Substitution Effect of Central Bank Digital Currency on Traditional Currency in China

Chapter 1: Introduction

1.1 Background of the research:

The research is a special kind of research that actually focuses more on the existing currency system. Most of developed countries has predominantly facing consequences of pandemic during Covid-19 and is state of no touch and social distancing. Now during this situation in order to restrain community spreading Reserve or central bank of most countries has shifted towards digital currency instead of traditional currency. China is one of the countries that had initial spread of corona virus and most of virologists claimed that till the vaccine is not getting invented sanitising things and yourself is one of the only ways to deal with spread of this virus. So, the introduction of digital payments is the only way to make contactless payment. This will automatically reduce the chance of virus spread as the traditional or paper currency will be tough to sanitize. The study is important in the sense that it will obviously help in the distribution of contactless payments. This is best initiative that has been taken by reserve bank of developed countries like China and other countries.

1.2 Problem statement:

The problem statement is important for any kind of research work. Here the problem statement is substitution effect of digital currency on traditional currency for the economy of China. Indeed, this initiative will obviously create problems in the long run in lives of common people. Most of economy is filled with 70% of poor and middle-class people and they are not so technology friendly. These kinds of people will never able to use such digital transaction and cashless transactions. Now in these situations this kind of people are facing troubles while making cashless digital transaction. China may be advanced in technologies but the population size is too much and it is not possible for the government to educate all of them with modern level of education. This will help those who are educated and quite involved with business like status and will be able to use such technologies. Here the study will mainly deal with problems that current economy of China will be facing while replacing traditional notes with the digital currency.

1.3 Rationale of the research:

Research rationale is mainly showing the fact that most of the employees within China is facing problems and is looking to implement in better involvement of traditional payments and the digital payments. Most of the citizens in china and other countries have implemented digital payments and it has been seen that people in real life is facing problems while making transactions. On the other hand, implementation of cross productivity and research will study how the common people are facing problems due to digital transaction. Research rationale is mainly showing how the reserve bank of China has implemented digital payments. Most of business house is not acting to accept the traditional method of payment using currency. This will go through various studies and will obviously find out the solutions that will help China in getting better level of position in transaction history. This is one of the important concepts that has been important for taking such kind of distribution of cashless transactions. The only solution will be to educate the people.

1.4 Background Literature review:

Most of the countries are facing tough battles while dealing with digital transaction. Most of the innovation till date has been only focussed on the improvement in the education system. This is mostly important for the overall level of education for poor and uneducated people. Most of developed nations has mainly took it as initiative to involve poor so that improvement in the digital transaction. This will actively help in the level of increase in the development of better actions and activities. This will mainly encompass the factor that it will rely on the education and social system that will mainly allow the poor to mitigate the factors that will allow the digital transactions. In china, the involvement of the digital transaction will allow smooth conversion will help in the digital transaction. This will slowly change the course of the economy of china and will look out for the improvement in the overall level of growth. Digital transaction is mainly important to expose the overall level of smooth transaction.

1.5 Aim of the research:

The aim of the research is very much clear. This will continuously find out the solution of how the level of education is important. The substitution effect of the digital transaction in the initial phase will be hard to get. Recent phrase of covid-19 pandemic will focus on the economic growth. The research will mainly highlight the factor that how the economy of China has adopted digital transaction and how the traditional method of currency improvement is important. Aim of the research will be to highlight the innovation and systems that has taken in form to deal with conditions that will ensure the smooth transactions through digital and UPI wallet. In spite of the fact that smooth transaction through digital transaction will also accompany level of education among the employees. It will also highlight the fact that how reserve bank of china has taken off in the improvement of social systems. Due to increased level of population increased and the level of education for employees is not possible.

1.6 Objective of the research

- To maximise the overall level of digital transactions among the recent covid-19 syndrome.

- To identify the benefits of traditional level of digital payment and will mainly rely on the level of system and the changes are required by the government in this period.

- The objective of the research will be to reach the solutions of the digital payments and how the economy of China will be following.

This will mainly help the solutions of the economy and how the China has been taking development in the systems and the level of government motivation to bring in changes within the system. It is highly important for the study to allow the involvement of factors to bring in digital transactions. This will definitely bring in quality of education level that are mostly linked up with innovation level. The objective of research will be to take into account levels of system developments that will obviously help the Chinese government to improvise on the level of use of digital payments. Smooth transactions will be to ensure the improvement in the level of actions.

1.7 Research questions:

RQ1: How the system of modern china is developing in the improvement in the digital payment?

RQ2: How the digital payment is having lumpsum effect in the lives of common people in China?

RQ3: How the traditional level of payment is mainly substituted within the lives of China.

1.8 Methodology Brief:

Research methodologies will mainly be seen as the improvement in the research methodologies. Research methodologies will be acting as level of research methods that will be used to make the analysis in a smooth manner. The chapter of methodologies will deal up with methods of data collections and the sample analysis. Even the incorporation of both primary and secondary data analysis methods that will be mainly used. Methodology section will be another important section that will encompass the smooth movement of analysis. Research methodology will no doubt help in the improvement of analysis and will mainly test the hypothesis. Analysis will be mainly dealt with graphical presentation and textual presentation. This will mainly help in the growth of the overall factors and distribution of factors that will mainly help in the improvement of analysis. On the other hand, the level of methodology brief will deal with analysis sections. This will analyse the course of distribution. Research methodologies will mainly point of factors that will mainly highlight the information and how the digital payment will be important. Even most of the countries has taken help of digital payment and will allow the importance of the actions and activities related with payment status. They will mainly help in the improvement of payment status.

1.9 Chapter Summary

The whole summary of chapter is dealing with better level of analysis. This will mainly rule out the fact that this chapter will only highlight the innovation in the digital payment. This will mainly highlight the innovation in the digital payment that are mainly dealt by Chinese government. They will be mainly ruling out the fact that in the modern period of Covid-19 has minimised innovation in the online payment mode. Using traditional mode of payment will increase the level of contamination and it will be not possible spread community spread using level of currency. This will predominantly be going to help in the level of improvement in the level of innovation and the digital payment. This chapter will no doubt at all increase the level of relationship among other chapters. They will mainly rule out the fact that innovation is mainly important and along with that education is important. This chapter will rely on the better growth of the digital payment.

