Strategic Analysis of a Company: Renault

Abstract

The report has analysed different factors associated with the strategic management of the company and the development of the different factors in the company. With the help of PESTLE analysis the macroenvironment of the company has been analysed . Porters’ five forces would help to improve the effects of different factors in the external environment. Renault’s actions and initiatives to the stakeholders and customers have been recognised in the report. On the contrary, Ansoff and BCG matrices have been used for the development of better understanding about the company’s management and effectiveness of decisions. VRIO has improved the ideas related to the financial resources, distribution, patents and cost structure of the company. After that, the SAF framework was used for the development of better recommendations and decisions in the market. At the end of the report, different recommendations have been suggested for the development of the company .

Table of Contents

STRATEGIC ANALYSIS OF A COMPANY-RENAULT. 1

Evaluation of the organisation’s strategic position. 9

Analysis of the organization’s internal business environment 10

Analysis of the organization’s strategic direction. 14

Formulation and critical evaluation of strategic measures SWOT. 17

Critical evaluation of the strategic measures SAF. 19

TABLE OF TABLES

Table 2: Porter’s Five forces of Renaults. 9

Introduction

Renault is one of the renowned automobile companies in the world. The French company has set a benchmark in terms of performance in the market of internal automobile business. While the company’s strategic analysis is analysed “RENAULUTION” -the new strategy has been observed. Three phased strategic plan has steps like “Resurrection” , “Renovation” and “Revolution”. The company has created its new strategy to improve its revenues and profits in this competition. Growings Mobility, Oldsmobile , Citroen international and Mercedes Benz and Volvo are the eminent competitors for Renaults. With effective management and developmental strategies, the company has created its popularity among the automobile market . During the Covid 19 situation, the automobile industry was affected for some time. However, the company has not faced an impressive performance in the UK. Moreover, the company has decided to improve its products and services in different types of innovative initiatives. The company has sold 2.95 ,millions of units and the revenue margin of the company would improve by 26624.8% (Renault, 2021). On the other hand, the UK automobile industry was not developed during the pandemic. The operating income of the company has improved after the withdrawal of lockdown. Moreover, this report has analysed the factors in the macro and micro environment factors have been analysed with critical factors. Organisation’s strategic direction and strategic formulation are the factors that would be analysed in this report.

Macro environment

| Factors in PESTEL | Analysis |

| Political | The UK has modern parliamentary democracy and has importance for the constitutions. Therefore, business expansion and development are not critical factors. Political instability due to Brexit would affect the situation for expansion of business in the country. The administrative systems are very critical after the implementation of Brexit. Associates and allies in the political association would also improve the factors for business development . |

| Economic | The country has a developed economic condition with a better level of GDP. The country is expected to achieve 6.76% GDP by the end of 2021.The UK has a diverse economy so that it can give every country equal opportunities to grow its business. FDI of the country is also better as it has attracted different foreign investment. However, the inflation rate of the country is also affected during the current financial year. |

| Social | The country has a higher education rate therefore the company would get skilled and trained employees. After Brexit the unemployment rate and the need for jobs have increased therefore the company would get a huge amount of workforce. Fall of income level might be an issue in terms of selling different products in the company. The company might not get the proper amount of customers as the number of new car registrations has decreased in recent years. After lockdown and COVID effects, the income and the intention of the car buying have been affected which would affect the sales of the company. |

| Technology | Appreciation of technology and acceptance of innovation are prevalent among the UK customers. Therefore, the opportunities for the consumers are high. The country has made progress in technological aspects. Increased level of education and needs of sustainability practices have improved the options for the company to extend in this country. Advanced technological infrastructure would help to improve the company in gaining better revenue. |

| Environmental | The UK has improved its environmental laws therefore the company might face some issues in maintaining sustainability for nature. Local and national authorities have taken different eco-friendly initiatives which might not be a good sign for the automobile company. Due to the COVID pandemic, tourism across the world has been affected and the use of cars has been changed for improvement of sustainability and this might be a threat for the company. |

| Legal | Different laws and regulations are present in the business environment of the UK. So that the employment acts and policies would be developed with the support of administration. Equality act and tax policies should be considered by the company to avoid critical legal situations. |

