Financial Analysis Plan

Introduction

The financial planning is a standard process for a business development where the feasibility study is also undergone for checking various scenarios. The objective of financial planning is to provide a clear direction to the future course of the business. In the meantime, the financial planning allows the management to check the details of the activities associated with a business. The financial planning deals with the cost estimation, operational planning, procurement designing, studying the forecasting of sales, projecting the income statement, preparing indirect and capital expenditures, cash flows and budgeting of the business. Hence, purpose of financial planning is to identify all the aspects of the business activities at all levels. In this context, the forecasting of sales may require to test various scenario analysis of the business where scenarios like poorest and the best situations are considered along with the moderate situations. The feasibility study of the business shows the sound financial condition of the business in future along with the probability of the sales in various seasons. The financial feasibility test also checks the return on investment for the investors along with the pricing feasibility of the products or services. It helps in analyzing the future direction of the business as well as setting up the pricing strategy of the products. The cost estimation of the operation allows to prepare the price of the product on basis of the activities and the positioning the product in the market competitively.

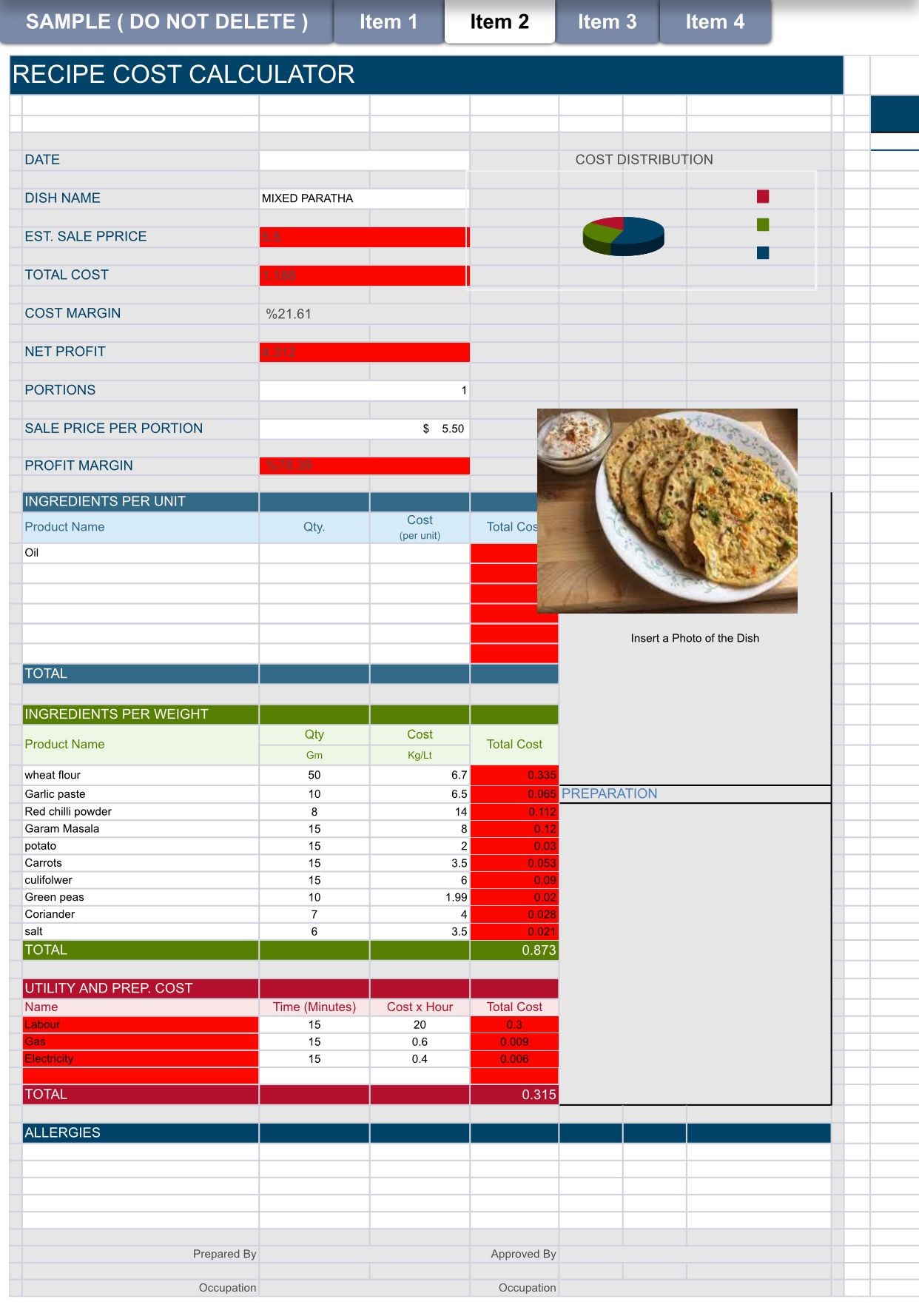

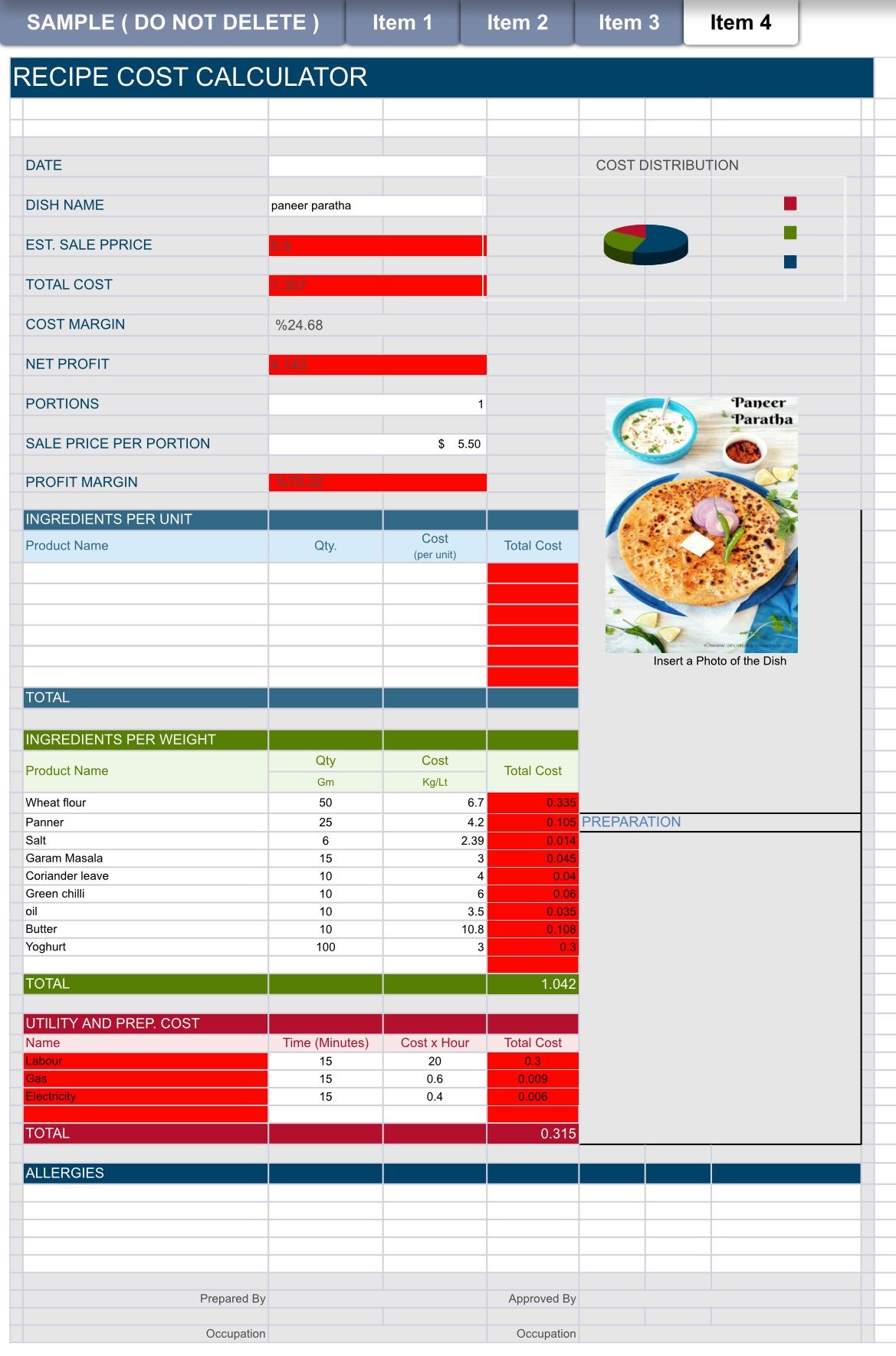

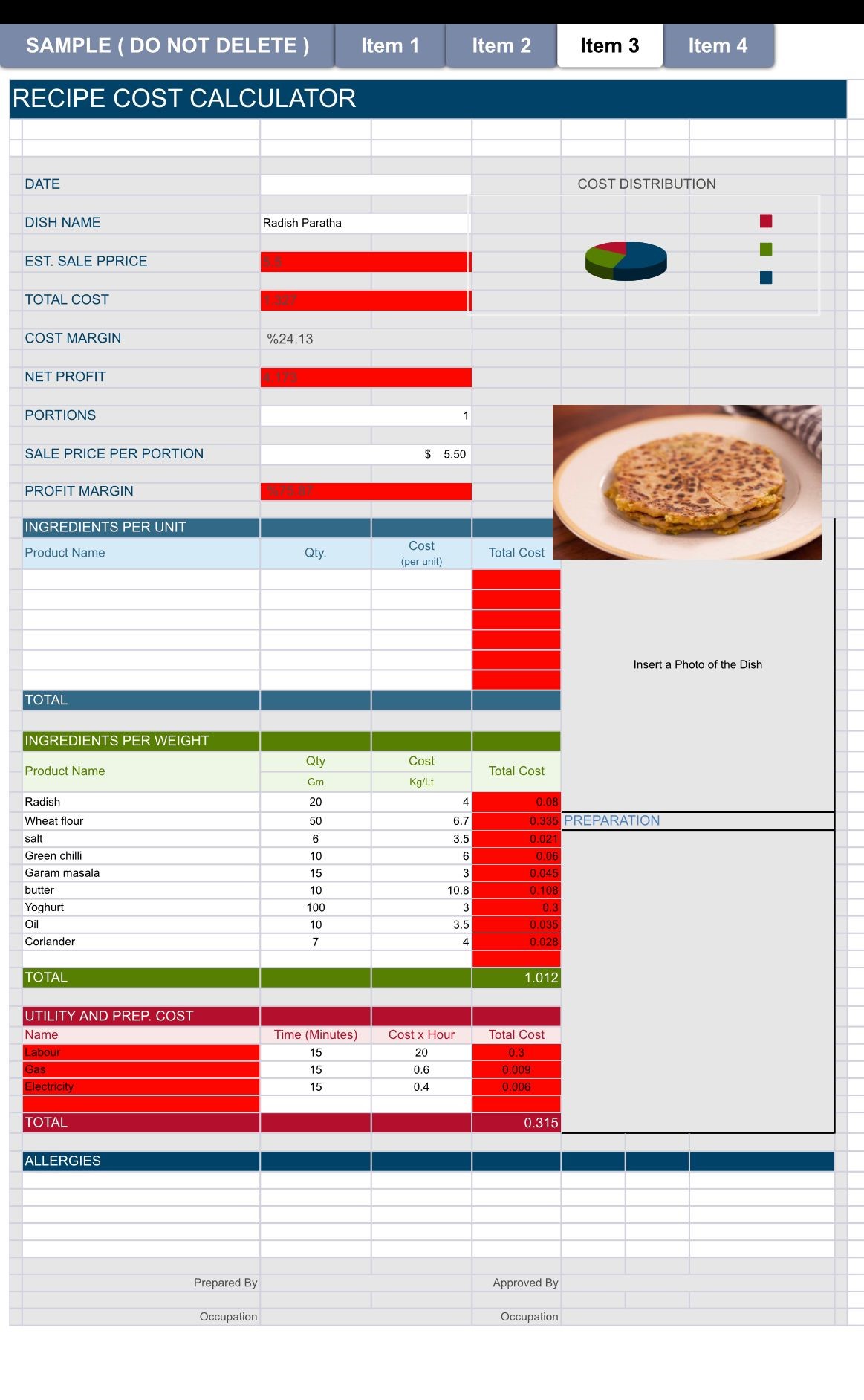

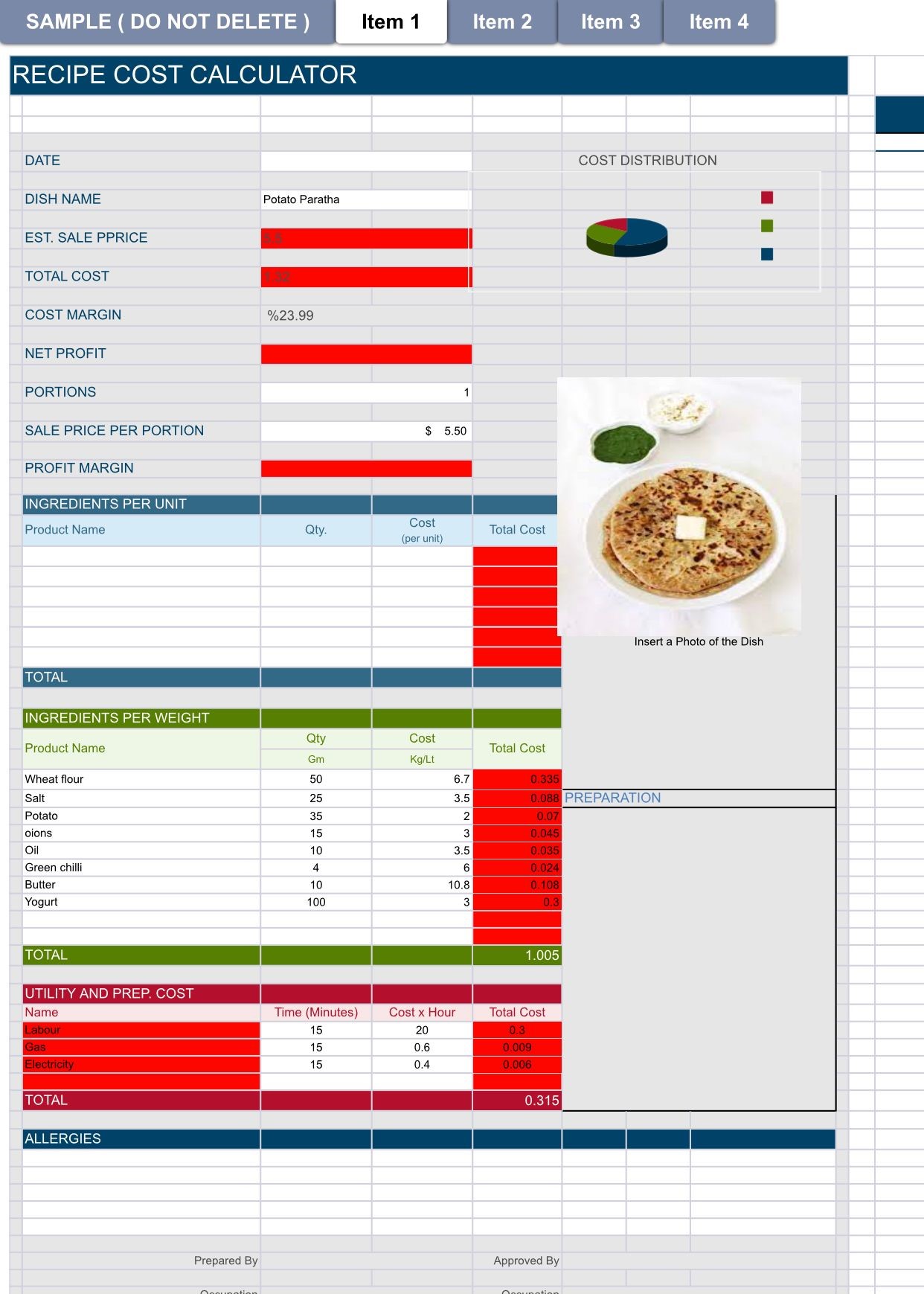

The report has prepared the financial planning for the restaurant business for four dishes. The ingredients per unit and per weight is prepared in this report for measuring the cost of the per unit of the dish. The average cost – both variable and fixed cost of the business are measured in the financial plan. The financial plan of the report ahs identified the fixed and variable costs of the dishes for the restaurant. The payroll cost of the business is explained in the report. The next step of the financial plan has elaborated the sales forecast of the business. Further, the deduction of sales forecast has also shown the controlling technique of the price from time to time. Further, the forecast of sales has allowed to create a projection on profit and loss statement for the next 12 months. In this context, the report has prepared the budget for controlling the activities with respect to the financial targets. The entire financial planning has the purpose of reflecting the financial targets of the four dishes, which are being prepared on basis of the assumption as well as the market standard for the next twelve months.