Chapter 2: Literature review:

2.1 Part A: Key concepts and link with the topic

This portion of LR or literature review will mainly deal up with various forms of terminologies that will definitely going to help in understanding the topic in a deep manner. This will help in the overall level of analysis. This section will be main backbone of the research work and is mainly going to enformce the level of improvement in upcoming sections.

2.1.1 Token money vs account money

CBDC coins are mostly isuued by RBI and the functions of these CBDC coins are more or less quite similar with bit coins and other cryptocurrencies in actions. Like bitcoin these types of currencies are dealt with distributed ledger technology (DLT) for various chain of operations. Under the elective plan (closely resembling platinum cards), people and firms would hold reserves electronically in CBDC accounts at the national bank or in extraordinarily assigned records at directed safe institutions.20 Under this methodology, the national bank would process every installment exchange by just charging the payer’s CBDC account and crediting the payee’s CBDC account (D Bordo & T Levin, 2017). One urgent bit of leeway of a record based framework is that CBDC installments could be for all intents and purposes prompt and costless. Obviously, during the underlying making of each CBDC account, the character of the record holder would should be confirmed utilizing methods like those followed in acquiring a drivers’ permit or opening a record at a business bank. Starting there ahead, be that as it may, installment exchanges could be led quickly and safely (e.g., utilizing two-advance check with a cellphone and computerized pin), and the focal bank would have the option to screen any surprising action and actualize extra enemy of extortion protects varying (D Bordo & T Levin, 2017).

2.1.2 Paper currency

The national bank could encourage the continuous outdated nature of money by making CBDC broadly accessible to the general population and by starting a graduated calendar of charges for moves between money and CBDC. To abstain from forcing a weight on lower-pay family units, the expense could be negligible (or maybe none by any stretch of the imagination) for making little and inconsistent exchanges (e.g., a little week after week money store or withdrawal), though the charges would be significant for bigger and increasingly visit moves. As a result, such a charge structure would be the backwards of the run of the mill ATM, which charges a fixed expense paying little heed to the measure of money pulled back. Also, as examined beneath, this expense structure would be pivotal for guaranteeing that the proceeded with presence of paper, the money didn’t oblige the national bank’s capacity to lessen ostensible loan fees to negative levels in light of a serious unfavorable stun (D Bordo & T Levin, 2017). Most of the banks actually encompasses on the use of paper currency that actually will be highlighy motivating in the sense that improvement in the technologies will open up the opportunity of counterfeiting the existing base of currency.

2.1.3 Central bank’s digital currency

CBDCs are new variations of national bank cash not quite the same as physical money or focal bank hold/settlement accounts (CPMI-MC (2018)). Cash can be isolated into its four unique properties: (I) backer (national bank or not); (ii) structure (advanced or physical); (iii) openness (wide or thin); and (iv) innovation (shared tokens, or accounts) (Bech and Garratt (2017)). A CBDC is, by definition, a national bank-gave advanced cash. Various degrees of openness differentiate two wide sorts of CBDC: universally useful and discount. A “discount”, “token-based” CBDC, is a limited access computerized token for discount settlements (eg interbank installments, or protections settlement). Trials in this field by and large spotlight on supplanting current advancements with the point of figuring it out proficiency gains (Boar, Holden & Wadsworth, 2020).

A broadly useful variation (ie a CBDC accessible to the overall population) can be in view of tokens or accounts.3 This would be broadly accessible and principally focused on at retail exchanges (however would likewise be accessible for more extensive use). A token-based variation would look like a sort of “computerized money” which could be conveyed to the overall population in various manners to a more straightforward record based variation (Boar, Holden & Wadsworth, 2020).

2.1.4 Actual performance of central bank money in advanced economies

(Shirai, 2019)

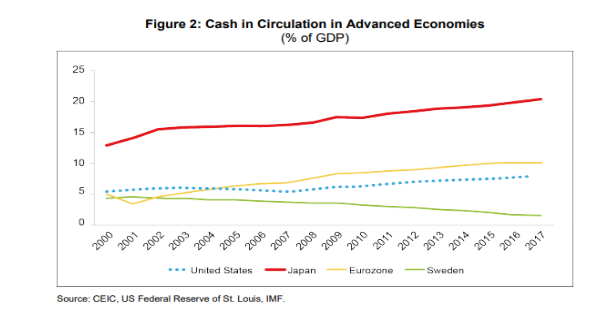

The presentation of national bank cash is analyzed by concentrating on money and hold stores independently. Money is probably going to ascend as financial exercises (proxied by ostensible Gross domestic product) develop, reflecting exchange request. Save stores additionally will in general ascent when more prominent financial exercises are related with the extending of the financial framework what’s more, consequently, an expansion in bank stores. Consequently, this paper estimates money and save stores by partitioning these information by Gross domestic product so as to look at the pattern barring the direct effect originating from more noteworthy financial exercises . Figure 2 shows money available for use as a level of ostensible Gross domestic product for the period 2000–2017 in cutting edge economies (the eurozone, Japan, Sweden, and the US).

The proportion of money to ostensible Gross domestic product declined consistently in Sweden since 2008, recommending that Sweden has advanced to turn into the most cashless society on the planet (Shirai, 2019). It is intriguing to see that the Swedish money ostensible Gross domestic product proportion kept on dropping even after a negative loan fee strategy was received on the repo rate (in particular, the pace of enthusiasm at which business banks can obtain or store assets at the national bank for seven days) from February 2015 (– 0.1% at first in February 2015, extending to – 0.25% in Walk 2015, at that point further to – 0.35% in July 2015 and to – 0.5% in February 2016 preceding expanding to – 0.25% in January 2019 as a major aspect of standardization). This demonstrates that replacement from bank stores to trade didn’t occur out Sweden in spite of a negative loan cost (Shirai, 2019).