Table 1: PESTEL analysis

Source: (Inspired by Song, Sun, & Jin, 2017)

Micro environment

| Five forces | |

| Competitive rivalry | · Renault faces huge competition in the automobile industry with automotive manufacturers like Nissan, Honda, Ford and Chrysler. · In this industry, the competitive actions amongst Renault and other companies are less. This is because no company needs to capture market share from each other. Companies with higher positions become market leaders. This nature of the automobile industry brings in a stronger force of rivalry within the firms. · Renault operates in an industry where the fixed costs are high naturally. This nature forces the firms to reach their full capacity and lessen the price of products when the demand slackens. |

| Bargaining power of suppliers | · Renault dwells in an industry where the bargaining power of suppliers is weaker compared to the buyers’. The suppliers of this industry have failed or have less control over the prices. · The raw materials used in the automobile industry, including paint, glass, plastic – are standardized products. As the input materials are not differentiated the switching costs are also low. This lessens the bargaining power of suppliers. · The industry itself is the customer for the suppliers which lead them to imply reasonable pricing over the products. This dependency on the market makes the bargaining power of suppliers weaker. |

| Threat of new entrants | · The products in the industry are differentiated within the firms because customers also look for differentiated products. This nature prioritizes customer services and advertising. These factors weaken the threat of new entrants in the industry. · As Renault has a strong distribution network, it is easier to launch new entrants by setting up new distribution channels. The product types are rare in the other firms that help the new entrants to get popularized and desirable amongst customers. This makes the threat of new entrants a stronger force. · The economies of scale play a vital role in the industry where Renaults dwell, as the price of production might be higher for the new entrants. But with its advantageous economies of scale Renaults can fight with new entrants of other firms using its cost advantage. |

| Bargaining power of customers | · The number of suppliers is less in the automobile industry that forcing the customers to rely upon a few existing firms for a better quality product. The customers do not have control over prices. With a huge customer base, Renault can lift the burgeoning power of customers. Renault can make the weak force a stronger one through the marketing strategies to create brand loyalty. · In this industry, buyers focus on the quality of the product more than the cost of that product. This proves that customers are less price sensitive. This makes the bargaining power of customers a weaker one. |

| Threat of substitutes | · As the market does not have many options for substitute products, Renault can differentiate its products compared to the other firms. This will help them to make a better customer base. Through market research, they can reach the desires of the customers regarding the products and can make unique ones with no substitute available in the market. · The cost-effectiveness will also help Renault to beat the threat of substitutes in the industry. Making better quality products at a reasonable price, less than the other firms dwelling in the market will help Renault to reach buyers and increase its customer base. |

Table 2: Porter’s Five forces of Renaults

Source: (Inspired by Khurram, Hassan, & Khurram, 2020).

Evaluation of the organisation’s strategic position

| KPIs | Analysis |

| EBITD / share | Reuter’s EBITD is 23.29 which is less than Mazda’s value for the EBITD is 55.28 (Editorial, R. (2021) . Therefore, the company has to improve the operating profit with the sales and revenues (renaultgroup.com., 2021). Therefore, the factors in the operating ratio should be improved properly. |

| P/B ratio | The company has 0.34 as P/B ratio but Mazda’s P/B is 1.73 (Editorial, R. (2021) therefore, it can be said that the company might improve its price to book ratio as per the industry requirement. |

| Net liquidity (current ratio) | Mazda’a current ratio (3.41) is better than the Renault’s (1.07) therefore this company should improve the share pricing and the sales in a proper way to improve its performances (Editorial, R. (2021). |

| Management’s efficiency (Price/ sales) | Mazda has the ratio of price to ratio is 1.63 and 0.18 is the price to sales of Mazda. Therefore, the price to sales ratio would be improved in Reuters. On the other hand, the factors would analyse that the company has better results in the management efficiency. |

| Debt to equity | Annual debt to equity of the company is 259.75 whereas the KPI in the Mazda is 0.88 (Editorial, R. (2021). Therefore, the chance of solvency in Reuters is high in compared to Mazda. |