Task 1

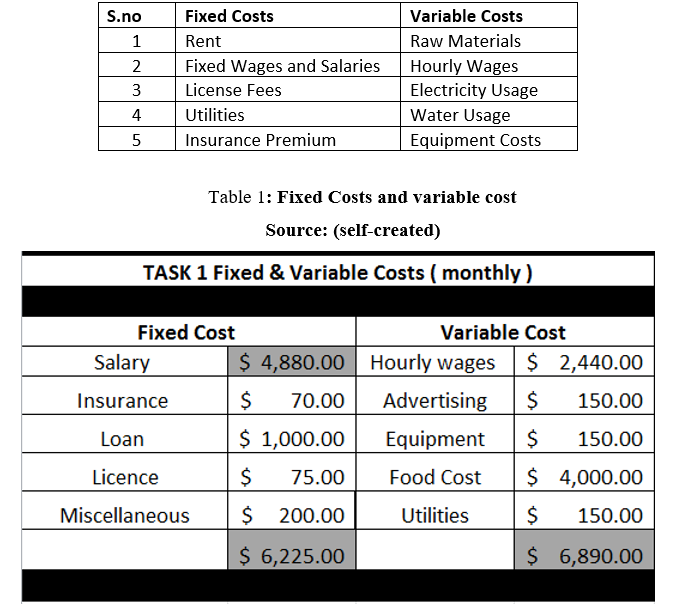

Fixed cost is associated with the fixed expense which will not expense variation within the organization. These are loan, salary and insurance. Variable cost is the cost which changes as per the revenue and capacity of the company. These are wages hourly, advertisement and utilities.