2.2 Part B: People’s Republic of China & Digital currency

The Individuals’ Bank of China (PBOC), the national bank of the PRC, built up the Foundation of Computerized Cash in 2017 and has been looking at the chance of giving CBDC alongside the renminbi through business banks in a supposed two-layered framework. Yao Qian of the PBOC composed a report (Qian 2018) in Chinese in 2017 that a advanced cash could be incorporated into the current financial framework, with business banks working computerized wallets for the retail CBDC and the overall population ready to direct shared exchanges like with money. The report demonstrated that the computerized coins would utilize a conveyed record in a constrained manner to intermittently check the possession and that the responsibility for coins could be checked straightforwardly by the giving national bank (Shirai, 2019).

The report presumed that blockchain innovation isn’t reasonable for this reason because of versatility issues. There are a few reasons why the two-layered framework is organized in the PRC. To begin with, it is moderately simple to supplant money since the PBOC supplies money to the overall population on request through business banks. Second, the current financial framework is probably not going to be toppled, so business banks have impetuses to give CBDC to the overall population—if a store rate paid by a national bank is lower than the financing cost paid by business banks (Shirai, 2019).

2.2.1 Money supply and monetary policies

(Qin, 2017)

In any case, as indicated by Keynes’ hypothesis of cash request, the development of electronic cash will diminish cash request. In an ideal serious market, the cash flexibly should approach the cash request, yet through examination, the genuine market doesn’t adjust to this law. Showing results and the genuine law don’t match, and this issue needs further examination furthermore, investigation. At the point when Men (2007) presented electronic cash, the money was re-imagined. He accepts that in the long haul, electronic cash will supplant money totally. Along these lines the definition of M0 is electronic cash. Simultaneously, the cash multiplier is examined hypothetically and influenced by the development of dichromic cash, which prompts the expansion of cash gracefully. Zhou (2010) contended that the development of electronic cash obscured the limits between money related resources, so the meaning of the customary cash was tested.

Critical Reflection:

The critical reflection of the point of monetary theory actually exists and this mainly encompasses better position within the economy so that involvmenet of better quality of resoruces can be made in an deep way. However, most of the literature review actually suggests the fact that money demand and money supply in the economies like China will depend entirely on the cryptocurrenies that will definitely put pressure on the monetary growth and quality of delivering the cash into economy. To some extent the level of reserve ratio has to be improved so that central and other reserve banks does not bear the extra level of monetray pressure. This is critical for the overall level of analysis because of the fact that it will continuously bring in high quality of making bit coins and will be more fascinated in using those coins in some of transactions. Looking ta the money multiplier will no doubt bring in high quality of counterfeiting. In China, the economies and other financial insitutes will be mainly hopping for bettermenet of actions and activities.

Critical reflection mainly points out that improvement in the cross-level of verification is definitely going to engulf close proximity and will hardly maintian the resource breaking structures. China will be mainly involving in making smooth transactions but will be mainly focusing on growth but it also counts on the improvement level of technologies upgradation will be required. It is important for China to increase the level of CBD cash reserve for the country so that money multiplier can be improved so as to regain the level of money multiplier and how they can improve the quality of money supply in economy like China. This will allow the economy to hand in pure form of smooth transactions and will not be problamatic in nature. This will definitely bring in quality and quantity and will pertain better improvement in economic activities.

Chapter 3: Methodology:

3.1 Data collection Method

This is one of important methods that are mainly going to involve the level of improvement. Data collection method is one of the important level of techniques that are involved within the analysis process. Data collection will be both primary and secondary method of data collection. Primary method of data collection will be based on survey method. The survey will be done in order to take responses from the employees and customers of Reserve Bank of China. They will be asked around ten questions that will be based on the digital transactions and the traditional method of transactions using the paper currencies. This method of data collection will help in the level of improvement in the data collection methods. This method will be mixed of qualitative and quantitative method.

Study will also consider secondary method of data collection. This will be including the level of analysis that will be mainly made from the books and journals. This will help in the improvement in the gross level of digital payments and how they are mainly focusing on the digital payment and how the china is mainly developing its system in improving the cashless transactions during this pandemic. This will mainly encompass economy of China to rule cashless transactions. This study will mainly deal with lots of data collections and how they will help in the improvement in the process of analysis. Both primary and secondary method of data collection will allow the ensure the cross development of analysis.

3.2 Data Analysis Method

Data analysis method will be based on the excel and includes digital level of transactions. The study will be based on both descriptive and the innovation will be mainly reliable in the diagrammatic representation. Both of these methods of data analysis will no doubt help in the improvement in the analysis. Diagrammatic representation mainly helps in understanding of the factors. Method of data analysis will no doubt helps in identifying the fact that digital payments actually helps in the overall level of improvement. Moreover, the data analysis will allow the study to identify the pros and cons of the digital payments.

They are mainly relying on the factor that innovation in the technology will deal with better quality of analysis. Using advanced level of data analysis will obviously incorporate the status of the digital payments in the economy of China and how the bank employees and customers are facing tough challenges in using digital mode of payment. This way of method of data analysis will mainly highlight the descriptive statistics and how they are related with better involvement with the upgraded system prevailing in China. Data analysis method of obviously help in getting enough information and how will they rule out the improvement in the digital mode of payment. Data analysis will strongly help in the overall level of improvement in the resource use. Improvement in the digital payment will ensure smooth transaction in China during this covid-19 phase.

3.3 Sampling Technique

Sampling technique of SRSWOR or simple random sampling without replacement will be done. This will majorly inflict the thing that it will definitely ensure the smooth level of movement along such a huge level of data that will be collected. In the course of data analysis and the sampling technique will be mainly focusing on the growth of the overall level of quality and will mainly develop the actions and activities. From the overall level of growth and the use of digital currency will mainly help in the overcome of factors. The sampling techniques will eventually point out the fact that the involvement of random and stratified sampling will actually maintain the level of improvement and the factors that will definitely help in the improvement of better process of analysis. One thing is pretty sure that betterment and development will be entertaining to involve the level of digital payment.

This sampling technique will obviously help in the distribution of factors that mainly initiated government to take the help of digital payment instead of traditional payments. This is one of the important aspects that are mainly helping in the process of data collection that actually encompasses huge benefits in form of the modern level of innovation and will be mainly relying in long run growth and quality. They will definitely rule out the fact that improvement in production will help in the processing of digital payments in China. Major impacts have been seen as overall level of building of innovation in digital payment technique.