Table 3: KPI analysis

Source: Self-created

Analysis of the organization’s internal business environment

| V | R | I | O | Analysis | |

| Financial performance | Yes | Yes | Yes | Yes | Financial performances and resources are related to better external investment opportunities in the market. The company has strong financial resources that could be observed in very few companies. Prolonged profits and popularity of the company would improve the financial resources.Captured value of the company has been identified as the financial resources in the company. |

| Distribution | Yes | Yes | No | Yes | The company has a worldwide distribution market, therefore, it is critical to imitate the distribution. Prolonged performances in the market would be valuable for the company to expand in a global approach. Use of networks to reach out to different global customers. |

| Patents | Yes | Yes | No | No | Patents are valuable for the development of exclusivity in brand. Therefore, designs and models of the company can be secured. Patents of Renaults might be considered as an intangible resource. The intellectual property of the company is related to patents.These are not easily available in the market so that the company should be careful to the patents. |

| Employees | Yes | Yes | No | Yes | Employees are one of the most important factors in a company’s perspective.Trained employees can improve the factors associated with the performance of the company. Employees should be retained with a proper salary package and compensation. |

| Cost structure | No | No | Yes | No | Cost structuring in the company is weak as compared to the competition. Production and development of the company would help to improve the performances of the company. The cost management of the company would be affected with different issues in strategic planning and management. |

Table 4: VRIO analysis

Source : (Inspired by Elias & Farah, 2020)

Renaults has focused on the development of a circular economy, therefore, the company might have improved its financial resources. Moreover, the stock price of the company is 28.93 in 2021 (renaultgroup.com. 2021). Therefore, Renault has to improve its performance in the share market as its price is dropping. Poor condition of the European car market affected the factors associated with the financial resources. Therefore, the company should improve its strategic management. On the other hand, employees in the company are valuable. 179,565 employees are associated with the company (Renault, 2021). The huge workforce would help to improve the factors in the development of better profitability. However, the company has cut down 15000 jobs while restructuring (BBC, 2021). As an initiative of cost cutting management, the company took this decision. Alliance with Nissan affected the unity among employees. HRM management of the company has been affected due to the effects of the external environment of the market.

Patents for the hybrid car models in Renaults are emphasized with greater quality management and customers needs (Čirjevskis, 2021). Therefore, to compete with the other companies like Mercedes and Toyota , the company has created its own mark on the design and modeling. The easy to park system is one of the most creative designs in automobiles. Renault has focused on the cost-structuring with the help of different factors like line-up optimization, parts diversity and commonalization. The organizational costs have been rationalized with the subcontractors base, RTX utilization and digitalization of different processes. The improvement of the cost structuring has a different impact on employment, manufacturing and technological implementation. Therefore, it can be said that the company has to manage the above mentioned factors in the development of better cost structure and optimization of the company design.

Analysis of the organization’s strategic direction

Ansoff matrix

| Market penetration | Product development |

| Strong market investment Engaging communication with stakeholders (Renault, 2021)Amplified distribution network Better competitive pricing Operational cost cutting for high affordabilityJoint ventures and alliance with renowned companies like Nissan | Launching new products Strengthening presences of 5 brands such as Renaults, dacia, Alpine, RSM and LADA (Renault, 2021)Betterment of existing products New product launching Better research and development Strategic partnership for new products |

| Market development | Diversification |

| Strong brand awareness New customer segmentsRegional expansion International market strengthening | Hybrid and electricity regulated models Future relevant model line up Diversified marketing and pricing policies Merger and acquisition (M&A) in the different regions |

Table 5: Ansoff ‘s Matrix

Source : ( inspired by Dawes, 2018)

The company has improved different types of strategies to maintain the financial status and development of different products for betterment of the company. In recent years, the automobile market of the UK has declined because of the effects of COVID. Moreover, Renault is trying to establish it as the greenest automobile company in the UK market. However, the alliance with Nissan was ruled out due to some organizational differences (CNBC, 2021). As a result, market acquisition was affected by the company.

