International Developments in Accounting

Table of Contents

Introduction

The International Financial Reporting Standards (IFRS) refers to a wide group of accounting rules for the development of financial statements of different public organisations. The process is effective for the development of consistency, transparency and comparability of different financial statements all over the world. The rules are issued by the International Accounting Standards Board (IASB) (Mohsinet al., 2020). The convergence of the IFRS system indicates the development of common financial standards for the transnational organisations of a nation. It is effective for the smooth operation of international organisations in different nations (Akisik, Gal and Mangaliso, 2020). The financial condition has steadily advanced in India for the last few years. The international organisations are focusing on their business opportunities in different sectors in India. Therefore, the Indian country is selected as the emerging economy with complex financial standards and different types of challenges in the convergence of the IFRS.

Literature Review

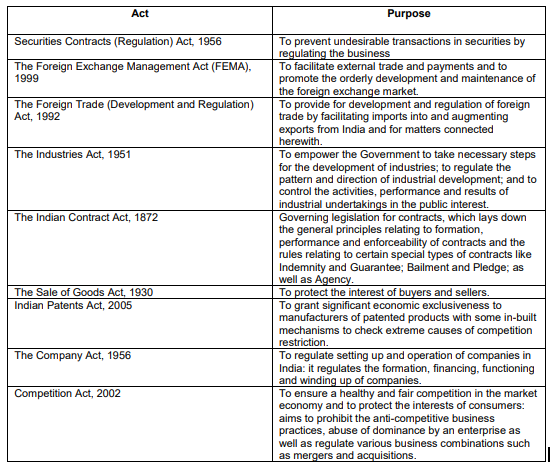

The government of India has enforced a wide range of rules and regulations for the development of economic actions and statements by the organisations in India. The Foreign Trade (Development and Regulation) Act, 1992 has provided standards for the facilitation of the imports and augmentation of the export level for the organisations in India. The Environment (Protection) Act, 1986 has developed rules and regulations for the protection of the environment such as emission, discharge level, management of the waste products and maintenance of the public health and welfare system (OECD, 2021).

Figure 1: List of Economic Regulations in India

(Source: OECD, 2021)

The Industrial Policy Regulation of 1956 and Statement of Industrial Policy of 1991 has provided regulations related to the pring system, distribution system, tax policies, investment licensing, trade practices and indirect taxation system. The Foreign Exchange Management Act in 1999 is administered by the Reserve Bank of India (RBI) for the transfer or issue of any type of security by a person who resides outside of India. It is further identified that the state government of India has focused on the development of different types of regulations on irrigation, supply of water, road, electricity, health, education, minor port, law and order and others (OECD, 2021).

It is identified that the economic reform practices in India have improved with the help of different market oriented policies. The financial system has helped the international business organisations to operate smoothly in different business sectors and domains. However, the implementation of rules and regulations by different local and state governments has created complexities for the actions in different domains and sectors (OECD, 2021).

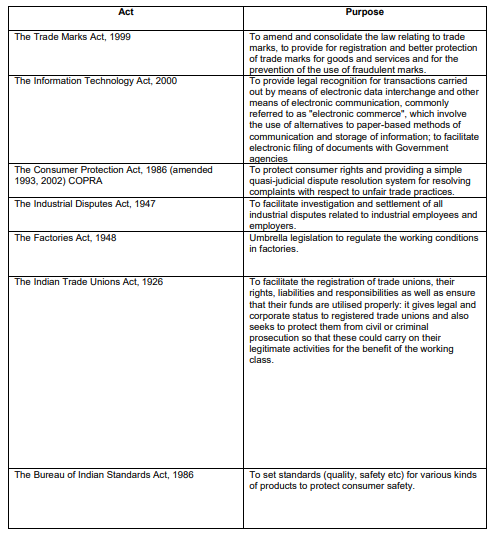

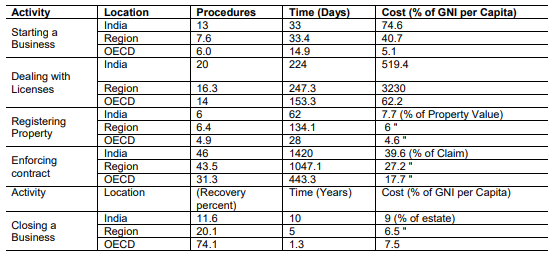

Figure 2: Regulations for Different Sectors in India

(Source: OECD, 2021)