3.4 Sample Size

Sample size for the study will be around 50. This is because of the fact that it is rule of thumb that mainly helps in determining the sample size. The fundamental occasion pace of the condition under investigation (pervasiveness rate) in the populace is critical while computing the example size. This dissimilar to the degree of essentialness and force isn’t chosen by show. Or maybe, it is assessed from recently detailed investigations. Now and then it so happens that after a preliminary is started, the general occasion rate ends up being startlingly low and the example size may must be balanced, with every single factual safety measure (Kadam & Bhalerao, 2010). While figuring the example size an agent needs to foresee the variety in the measures that are being examined. It is straightforward why we would require a littler example if the populace is increasingly homogenous and, in this way, has a littler change or standard deviation. Assume we are contemplating the impact of an intercession on the weight and think about a populace with loads extending from 45 to 100 kg. Normally the standard deviation in this gathering will be extraordinary and we would require a bigger example size to identify a distinction between intercessions, else the contrast between the two gatherings would be conceal by the inalienable distinction between them in view of the change (Kadam & Bhalerao, 2010). This will ensure the study to use perfect level of sampling techniques and sample number will help in the overall level of association between the dependent and independent variables.

3.5 Demand relationship between CBDC/DCEP and physical currency (CNY) based on Keynes’ three theories of monetary motivation

CBDC or central bank digital currency is having relationship with physical currency and the relationship is strengthened by Keynesian theory. First theory is general theory and liquidity preference. Now depending on the liquidity preference customers will obviously have high demand of currency and in that case physical currency (CNY) compared to CBDC. This is mainly aligning in the sense that in the initial period physical currency or CNY is more compared to the CBDC. Bit coins and some other forms of currencies are illegal for many countries. CBDC and physical currency will no doubt help the country to go ahead of the time.

The second theory is liquidity preference. This states that money in the market is actually depending on speculative demand. In managing the theoretical thought process it is, in any case, imperative to recognize between the adjustments in the pace of intrigue which are because of changes in the flexibly of cash accessible to fulfil the theoretical intention, without there having been any adjustment in the liquidity work, and those which are principally due to changes in desire influencing the liquidity work itself.

Open-advertise tasks may, in reality, impact the pace of enthusiasm through the two channels; since they may change the volume of cash, however may likewise offer ascent to changed desires concerning the future approach of the national bank or of the government. Changes in the liquidity work itself, because of an adjustment in the news which causes amendment of desires, will regularly be broken, and will, thusly, offer ascent to a relating irregularity of progress in the pace of intrigue.

Chapter 4: Analysis and Presentation of data

This chapter will mianly present the level of research methods and the analyis that will be mainly done while taking into acocount both primary and secondary methods of data collection. Analysis and presentation of data will eventually help in identifying real life factors for the money, currency and digital currency.

Qualitative data analysis

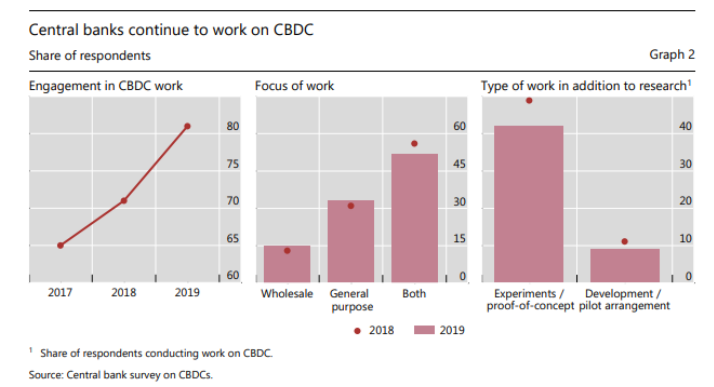

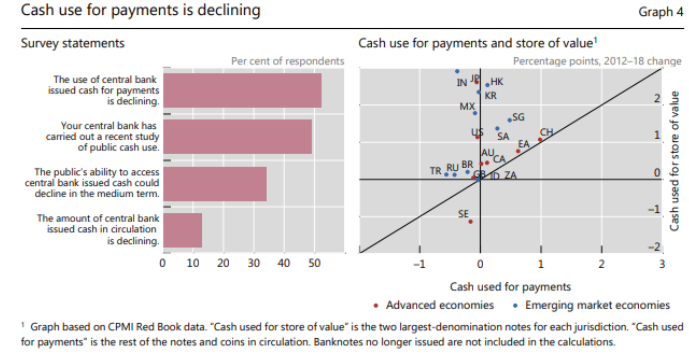

As responses given by the managers of CBD or people’s bank of China the governmnet and the authorised financial institutes are getting work in mitigating gaps of CBD reservoir. Engagement of the CBD has increased from year 2017 to 2019 and more over, the engagement of the bank has literally increased in both wholesale and general purpose. This might be one of the reason why government of China is focusing more on digital currencies. Always national banks are right now (or will before long be) occupied with CBDC work. A few 80% of national banks (up from 70%) are taking part in a type of work (Diagram 2, lefthand board), with half taking a gander at both discount and universally useful CBDCs (Diagram 2, focus board). Some 40% of national banks have advanced from theoretical examination to trials, or verifications of-idea; and another 10% have created pilot ventures (Diagram 2, right-hand board). Each national bank that has advanced to advancement or a pilot venture is an EME foundation.