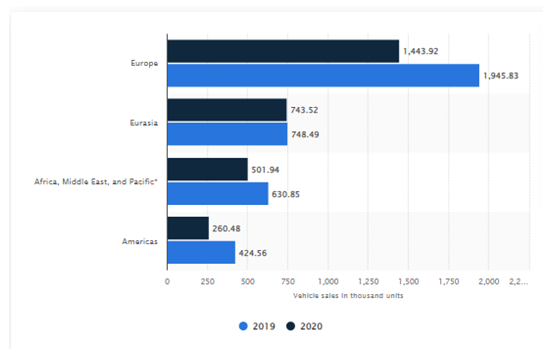

Fig : Sales in different regions by Renaults

Source : (Satista.com, 2021)

In the modern world, the company has focused on sustainability performances in the market. With the changing approach for M&A or market trend, the company has shifted its focus in the market segments (Sukma, Lubis & Utami, 2019). With the diversification of products, the company has improved its manufacturing units for the development of sports cars in the market. In poor market performance of the company, Group Renault’s models in EV segments were renovated to achieve the EU’s CO2 fleet with the average target of 2020. The company has expected different v renovation and innovation in the market development. Electrification and lifetime value are provided by the company in the market. Best segmentation in reconquering for C-segment and defending B-segments would be provided by the company by 2025. As an example of product diversification , Dacia has launched the most cost effective model called “Logan”. On the other hand, 1.8 million and 2.2 million models of Duster and Sandero were sold in 2019. Moreover, there are different types of models are included in the management

BCG

| Stars | Question mark |

| Renualt PC+LCVLada | Mobilize Alpine DACIA |

| Cash cow | Dog |

| RENAULT SAMSUNG MOTORSAutovazZoe | JinBei & huasong Group renault |

Table 6: BCG Matrix

Source : (Inspired by Chiu, & Lin, 2019)

During 2020, the passenger cars and light commercial vehicles have performed in terms of sales. However, the Grope Renault brand was severely impacted in the business. The electrical vehicles like Mobilize and Autovaz performed well in the market with an increase of 14% sales. Among Renault brands, Clio was the best selling vehicle category in Europe. On the other hand, Dacia fell by 31% worldwide in terms of sales (Torquati, 2018). LADA has improved its market with better performance and high growth in the market. Electric vehicle brands are promoted by the company with higher intensity so that a fast-track development would be observed (Čirjevskis, 2021). Alpine was relaunched in the presence of Nissan by the company . According to a report of Autocar.co.uk. (2021), sales of cars of groupe Renault fell by 21% but the range of sales was developed in the Electric Vehicle market.

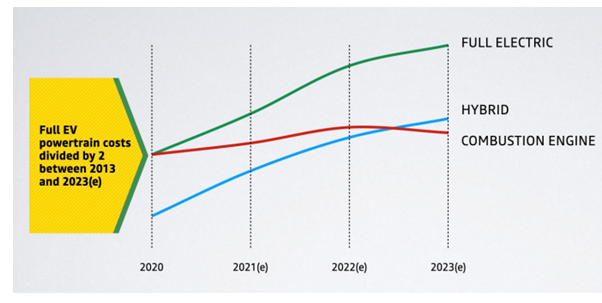

Figure : Market declination of combustion engine

Source : (renaultgroup.com., 2021)

The company focused on the sales development of the market of the new brands in the market. Moreover, the image of the business will be developed with the new hybrid and with the electric regulated vehicles. On the other hand, development of new models are emphasized in the automobile market. Renault Dacia was launched in the UK to imp[rove the company’s performance in better market management. The company has faced losses in the section of JinBei & huasong brands. Therefore, different strategic development in the company for maintaining the sales and marketing in the country. In the UK, Renault also expanded its products like Clio, Megane and Captur in the Group Renault section but the products were not successful in the market . As the company sold more than 30000 hybrid models , 25% fall could be observed in the models of Group Renaults.