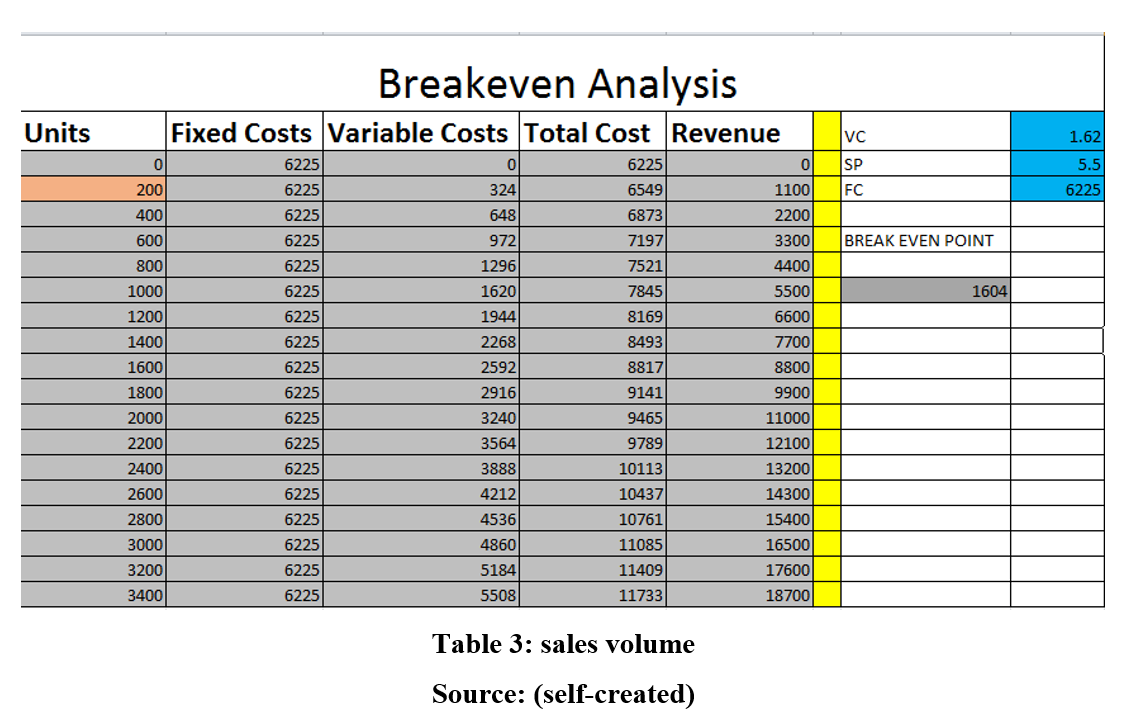

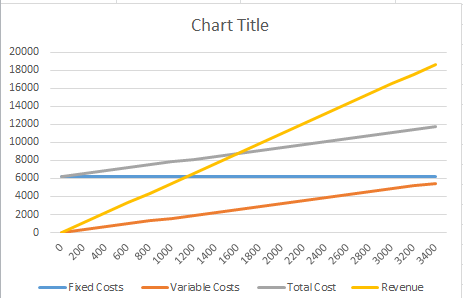

The fixed and variable costs of the business are separated in the above tables. The table 1 has shown that rent, wages and salaries, license fees, utilities and premium for insurance are the fixed costs of the business. On the other hand, the cost incurred for raw materials, hourly wages, equipment cost, usage of electricity and water for different levels of activities are considered as variable costs of the business. The fixed costs are constant costs for every level of activity of producing dishes of parathas. The variable costs of the business change due to change in the business activity. In this context, the costs of raw materials and hourly wages of contracted workers are entirely the variable cost. Further, the cost of license is same for all level of activities. Hence, it is considered as the fixed cost of the business. The variable costs such as modern equipment, which are enhanced due to increase in the activity levels of the operation. Total fixed cost of the business is estimated to $6225 whereas the total variable cost is estimated to $6890 during the period.

Task 2

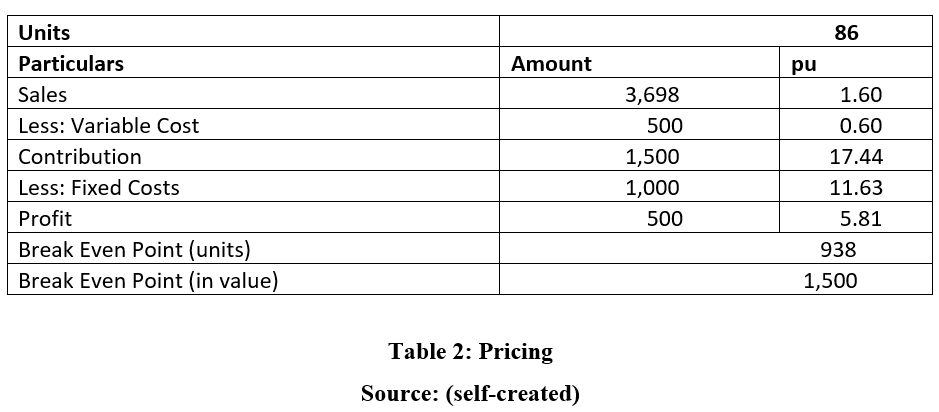

The approach taken for pricing the product is value based. The products of the business are food items and the prices are framed according to the value of the raw materials and the value of product in the market. There are many methods of pricing such as price skimming, cost basis, demand basis, competitive positioning of the products and regulated price. In this context, the dishes of the restaurant are logically or scientifically prepared for pricing purpose. Therefore, the report has prepared the break even point on basis of the estimated cost of average price as well as the cost of producing each dish. There are four different dishes and these have different costs for producing such dishes. Hence, the cost as well as the price of four dishes are not the same. Therefore, the management has to prepare the BEP on basis of the average cost and price of the dishes. Moreover, the profit has come after deducting the fixed cost of the business, which is same for every activity level. The BEP in unit of the dish ahs shown that 938 units require to be sold for meeting the no profit and no loss point. Further, the BEP in sales value is 1500 to meet all the variable and fixed expenses of the business.

Task 3

Figure 1: sales forecast

Source: (self-created)

The breakeven point of the projected business of paratha dishes are prepared and depicted in the above diagram. The diagram has shown that 1604 dishes to be sold in future for four dishes of paratha altogether to meet the no profit and no loss point of the business. In this context, the fixed cost of the business remains at the same level whereas the variable cost and level fo sales have changed from month to month. The projection of sales has allowed to prepare such breakeven point for the business where all the dishes of the parathas are estimated in terms of reach the breakeven point.