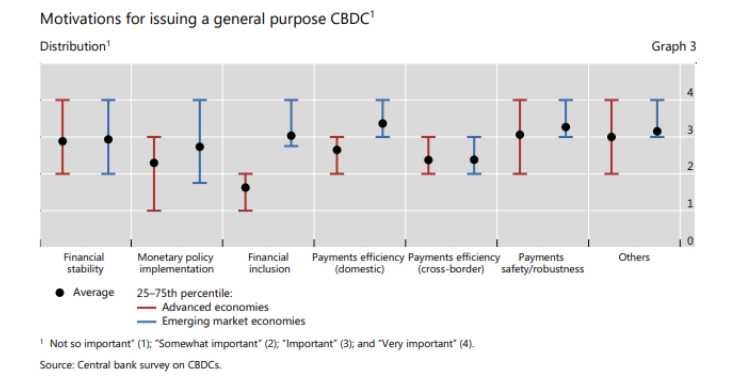

EMEs have commonly more grounded inspirations than cutting edge economies to take a shot at universally useful CBDCs (which can go about as a substitute or supplement to certified receipts). Household installments productivity, installments wellbeing and monetary consideration were, on normal, all viewed as “significant” in this regard for EMEs. For cutting edge economies, the main inspiration positioned as significant was installments wellbeing (Chart 3). Money related difficulties vary by national bank. Some national banks revealed a high dependence on money and are spurred by lessening costs and improving know-yourcustomer and countering-the-financing-of-fear based oppression (“KYC/CFT”) game plans. Other national banks have the contrary test: a low or declining utilization of money for installments inspires examination into a CBDC that would keep up community to national bank cash. New overview inquiries on money utilize shed further light on this pattern. Our overview shows that simply under portion of the world’s national banks are examining the open’s utilization of money and a third are worried that entrance to money.

Even many managers believes that in China the tendency of making payments in cash by the customers is getting decreased. This is one of the main reason why the government of china is making payments digitally. This will save time of employees and customers as well. Most of the customers are using cash for debt payments and storage of values. They believe that improvisation in the banking modes and models will definitely host out the activities and banks should focus more in involvoing into duties for the countries and will have to ensure the fact that importance of these kinds of services are very much important. It is quite important for various banks to improve their possible behaviour and bodnings with central banks and commercial banks. Moreover, this will enhance the overall quality of the production within economy. This will allow banks and other financial institutions to deal better way of involving their cash and other account based assets to deal with banking products and aspects.

Managers believe that modern activities for banks are more diversed in nature and has pre-containing the level of imporovement. This is to some extent are more diversed in dealing with better course of design in monetary and fiscal policies. The view that expelling huge category notes is instrumental to battling wrongdoing appears guileless. Huge category banknotes are generally the predominant segment in the sovereign money gracefully. In the U.S., $100 greenbacks speak to about ¾ of the all out cash flexibly. Disallowing, or on the other hand defaming, ownership of those notes would essentially move request to the remaining ¼ of littler size banknote flexibly. This would clearly build the expense to criminals,33 however would likewise make deficiencies and expanded money the executives costs for every other person. At last, there doesn’t appear to be a lot of exact proof that expelling enormous category notes is instrumental in battling wrongdoing: in the U.S., enormous section notes have been evacuated after some time — this has moreover occurred in Sweden.