Formulation and critical evaluation of strategic measures SWOT

| Strength | Weakness |

| Strong presence in the European market Strategic alliance with Nissan Offers different types of products Present in more than 100 countries Higher technological integration in the stems and operations | Inappropriate cost structures Withdrawal of models affecting popularity Brand image is weakening Poor market presence in Northern America |

| Opportunities | Threats |

| Investment in the hybrid modelsSustainable development with the electric vehicles Extensive distribution network in the market | Political instability in the UK Inability to maintain the balance in economyLower range of business for different models Natural phenomenon like COVID waves |

Table 7: SWOT analysis

Source : (inspired by Vlados, 2019)

From the report of Renault (2020), it was observed the company has a strong presence in the European continents and in other continents also. Moreover, technology, productivity and generation of new ideas would be associated with the development of better quality production and manufacturing. The company has developed its production in different locations for better production. Moreover, investment in hybrid and electric vehicles would help to improve the profitability in the company (GURL, 2017). In addition to that, Ranualation or better strategic development would help to improve better production in the market. Systems and softwares are developed in the company for better sustainability in the company with high quality sales mix in hybrid cars and EVs. With the help of data and AI, ASAS or AD softwares, alliance cloud networks and cyber securities would be related to the betterment of the services.

On the other hand, the company has faced different issues in the external environment which can be used as threats. For example, during the covid pandemic the company has faced a huge amount of loss as the automobile industry of the entire UK declined that time. Due to the financial crisis , the company might be affected by different factors like poor performance of different models in the market, inability to maintain the balance in the circular economy and weakened brand image due to high competition. Most importantly , the company is unable to impact the USA market and different American countries as well. On the other hand, withdrawal of different models would affect the brand image of the company. Moreover, cost structure would be affected with poor planning and designing in the company. Moreover, there are different factors like pricing and shutting down of the factorsines might affect improvement of the company.

Critical evaluation of the strategic measures SAF

Sustainability : The company has focused on different factors like eco-friendly models in the market. Evolution of different models for Renaults would be better for higher sustainability and mobility. Moreover, it has been observed that the company would help to improve the hybrid and automated car models in betterment of the company. There were differ t issues such as pricing and sales drop in the market . Therefore the company has improved the manufacturing of different cost-effective EVs for the European regions. Moreover, the company has revised different models for the betterment of the profitability and sales volumes in the developed market. Moreover, factors in the company like affected brand image and poor brand positioning could be observed in post-COVID scenario of the company. As a solution to different issues in the company, factors like poor cost-structures and pricing would be affected in the company. To get better sustainability, proper presence in the USA would improve the profitability of the company (McAlpine et al. 2019). Different federal laws and regulations are not followed by the products of the company. Therefore,Renault is losing different opportunities to grow in the market.

Acceptability : Moreover, there were different types of initiatives like hydrogen fueled commercial vehicles in the UK market. Deploying all sustainable models in different brands would improve the value of the brand. On the other hand, Economic sustainability would help to improve the supply chain and relations between customers and the company. With the financial management the company is trying to sustain the relationships with the stakeholders. Cost-structure can be developed by the company. To optimise the condition of the market, the company should improve different factors like circular economy leaderships and emission control. Upcoming models of the company are intended to improve emission rate by 30% within 2030 (Renaultgroup.com. Retrieved 4 December 2021). Digital supply chain in the company would help to improve the management with a more sustainable model development in the UK market. With the help of CAFE standards, different sustainable development would help to improve the emission control factors and this would improve the brand image of the company.

Feasibility: The company has a huge workforce in and outside of Europe. Moreover, Renault is trying to penetrate the market in Asia. Therefore, the company would get better options for a high quality labour force with cheap pricing. The company has focused on cost-effective strategic management so that they could provide better options at lower prices.with a strong strategic positioning and alliances, supply chain and labour issues can be resolved. Moreover, the factors in the development of sustainability would be improved with better strategic alliances and partnerships. To improve the cost effective marketing and product development in European markets. With the help of proper resources and development of scopes, Renault can penetrate and improve the performance in the USA market.

Conclusions

The report has analysed different factors associated with Renaults with the help of applying SWOT, PESTLE, VRIO , Ansoff and BCG matrix. The report has analysed different factors in the product development and diversification. Market penetration issues and drawbacks in the current markets have been identified in the report for the development of better strategies and management. With better strategic management and development in the company, Renault would help to improve the market positioning in the UK market. The company’s performance and future goals have been analysed in this report with specifications and detailing. Moreover, factors related to demand and growth of the company have been analysed in this report. On the other hand, the SAF framework has found out the issues in the company and whether the company has the potential to overcome it.