The Factors that impact the sales Forecast and create variances are:

- Internal Factors: The internal factors such as the errors in production, faulty products, and reduction in raw materials can lead to impact in the sales and can create variances in the total sales and costs of the business.

- External Factors: The external factors such as change in the govt. policy, increase in price of raw materials, unavailability of the raw materials can lead an impact on the sales forecast and create variances.

- Customer Satisfaction: One of the key factors such as Customer Satisfaction plays a vital role in the impact on the sales forecast. The changes in the likes and choices of the customers can impact the sales of the company.

Task 4

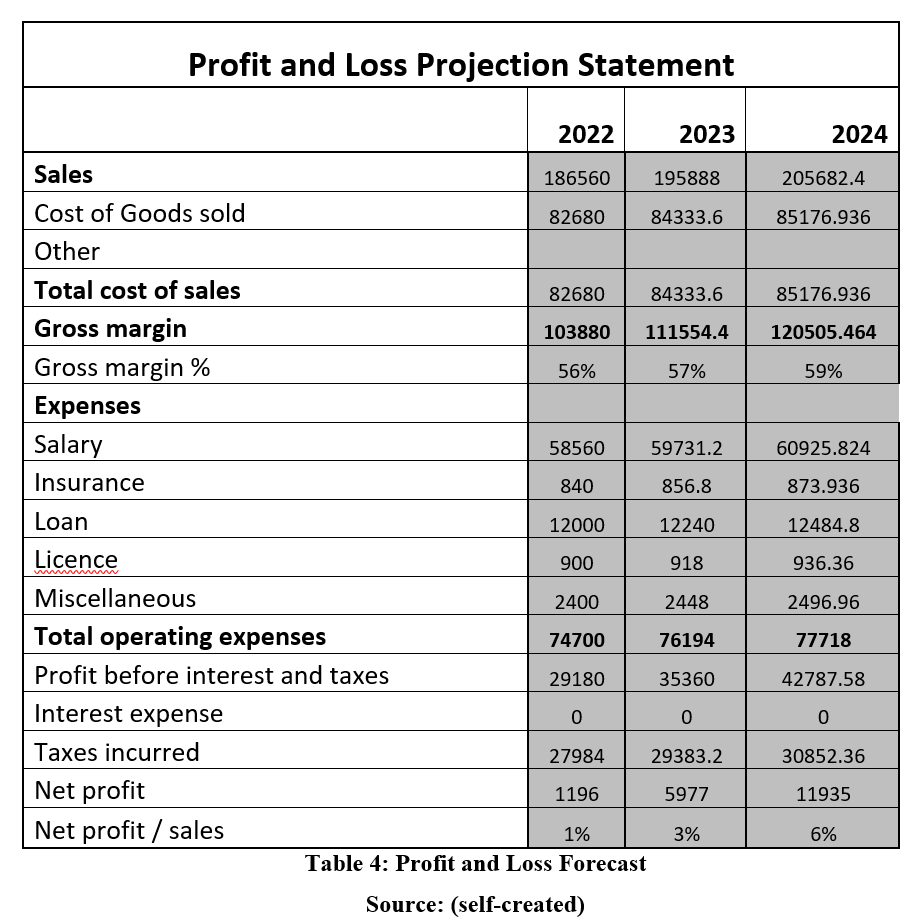

The profit and loss statement is prepared on basis of the sales forecast of the restaurant for the next three years. It is projected to increase sales in the next year will be same. However, the growth is sales will take place in 2023 and the year next by 5% per year. However, the cost of goods sold is projected to increase by 2% only in these years. The gross profit margin of the business is estimated to increase by 1% in 2023 and 3% by 2024. Therefore, it is projected that profit margin of the business would not increase fast as the growth of sales is very low. Further, all the fixed costs are considered to be increased by 2% per year at a constant rate. Hence, it is projected that net profit margin of the business might go up by 3% in 2023 and 6% in 2024 only.

According to the Computations, the Profit and Loss Projection of the Company states that the company will earn profit of $ 1,196.00 in the first year, $ 5977 in the second year and $ 11935 in the third year. The projection assumes that there will be annual increase of 10% in the total units produced every year and there will be increase of 5% in the per units costs.