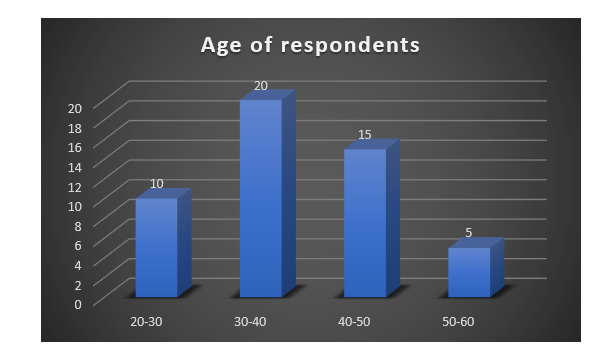

Quantitaive method of data analyis

| 1. Age of respondents | Responses |

| 20-30 | 10 |

| 30-40 | 20 |

| 40-50 | 15 |

| 50-60 | 5 |

| 50 |

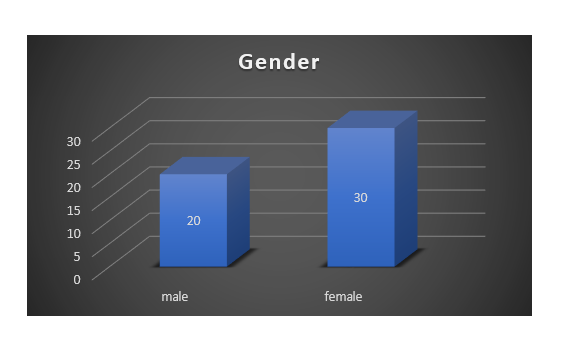

| 2. Gender | Responses |

| male | 20 |

| female | 30 |

| 50 |

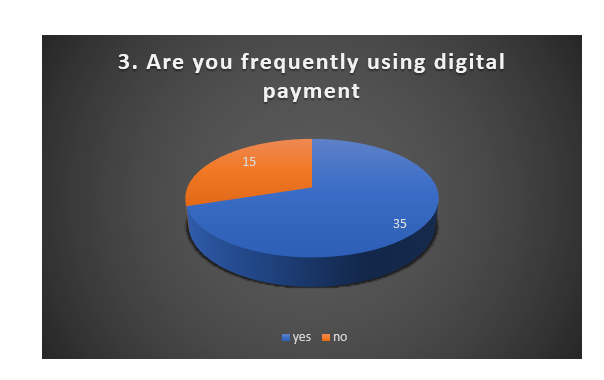

| 3. Are you frequently using digital payment | responses |

| yes | 35 |

| no | 15 |

| 50 |

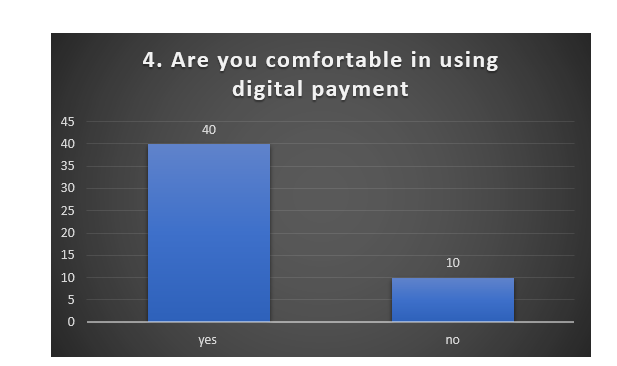

| 4. Are you comfortable in using digital payment | responses |

| yes | 40 |

| no | 10 |

| 50 |

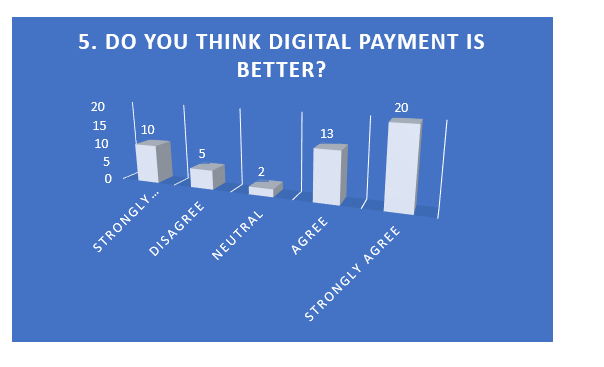

| 5. Do you think digital payment is better? | responses |

| strongly disagree | 10 |

| disagree | 5 |

| neutral | 2 |

| agree | 13 |

| strongly agree | 20 |

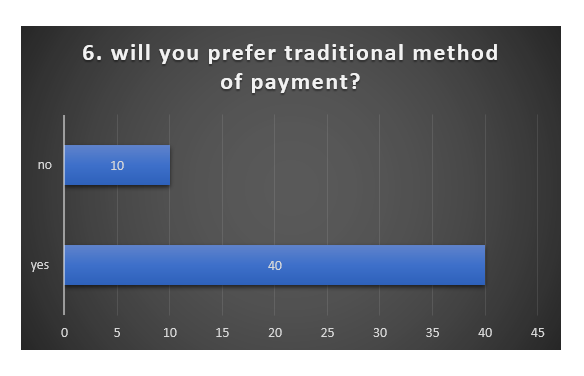

| 6. will you prefer traditional method of payment? | responses |

| yes | 40 |

| no | 10 |

The graph above is mainly showing the fact about the responses people are giving in terms of digital payment and traditional payments. One thing is clear that people are pretty much comfortable in using digital payments and also traditional forms of banking account. This will better help in the improvement in the level of growth of business in banking sectors. This will pertain the overall level of cross quality and benefit will be given while making decisions in business in banking industry. Looking to pertain the overall level of improvement in the development of banking will help in banking. All the exchanges are mysterious, as money, yet are in fact discernible, conversely with money. In contrast to money, in the interim, computerized tokens are advanced cash, so a positive or negative loan fee can be applied. Despite the fact that this loan fee bearing component makes computerized tokens better than money, one unmistakable component of money over computerized tokens is the general simplicity of checking shared exchanges. This is halfway in light of the fact that money is structured by a national bank (or a government on account of coins) in a way that isn’t effortlessly misrepresented, and mostly in light of the fact that money beneficiaries, (for example, business banks, shops, and people) simply need to check cautiously whether money got is bona fide, while advanced tokens require more confused confirmation draws near.

Chapter 5: Discussion of Findings

5.1 Primary Research Findings

Primary research findings is important in the sense that it will definitely help in getting form of better accessibility.

Most of the gender is saying that innovation is main thing and 20-30 is the maximum age limit that is using digital payament more compared to the aged ones. This is important in the sense that through the out the living material it is important for a person to get prooper levl of education. It is important to bring the generatiomn gap. It is clear form them about the fact that information technology is important for any country to get implemented. Around 20% of the employees believes that innovation is driving force and is mainly looking to innovate in their belongings.

China is home land of counterfeit and challenges are being seen when the overall level of importance are seen. This is too some extent highly suspension in the sense that improvement basically will allow them to grow. Around 40% of employees believes that they prefer using digital payment and clasification. Cost reserve funds are one of the primary reasons why numerous individuals in EM nations are grasping advanced installments. Customary budgetary administrations and ordinary installments frameworks, which will in general duty some type of administration expenses and exchange costs, don’t engage most by far of individuals in creating countries where exchanges sums will in general be extremely little. Utilizing their cell phones to perform fundamental money related exchanges at moderately low expenses and in a consistent way—by means of advanced installments applications and e-wallets that encourage support moves, cross-fringe settlements just as the purchasing of essential products and ventures—offers a progressively alluring and less expensive installments option to the unbanked masses in Asia and other EM nations.

In addition, the low credit/platinum cards entrance in EM nations is giving advanced installments organizations an edge in getting customers to utilize their portable installments stages and e-wallets rather than plastic cards. This is as of now common in China, a carefully canny country with the world’s biggest number of cell phone clients and the undisputed worldwide pioneer in advanced payments3, where Alipay and Tenpay overwhelm the market as far as non-money exchanges.

Installment subtleties of clients are probably the most extravagant wellspring of information, containing key money related data just as different subtleties, for example, areas, spending examples and propensities, and way of life selections of people. It does not shock anyone that advanced installments firms are drawn towards information gathering, which could deliver new business advances into publicizing, money related administrations and different contributions past installments.

With bits of knowledge from information, dynamic computerized installments organizations could offer more modified administrations, for example, programmed charge installments, bill parting and other one of a kind installment alternatives, just as customize the client interfacing encounter and improve usefulness of contributions, all of which could prompt further extent of customer fulfillment and dependability. Besides, information rich e-installments firms that have remarkable points of view on their clients’ spending examples could wander into focused promoting just as grow new stages for mass market money related administrations and contributions, for example, in the regions of vendor loaning, protection, wellbeing and travel.

The additional incomes created from information driven customized contributions likewise empower e-installments firms to offer progressively serious value-based rates for their essential distributed installments business so as to pick up piece of the overall industry. To put it plainly, priceless information could be monetised and enlarged by innovation centered organizations to make a one-stop look for clients.

An a valid example is the development of Jakarta-based Go-Jek, which began as a ride-hailing organization however before long wandered into food and staple conveyance, e-wallet administrations and an entire host of way of life contributions. Go-Jek, which has key partners, for example, Google, Tencent and JD.com, was as of late esteemed by New York-based market knowledge organization CB Experiences at around USD 10 billion4, which is proportionate to the market capitalisation of the fifth biggest bank in Indonesia.