Recommendations

The company can improve its development or manufacturing section so that it would help to provide the products like sustainable Two-wheelers and trucks in the existing market as well as the medium of market penetration. Both sustainable two-wheelers and trucks are very popular for the development of better marketing strategies in the UK market. It would be beneficial to enter into the market of Northern america also. In the UK market, Cost-effectiveness and brand image can help to gain a better level of profitability in the market.

Shareholders for the strategic management are manufacturers, designers, R&D team, employees , factory workers, supply chain managers, company authority, transporters and government. With the help of a strong R&D team, the manufacturing and designing of the models would be able to make sustainable two wheelers. The company authority might hesitate about the innovation. The suppliers and transporters would be in a profitable position. If the policies and regulations of the government are met with the launch of new models, the government would be interested in allowing the company’s innovation. Political tension and issues might affect expansion of the business. On the other hand, the company would get a better chance of expanding its market in the land of America. In post-covid era, issues related to sustainability have been emphasized by the business leaders and administration also. Therefore, this innovation would definitely improve the factors of expansion.

Therefore, in a board meeting, these recommendations might be suggested as these are not only impactful on the development of the market in the USA. Electronic two-wheelers would improve the acceptance of the brand in wider customer range irrespective of country if the cost-structure is effective.

REFERENCES

- Renaultgroup.com. Retrieved 4 December 2021, from https://www.press.renault.co.uk/en-gb/releases/2814

- Autocar.co.uk. (2021). Groupe Renault sales fall 21.3% in 2020 but EVs grow. Autocar.co.uk. Retrieved 4 December 2021, from https://www.autocar.co.uk/car-news/industry-news-dealership%2C-sales-and-marketing/groupe-renault-sales-fall-213-2020-evs-grow#:~:text=The%20Renault%20brand%20sold%201%2C787%2C121,examples%20of%20the%20A110%20sold.&text=Sales%20of%20the%20Renault%20Zoe,100%2C657%2C%20from%2047%2C027%20in%202019.

- BBC. (2021). Renault cuts 15,000 jobs in major restructuring. BBC News. Retrieved 4 December 2021, from https://www.bbc.com/news/business-52845849

- Chiu, C. C., & Lin, K. S. (2019, July). Rule-based BCG matrix for product portfolio analysis. In International Conference on Software Engineering, Artificial Intelligence, Networking and Parallel/Distributed Computing (pp. 17-32). Springer, Cham. https://doi.org/10.1007/978-3-030-26428-4_2

- Čirjevskis, A. (2021). Exploring Critical Success Factors of Competence-Based Synergy in Strategic Alliances: The Renault–Nissan–Mitsubishi Strategic Alliance. Journal of Risk and Financial Management, 14(8), 385. DOI: https://doi.org/10.3390/jrfm14080385

- Čirjevskis, A. (2021). Exploring Critical Success Factors of Competence-Based Synergy in Strategic Alliances: The Renault–Nissan–Mitsubishi Strategic Alliance. Journal of Risk and Financial Management, 14(8), 385. https://doi.org/10.3390/jrfm14080385

- CNBC. (2021). Renault and Nissan rule out merger as they unveil survival plan. www.cnbc.com. Retrieved 4 December 2021, from https://www.cnbc.com/2020/05/27/renault-and-nissan-rule-out-merger-as-they-unveil-survival-plan.html.

- Dawes, John, The Ansoff Matrix: A Legendary Tool, But with Two Logical Problems (February 27, 2018). Available at SSRN: https://ssrn.com/abstract=3130530 or http://dx.doi.org/10.2139/ssrn.3130530

DOI: http://dx.doi.org/10.17719/jisr.2017.1832

- Editorial, R. (2021). MAZD.BO – Mazda Ltd Key Metrics | Reuters. Reuters.com. Retrieved 4 December 2021, from https://www.reuters.com/companies/MAZD.BO/key-metrics.

- Editorial, R. (2021). RENA.PA – Renault SA Key Metrics | Reuters. Reuters.com. Retrieved 4 December 2021, from https://www.reuters.com/companies/RENA.PA/key-metrics.