Task 5

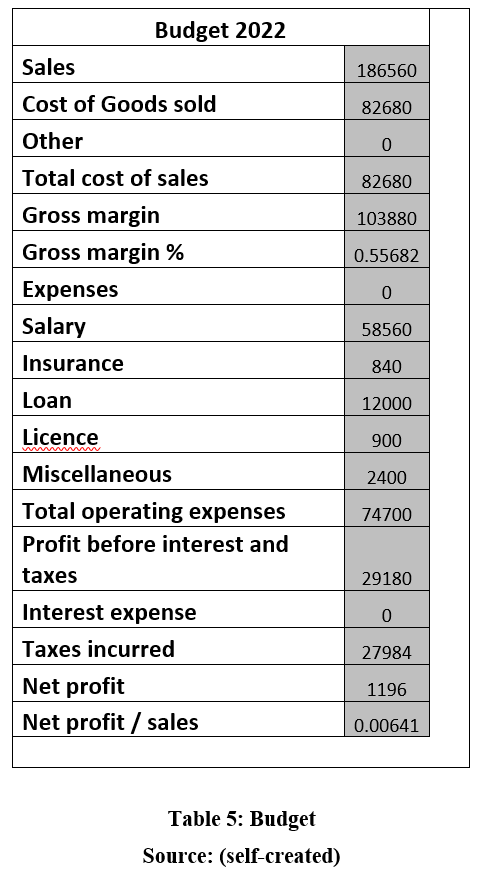

The current budget of the business has shown that estimated sales of the business of paratha could be 186560 whereas the cost of goods sold is 82680. The gross profit of the business is budgeted for the current year is 103880, which is equal to 55.6% of total projected revenue. There are various fixed items as cost incurred for the business such as license, loan, insurance, salary and miscellaneous. Total operating cost for running the administration is 74700. Hence, the profit before tax of the business is estimated to 29180. However, the estimated tax cost is too high as it is considered to be 15% of total sales. It may be lowered in reality improving the net profit of the business from 1196 to higher level. The net profit margin of the business is considered to be .6% for the current year, which is low because of higher tax cost.

Task 6

The new business idea will sell different types of parathas in the ATC Vision campus in East Tamaki. The location could help the business to get the proper number of customers with faster and easier ways. It would be a good option as the business opportunities are higher in the campus as the business has taken a cost based marketing strategy to improve the strategy. With the help of a value based pricing model with maintaining the quality , the business venture can improve the customer base by improving or controlling the quality of manufacturing, distribution and production (Ståhl et al., 2018). Therefore, the market demand can be captured easily. On the contrary, presence of more than one competitors like Sivaji and Pak n Save would affect the sales forecast as they are competing in the market for a long time. The quality and pricing balance would help the new business venture to stand out in the competition. As both of the competitors are lacking in quality but this new venture would improve the quality by maintaining the cost and pricing. However, customers are aware of the tastes of products given by the competitors. Therefore, it can be said that the company would be in a beneficial position as it would maintain both quality and quantity. In three consecutive years expected revenues are $1198, $1271 and $1453.

The business venture is near to the college premises therefore, it would be effective for attracting the target market. As a result, the company would not have to invest more in paid marketing as both word of mouth and referral would be strong (Chen & Yuan, 2020). The venture would cover the market gap by utilising the demand of food among the college goers (Mersland et al., 2020). Online marketing would be effective and another recommended strategy also as the company would not have to invest much and the young people are very attracted to digital marketing. The selected business of paratha is justified after researching the nearby market. The local restaurants do not offer such products to its customers whereas customers have the needs of such cuisine in the local area. Further, it can be said that the profit margin of the business is estimated lower due to expecting higher tax cost. However, there is a great chance of having higher profit margin due to the business by lowering the cost of tax.

References

Chen, Z., & Yuan, M. (2020). Psychology of word of mouth marketing. Current opinion in psychology, 31, 7-10. DOI:https://doi.org/10.1016/j.copsyc.2019.06.026

Mersland, R., Nyarko, S. A., & Sirisena, A. B. (2020). A hybrid approach to international market selection: the case of impact investing organizations. International Business Review, 29(1), 101624. DOI:https://doi.org/10.1016/j.ibusrev.2019.101624

Ståhl, J. E., Windmark, C., & Kianian, B. (2018). Cost-based pricing for learning organizations–a model presentation and demonstration. Procedia Manufacturing, 25, 239-246. DOI:10.1016/j.promfg.2018.06.079