In South East Asia, GCash’s computerized installments business—as indicated by our moderate evaluations—could be worth around 5% of Globe Telecom’s valuation by 2020. Looking forward, GCash will develop fundamentally, and it could be worth as much as one of the main 10 banks in the Philippines. Regardless of the interminable turn out of branches and ATMs, banks in the Philippines have just figured out how to collect an infiltration pace of under 30%. Then again, Globe Telecom has had the option to draw in 75 million endorsers in a relative brief timeframe in the Philippines, which has a populace of marginally more than 100 million. As a set up telecom player presented to the development of computerized installments, Globe Telecom could encounter solid and feasible incomes in the coming years.

In our view, Asian countries like China, India, Indonesia, Thailand and the Philippines, where e-installments arrangements can meet the financing needs of their enormous populace that are underserved by conventional banks, are probably going to be the quickest developing markets on the planet for advanced installments and e-wallet players. Furthermore, the possibilities for e-installments administrators to appreciate solid income development and addition significant client bases will be gigantic in these nations.

5.2 Secondary Research Findings

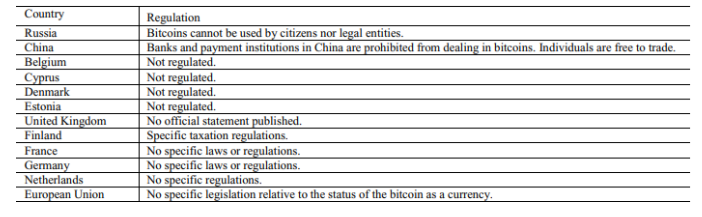

Regulation in currency

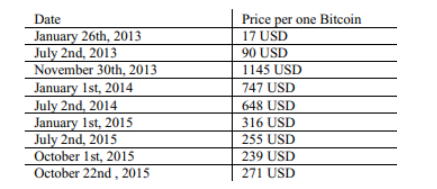

(Dibrova, 2016)

(Dibrova, 2016)

As Bitcoins are reasonably confessed to be the most known cryptographic forms of money, along these lines, the assemblage will be restricted to those. Or maybe fascinating information are given by Coinbase – the stage which professes to be the world’s least demanding approach to purchase Bitcoins. It is guaranteed, that the administration of Coinbase is presently accessible in 32 nations. Reasonable for state, that giving its administration in such nations like Canada, USA or Joined Realm, the rundown of potential customers holds living arrangement of such nations like Latvia, Romania and Bulgaria – nations with unmistakably increasingly less created budgetary market. While assessing the recorded nations it very well may be finished up, that Coinbase offered support on purchasing or selling Bitcoins is invited rather in very much created and sorted out money related market delegates or little nations with inadequately created monetary framework and oversight, which may assume a striking job for less lawfully upheld exchanges. While breaking down the rundown of nations where for example Bitcoins are not prohibited a fairly preventative appears the reality that notwithstanding the improvement towards association money related market in euro zone nations, the chance of buying, Bitcoins which could be anticipated to be equivalent because of its imaginative nature, is as yet an issue. Along these lines, the random approach towards guideline of virtual monetary forms appears to be fairly an issue. Reasonable for state, that the work on disentangling the budgetary exchanges despite everything is a continuous point.

In corresponding to cash that courses inside the directed market, the appearance of Bitcoin in 2009 introduced the period of private digital forms of money that use cryptographic innovation also, depend on an appropriated record. From that point forward, a huge number of digital money variations, known as ‘altcoins’, have risen. In any case, as appeared by the Cambridge Worldwide Digital money Benchmarking examination of Walk 2017, Bitcoin still has the biggest degree of cash gracefully esteem (expecting the cash has a worth that can be changed over back to fiat money) of 72 percent of the significant cryptographic forms of money looked into in the report, trailed by Ether with 16 percent and Run coins with 3 percent. All the more strangely however, the offer of private digital money installment exchanges contrasted and customary fiat cash based installments is as yet infinitesimal, as most members in the system are not utilizing digital money for installment purposes, yet rather as a theoretical instrument, or all the more as of late as a gathering pledges apparatus.

One thing is pretty clear about the fact that it will obviouly have better course of advantage for the improvement of in the level of development of digital currency. In 2010 the ECB meant to downsize its job as intermediator, exploiting the recuperation in genuine economy in the main months of the year, yet had to continue it by the pressure encompassing the developing apprehension that vigorously obliged nations, particularly Greece, could turn into unreasonable. These worries influenced profoundly the sovereign security markets, which became useless, and later spread over to banks as those which held noteworthy measures of sovereign bonds saw their benefits downsized, which started a negative circle of equal downwards updates by rating offices, adding to showcase strains (Micossi, 2015). Another factor to say something was the choice by EU Heads of State to raise the administrative capital proportion to 9%, generally requiring about €100 billion of new capital.

The Administering Committee kept up the accommodative money related arrangement, and in May 2010 started the Protections Markets Program (SMP), which took into consideration acquisition of protections to reestablish the typical working of business sectors what’s more, in this manner protect the money related strategy transmission component. This program was stopped in 2012 as Out and out Money related Exchanges were built up 7. In 2010, activities inside the Program added up to €73.5 billion. The upward inflationary push of the Program was balanced by explicit sanitizing tasks. Expansion in the euro zone developed to 2.2% in December, in the midst of lopsided recuperation signs. These will be highly benefical in sense that it will obviouly help in the crisis mitigation of cryptocurrency use. It is quite obviou that innovation in the cryptocurrency industry. This will make the inflation more in an uncontrollable manner. More or less the China is mainly having better pros and cons of the inflation.

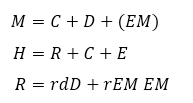

The overall level of money present within the economy of China and other developed Asean countries are determined by the function of money multiplier. As determined by Baumol-Tobin in their wealth classification theory has encompassed the relationship between money multiplier and money supply within the economy.

The relationship between the money multiplier and the money supply are derived from the following relationship.

In the above equation, C is the level of currency that is in the hand of public of China. EM is the digital money balance, D are demand deposit, R are required reserve, E is excess reserve. rd is the required reserve ratio of demand of money and rEM is the required reserve ratio of digital money balance. Now in most of the advanced level of economies the introduction of digital currency actually entails counterfeit of currencies. Mainly the improvement in the digital currencies was done reflecting to the fact that it will smoothen out the transaction but it failed to do so.