- Elias, R., & Farah, B. (2020). Locked-in resources, coopetitive relationship stability and innovation. Journal of Strategy and Management. https://doi.org/10.1108/JSMA-02-2020-0044

- GURL, E. (2017). SWOT analysis: A theoretical review.

- Khurram, A., Hassan, S., & Khurram, S. (2020). Revisiting Porter Five Forces Model: Influence of Non-Governmental Organizations on Competitive Rivalry in Various Economic Sectors. Pakistan Social Sciences Review, 4. https://pssr.org.pk/issues/v4/1/revisiting-porter-five-forces-model-influence-of-non-governmental-organizations-on-competitive-rivalry-in-various-economic-sectors.pdf

- McAlpine, J. B., Chen, S. N., Kutateladze, A., MacMillan, J. B., Appendino, G., Barison, A., … & Pauli, G. F. (2019). The value of universally available raw NMR data for transparency, reproducibility, and integrity in natural product research. Natural product reports, 36(1), 35-107. DOI https://doi.org/10.1039/C7NP00064B

- Pan, W., Chen, L., & Zhan, W. (2019). PESTEL analysis of construction productivity enhancement strategies: A case study of three economies. Journal of Management in Engineering, 35(1), 05018013.

- Renault. (2021). Annual Report. Renaultgroup.com. Retrieved 4 December 2021, from https://www.renaultgroup.com/wp-content/uploads/2020/06/renault-annual_report-2019_2020.pdf.

- renaultgroup.com. (2021). 2O22 COST REDUCTION PROJECT. Renaultgroup.com. Retrieved 4 December 2021, from https://www.renaultgroup.com/en/finance-2/financial-information/key-figures/

- renaultgroup.com. (2021). Key Figures. Renaultgroup.com. Retrieved 4 December 2021, from https://www.renaultgroup.com/en/finance-2/financial-information/key-figures/

- renaultgroup.com. (2021). THE UNITED KINGDOM AND IRELAND WELCOME THE DACIA BRAND. Renaultgroup.com. Retrieved 4 December 2021, from https://www.renaultgroup.com/en/news-on-air/news/the-united-kingdom-and-ireland-welcome-the-dacia-brand/

- renaultgroup.com. (2021). WORLDWIDE SALES RESULTS 2020. Renaultgroup.com. Retrieved 4 December 2021, from https://www.press.renault.co.uk/en-gb/releases/2810

- renaultgroup.com. (2021).GROUPE RENAULT “RENAULUTION” STRATEGIC PLAN

- Song, J., Sun, Y., & Jin, L. (2017). PESTEL analysis of the development of the waste-to-energy incineration industry in China. Renewable and Sustainable Energy Reviews, 80, 276-289. https://doi.org/10.1016/j.rser.2017.05.066

- statista.com. (2021). Motor industry economic contribution in the United Kingdom 2009-2020 | Statista. Statista. Retrieved 4 December 2021, from https://www.statista.com/statistics/299342/motor-industry-contribution-to-the-economy-of-the-united-kingdom/

- statista.com. (2021). Renault car sales in the United Kingdom (UK) from July 2016 to December 2019 | Statista. Statista. Retrieved 4 December 2021, from https://www.statista.com/statistics/385407/renault-car-sales-in-the-united-kingdom/

- statista.com. (2021). Renault Group’s vehicle sales by region 2020 | Statista. Statista. Retrieved 4 December 2021, from https://www.statista.com/statistics/387133/vehicle-sales-of-renault-by-region/.

- Sukma, D., Lubis, P. H., & Utami, S. (2019). Analysis of Marketing Strategy of Minyeuk Pret Using STP, Ansoff Matrix, and Marketing Mix. https://easpublisher.com/media/features_articles/EASJEBM_210_601-606_c_wHtxsK3.pdf

- Torquati, B., Scarpa, R., Petrosillo, I., Ligonzo, M. G., & Paffarini, C. (2018). How can consumer science help firms transform their dog (BCG Matrix) products into profitable products?. In Case Studies in the Traditional Food Sector (pp. 255-279). Woodhead Publishing. https://doi.org/10.1016/B978-0-08-101007-5.00012-9

- Vlados, C. (2019). On a correlative and evolutionary SWOT analysis. Journal of Strategy and Management.