It is identified that the wide range of rules and regulations have created challenges for different business organisations in different sectors in India and other emerging economic nations. The nature of the business regulations is different in comparison to the sets of regulations mentioned in the IFRS systems. It is identified that the IASB has set up different types of international rules and regulations for combination in business, insurance contracts, non-current asset system, financial instruments, operating segments, fair value measurement, joint arrangement and so on (Mongrutet al., 2021). It has also provided separate rules and regulations for different financial performance indicators such as earnings per share, intangible assets, investment property, financial reporting, contingent liabilities, contingent assets and impairment of asset systems (Gabriel, 2021).

It is identified that the series of regulations has created difficulties for the organisations in different sectors. However, the recent trend in globalisation has forced the governments of different emerging nations to develop rules and regulations as per the international standards for smooth economic growth. The process is aligned with the Convergence Theory which states that the industrialised nations become similar in terms of business operations and regulations. The recent trend of modernisation and globalisation has helped in the development of business practices in India as per the global standards and regulations (Cartone, Postiglione and Hewings, 2020).

The economic reforms have maintained a constant process in India and other emerging economies all over the world. The government officials have identified different key factors for economic progress such as utilisation of proper human resources, natural assets, occupational structure, formation of proper business capital, investment patterns, technological infrastructure and others. The barriers for the implementation of regulations have been removed from the central and state level. The government has also focused on the enhancement of the quality of government and business interfaces in different ministries. It is effective for the ultimate development of the economic convergence process of IFRS in India (OECD, 2021).

Critical Discussion

It is identified that the business environment in different emerging economies such as India face a lot of challenges. The investment process for any business organisation in a certain economy is decided by several important factors. One of the major factors of business development in India is the regulatory principles in a certain country. It is identified that the regulatory framework for the operation of business in India is not cooperative.

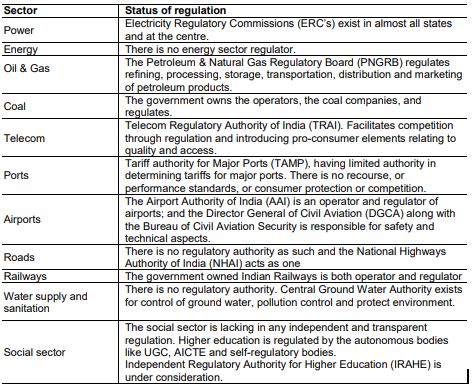

Figure 3: Doing Business Index in India

(Source: OECD, 2021)

It was further identified that the presence of a wide range of procedures and clearance processes by different agencies at the central, state and local level has created problems for the business organisations. The country also possesses different types of regulations in different sectors which is challenging for the convergence process of IFRS in the economic standards of India (Jyothi, 2016). It is challenging for the organisations to maintain financial independence and accountability for the financial practices. It was also noticed that the financial practices of India are not transparent. The lack of transparency in different financial regulations and standards of business organisations has created challenges for the smooth operation of the transnational business organisations (Adhikari, Bansal and Kumar, 2021).

It was also identified that the convergence to the IFRS system is challenging for different business organisations and stakeholders in India due to complex taxation systems, fair value measurement, negotiation of contact and reporting systems (C and Banupriya, 2016). The series of challenges has created difficulties for the convergence of IFRS in the Indian financial system. However, the government officials have identified different key factors for economic progress. The government has also focused on the enhancement of the quality of government and business interfaces in different ministries. It is effective for the ultimate development of the economic convergence process of IFRS in India (OECD, 2021).