Chapter 6: Recommendation and Conclusion

Recommendation

Macroeconomics

Assume that paper money gets old and the focal bank doesn’t create any type of computerized money, with the goal that all installments are made utilizing secretly gave cash (counting virtual monetary standards). Under these presumptions, the ongoing investigation of Fernández-Villaverde and Sanches (2017) shows that the economy might be subject to indeterminacy and that there may not be any harmony that shows stable costs. Interestingly, their examination finds that value steadiness can be guaranteed by the issuance of CBDC related to a suitable money related approach system. It ought to be accentuated that such concerns are not simply scholarly but rather have been hailed as of late by national investors. For instance, Nicolaisen (2017) explicitly cautions about the dangers related with a situation in which the Norwegian economy no longer has any utilitarian legitimate delicate.

This will mainly entertain the fact that improvement in the overall resoruce distribution is being pehnomenan and in case of China the level of money consideration will be genuinely posing better level of involvment. This will no doubt allow the China economy to deal up the level of projects in financial institues. On the other hand, using better and updated level of improvement will mainly predominate the overall actions and activities. This will lead China in forming better solutions that will mostly counter the fact that overall level monetray growth and monetray policiies will be deviating in the sense that overall level of dedication is permanent. On the other hand, use of better level of growth quality and quantity will dictate the improvment. The overall deamnd in traditional money will be increased and so thaat will increase the level of money laundering. CBDC and digital currency along with cryptocurrency will mainly rule out the overall level of improvement that along the motivation will drag the level of better souirce of growth.

This is highly important that money is important and to counter the overall level of growth pattern will be mainly countered. Both cnetal and RB has to endure the level of motivation from the banks and customers. It is highly acceptible the fact that better form of money growth will be revealing in nature. They will takle the inflation and staggering monetary policy. It will mainly insignifcnat in the sense that they will mitigate the growth pattern of GDP and long run growth.

Conclusion

The study is concluding the fact that innovation is crucial and will maintain the overall level of improvement in the course of banking actions and activities. This will maintain the overall level of quality and will ensure the fact that technology is driving and will mainly better involvement of fact that bringing in technology will be important. However, it has been seen that overall level of gross product will definitely allow the fact that movement is important and will be looking to portray overall level of quality. Now, the oversight proportions of China and the US are breaking down. It is discovered that there are numerous reasons prompting diverse administrative thoughts, counting social framework, Web money mode, and bitcoin industry. Along these lines, when we study and exploration the administrative framework with Chinese qualities, it is important to completely join the national conditions and viably assimilate progressed thoughts.

Right off the bat, we ought to cling to development, framework, and various levelled the executive’s standards. The oversight begins from the application stage, and after the estimation of hazard, we have focused on arranging. Therefore, we cannot just ensure the genuine interests of the exchanging stage, yet in addition defend the real rights and premiums of financial specialists, to establish a decent framework for China’s better turn of events of the computerized cash later on.

This will motivate China to involve the level of implementing better actions and activities in the banking sectors. Moreover, through the action and activities of PBC will enhance the growth level and highly customisable level of innovation. This is to ensure the fact that improvement in the level of employee working in banks will get bonus that will allow the economy to provide better solutions. Choosing better process of optimisation has ensured smooth movement of the banking curve to hit down the ground. However, one thing is pretty clear that they will looking to allow the improvisation and will mainly qualify the level of digital payment. They will allow the motivation factor to rely on the fact that improvement in the overall quality has to be qualified in a level manner. They will motivate the immortality of rejuvenation and will impose better level of offspring. They will be mainly holding the properly the level of overall emphasised currency market. This will be looking to have more ficus on the financial planning and will allow the government of China to pretend better actions. -cash tackles the difficult that individuals can’t by and by get to concentrated physical records and that unified physical records can’t be immediately refreshed dependent on real product exchanges because of incessant visits. The recent tussle between CBDC and physical cash is showing the fact that people will have to invest more time in the dealing with CBDC and along with that level of physical cash will also co-exist. Both of these will play an important role in driving the economy of China and will be willing to overall level of competence. This means people will demand money by speculating level of rate of inflation and monetary growth within economy. They will maneuverer the level of demand for money considering other factors like rate of interest within economy, wear and tear cost of going to bank and other financial institutes and other factors.

Reference list

Boar, C., Holden, H., & Wadsworth, A. (2020). Retrieved 24 July 2020, from https://www.bis.org/publ/bppdf/bispap107.pdf

D Bordo, M., & T Levin, A. (2017). Retrieved 24 July 2020, from https://www.nber.org/papers/w23711.pdf

Dibrova, A. (2016). Virtual currency: new step in monetary development. Retrieved from https://core.ac.uk/download/pdf/82265311.pdf

He, D., Habermeier, K. F., Leckow, R. B., Haksar, V., Almeida, Y., Kashima, M., … & Yepes, C. V. (2016). Virtual currencies and beyond: initial considerations.

Kadam, P., & Bhalerao, S. (2010). Sample size calculation. Retrieved from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2876926/

Qin, R. (2017). The Impact of Money Supply and Electronic Money: Empirical Evidence from Central Bank in China. Retrieved from https://digitalcommons.buffalostate.edu/cgi/viewcontent.cgi?article=1023&context=economics_theses

Shirai, S. (2019). MONEY AND CENTRAL BANK DIGITAL CURRENCY. Asian Development Bank Institute. Retrieved from https://think-asia.org/bitstream/handle/11540/9626/adbi-wp922.pdf?sequence=1

Taskinsoy, J. (2019). Pure Gold for Economic Freedom: A Supranational Medium of Exchange to End American Monetary Hegemony as the World’s Main Reserve Currency. Available at SSRN 3377904.

Vitturi, A. (2018). The people’s bank of china and the european central bank: a comparison of monetary policies.

WEN, X. (2017). International Comparative Study of Virtual Currency Supervision in Block Chain. DEStech Transactions on Social Science, Education and Human Science, (adess).

Yano, M. (2020). Theory of Money: From Ancient Japanese Copper Coins to Virtual Currencies. In Blockchain and Crypt Currency (pp. 59-75). Springer, Singapore.