xin, Hongbing Zhang, Shanshan Fan, Yidan Zhang, Zhen Yang, Simiao Fan, Pengwei Zhuang, and Yanjun Zhang. “Quality markers based on biological activity: A new strategy for the quality control of traditional Chinese medicine.” Phytomedicine 44 (2018): 103-108.

[1] Adam Hayes, ‘Poison Pill Definition’ (Investopedia, 2020) <https://www.investopedia.com/terms/p/poisonpill.asp> accessed 22 July 2020.

[2] Ananya Singh, ‘Understanding Mergers And Acquisitions Strategy Through Corporate Governance Perspective’ [2019] SSRN Electronic Journal.

[3]Duc Giang Nguyen, ‘The Endogeneity Of Poison Pill Adoption And Unsolicited Takeovers’ (2018) 14 International Journal of Managerial Finance.

[4]Lisa B. Li, ‘Power Differentials And Bargaining Positions In Poison Pill Negotiations’ [2016] SSRN Electronic Journal.

[5] Shane Sanders, ‘Firm Mergers And Acquisitions (M&As)’ (2019) 45 Managerial Finance.

[6]William C. Johnson, Jonathan M. Karpoff and Michael D. Wittry, ‘The Consequences To Directors Of Deploying Poison Pills’ [2019] SSRN Electronic Journal.

[7]Harvard.edu, ‘Yucaipa American Alliance Fund II V. Riggio’ (H2o.law.harvard.edu, 2011) <https://h2o.law.harvard.edu/cases/3428> accessed 22 July 2020.

[8]Harvard.edu, ‘Air Products & Chemicals, Inc. V. Airgas, Inc.’ (H2o.law.harvard.edu, 2011) <https://h2o.law.harvard.edu/cases/5452> accessed 22 July 2020.

[9]F. de Souza, D.C. Neri and A.P. Costa, ‘Asking Questions In The Qualitative Research Context.’ (2016) 21(13) The Qualitative Report <https://www.researchgate.net/profile/Francisle_De_Souza2/publication/303999090_Asking_Questions_in_the_Qualitative_Research_Context/links/57628f3b08ae5d145f361a58/Asking-Questions-in-the-Qualitative-Research-Context.pdf>

[10] Farrukh, K., Irshad, S., Khakwani, M.S., Ishaque, S. and Ansari, N.Y., . Impact of dividend policy on shareholders wealth and firm performance in Pakistan. Cogent Business & Management, 4(1), (2017) p.1408208