Conclusion

It is identified that the FRS refers to a wide group of accounting rules for the development of financial statements of different public organisations. The process is effective for the development of consistency, transparency and comparability of different financial statements all over the world. The regulation practices in India are quite challenging for the business organisations due to a wide range of rules and regulations for different sectors at the central and state level. The convergence of IFRSregulations is also challenging for the organisations in India due to differences in nature for the regulations of IFRS and local level. The convergence to the IFRS system is challenging for different business organisations and stakeholders in India due to complex taxation systems, fair value measurement, negotiation of contact and reporting systems. However, the government officials have identified different key factors for economic progress. The government has also focused on the enhancement of the quality of government and business interfaces in different ministries. The process can create opportunities for the convergence of the IFRS system in the business environment for smooth growth of financial efficiency of different transnational organisations in India.

References

Adhikari, A., Bansal, M. and Kumar, A. (2021). IFRS convergence and accounting quality: India a case study. Journal of International Accounting, Auditing and Taxation, [online] 45, p.100430. Available at: https://www.sciencedirect.com/science/article/abs/pii/S1061951821000550?dgcid=rss_sd_all [Accessed 18 Jan. 2022].

Akisik, O., Gal, G. and Mangaliso, M.P. (2020). IFRS, FDI, economic growth and human development: The experience of Anglophone and Francophone African countries. Emerging Markets Review, [online] 45, p.100725. Available at: https://www.sciencedirect.com/science/article/abs/pii/S1566014119305655 [Accessed 18 Jan. 2022].

C, V. and Banupriya, K. (2016). (PDF) ADOPTION OF IFRS – PROBLEMS AND CHALLENGES OF STAKEHOLDERS IN INDIA. [online] ResearchGate. Available at: https://www.researchgate.net/publication/343255637_ADOPTION_OF_IFRS_-_PROBLEMS_AND_CHALLENGES_OF_STAKEHOLDERS_IN_INDIA [Accessed 18 Jan. 2022].

Cartone, A., Postiglione, P. and Hewings, G.J.D. (2020). Does economic convergence hold? A spatial quantile analysis on European regions. Economic Modelling, [online] 95, pp.408–417. Available at: https://www.sciencedirect.com/science/article/abs/pii/S0264999319309423 [Accessed 18 Jan. 2022].

Gabriel, J. (2021). RPAUse Case—“IFRS 9/SPPI.” The Digital Journey of Banking and Insurance, Volume II, [online] pp.295–310. Available at: https://link.springer.com/chapter/10.1007/978-3-030-78829-2_17 [Accessed 18 Jan. 2022].

Jyothi, A. (2016). MIJBR -MITS International Journal of Business Research Obstacles of Implementation of IFRS In India. [online] Available at: https://mba.mits.ac.in/MIJBR/Article%2010%20-%20A.Jyothi%20-%20OBSTACLES%20OF%20IFRS.pdf [Accessed 18 Jan. 2022].

Mohsin, M., Nurunnabi, M., Zhang, J., Sun, H., Iqbal, N., Iram, R. and Abbas, Q. (2020). The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. International Journal of Finance & Economics, [online] 26(2), pp.1793–1807. Available at: https://onlinelibrary.wiley.com/doi/abs/10.1002/ijfe.1878 [Accessed 18 Jan. 2022].

Mongrut, S., TelloMarín, M., Torres Postigo, M. del C. and FuenzalidaO’Shee, D. (2021). IFRS adoption and firms’ opacity around the world: what factors affect this relationship? Journal of Economics, Finance and Administrative Science, [online] 26(51), pp.7–21. Available at: https://www.emerald.com/insight/content/doi/10.1108/JEFAS-02-2020-0060/full/html [Accessed 18 Jan. 2022].

OECD (2021). Regulatory Management and Reform in India . [online] Available at: https://www.oecd.org/gov/regulatory-policy/44925979.pdf [Accessed 18 Jan. 2022].