The Impact of Macroeconomic Announcements and Variables on Exchange Rate

Abstract

The study aims to evaluate the impact of macroeconomic announcements and variables on the GBP/USD exchange rate. I examined whether market participants reacted differently to news depending on whether the news came from the United States or the United Kingdom and whether it was good or bad news. I also examined whether traders’ response to the news has changed over time. I found that macroeconomic news exhibits a statistically significant correlation with the daily movements of the euro against the dollar. However, this relationship exhibits significant time variation. There is evidence of an asymmetric response, but to different degrees and at different times. The results also provide evidence that the market seems to ignore good news and remains fixated on bad news, as is often claimed in the market commentary, but only for a certain period.

1. Introduction

The exchange rate refers to the value of a currency about another with the aim of conversion. There are various commodities and currencies traded on brokerage platforms that depend on exchange rates for value variation. Forex refers to the foreign exchange trade whereby the local currency of country exchanges with another country’s local currency (foreign currency) at a particular rate set and determined by the market forces of demand and supply (Kočenda & Moravcová, 2018). The market forces of demand and supply only have an impact on floating foreign exchange markets. The floating foreign exchange markets are those that have been set free from any form of government interference on the forex rates (Égert & Kočenda, 2014). The GBP/USD is just one among the many currency exchange pairs that investors trade on depending on the rates. This rate is affected by numerous factors, including inflation, interest rates, political stability, the balance of trade, speculations, and public debt. Currency exchange rates are affected by the appearance of new data and news. In this paper, I investigated how some macroeconomic announcements have a significant impact on the GBP/USD exchange rate in the short term, and examine the surprise effect when the announcement is released.

The exchange rate is defined as the value of the currency of the country v/s that of another country or a country that is in the economic zone. The exchange rates are free-floating in nature and they increase and reduce according to the demand in the market respectively. The exchange rate is defined in the UK according to the currency with which the country is trading at the time. For instance, if the 1 US Dollar is 0.72 Pound, then £1 will get $0.72 in the US. When the price of the Pound increases from the value of the other currency, then it is stated as appreciation in the value of the Pound. It can also be said that the value of the Pound has become stronger. In a similar case, when there is a decline in the value of the pound as compared to the currency of another country while doing the trade transactions then it is noted that the value of the pound has depreciated and has become weaker. There is a situation associated and linked with this case, which is that when the value of the Pound is weaker than in the foreign country, the individual has to spend more amount for doing payments relevant to one dollar.

The position of which currency is stronger, whether $ or £ is determined by the value of trade in goods and services as compared with that of the other country. Various factors lead to the downfall of the value of one currency from another. In this case, due to several steps such as the decision of Britain to exit from the European Union was some of the key reasons due to which there was a fall in the value of currency which has also impacted the devaluation of the currency in the market. The impact of the devaluation or increase in the value of the currency is felt in the cases of International Business, govt. Imports, Foreign Travel and so on. In the case when the pound is strong against the dollar, then one gets more dollars (in terms of value) for the pounds, therefore, the stronger the pound is, the cheaper it would be to purchase things abroad and it would also reduce costs in the international trade on tariff duty and other expenses if the pound is stronger.

Macroeconomics is one of the most popular branches of economics in its general sense. It studies macro phenomena in the national economy on a large scale, such as national income, capital formation, inflation, price levels, growth rate, changes in unemployment, and focuses on the economy’s trends and how the economy as a whole is progressing. Every day, newspapers, T.V., and the radio report a wealth of economic information released by statistical bureaus worldwide. To interpret this information, we need to understand the different concepts and definitions used when collecting and reporting economic data (Gottfries,2013). One strain of this literature centers around the impacts of macroeconomic information declaration on different markets, including Forex markets. Three macroeconomic variables are especially important: real gross domestic product (GDP), the inflation rate, and the unemployment rate (Mankiw, 2010). The Forex market is one in which a nation’s currency is traded for that of another at a mutually agreed rate, and it is the largest market in the world. The price for the currency pairs always moves up or down; many factors impact the demand for one of the currencies and make this movement. Some movement happens when the announcements or the news are released, and that can make a move up or down for a few minutes, hours, or the long run, monthly or yearly. This study will see the impact of macroeconomic announcements and news on one of the Forex currencies, the GBP/USD, where the announcement effect is defined as the impact of news on financial markets. News is defined as the difference between the market’s expectation of the release and the actual release (Parker, 2007). The study’s focus is on the U.K market, and the data that I will use are from historical foreign exchange rates between the U.K Pound Sterling against the United States Dollar.

Technological development and the development of communications are decisive means for the transmission of crises and the transmission of impact between local, regional, and international economies, especially with their devastating effects. Therefore, a phenomenon or a pandemic will lead to effects for all countries, especially in the financial and monetary aspects. During the period covered by my study, the British economy in particular, and the European economy in general, underwent the impact of the announcement and measures for Brexit from the European Union, and the global economy also underwent the impact of a sudden event through the impact of the Corona pandemic.I have highlighted the impact of Corona and Brexit on the GBP/USD in an overview without doing a deep or statistical study, as the impact of Corona is not yet clear, and we are still in the crisis and the epidemic.

1.1 Problem Statement

Macroeconomic news gives the general pulse of the economy. The main purpose is to analyze the macroeconomic announcements and factors and determine whether or not they affect the exchange rate in the short run. I also examine whether market participants reacted differently to news depending on whether the news came from the United States or the United Kingdom and whether it was good or bad news.

1.2 The Purpose of the Study

The purpose of this study is to examine the effect of macroeconomics announcements on currency movements. The period of the study is 5 years, from 01/01/2016 to 31/12/2020. The original data include one-minute frequency transaction price data of the GBP/USD exchange rate. The exchange platform works 24 hours from Sunday 5 PM EST to Friday 4 PM EST.

1.3 Limitation of the study

The study is based on historical data. The study ignores statements by central bank managers and Federal Open Market Committee (FOMC) meeting minutes, which can sometimes have a major impact. The study also ignores the impact of a different economy in a different country, especially the impact of the Euro on the USD.

The scope of the study is mainly limited to USD and GBP as base currencies and how the macroeconomic announcements in the United Kingdom and the United States affect the currencies in the short term or the surprise effect. In addition, the study also assesses the impact of Covid-19 and Brexit on macroeconomic variables and GBP/USD exchange rate. I have examined the impact of Covid-19 and Brexit literally and by looking at the studies conducted during this period without considering the statistical or analytical aspect.

2. Literature Review

How do macroeconomics affect the exchange rate? This has been the subject of several studies in the literature. As an endogenous variable, the exchange rate has a complex interaction with the remaining observable macroeconomic, and it is also affected by the unobservable factors in the money market.

Engel and West (2005) define this feature of the exchange rate where they model the

exchange rate as an asset price and define it as a linear combination of observable

fundamentals and unobservable shocks.

There are a lot of studies and research about the effect of macroeconomic announcements on the exchange rate. Some of the studies look for the effect and relationship between macroeconomic surprise news and currencies volatility in the short run, and other research attempts to conduct long-term research. Even though various studies have recommended a generous force of announcement on market changes, others guarantee entirely something else, expressing the impact of announcements is exaggerated and immaterial. I will give an outline of the significant studies.

Evans and Lyons (2007) found a positive correlation between the news such as the changes in the market, the introduction of a new policy, indirect effects of the trade, and the GBP/USD exchange rate changes. The changes mean that when there is a decrease in the market or there is any policy that is not in favor of improving the position of foreign exchange and foreign growth, then there is a change in the exchange rate. For instance, when the UK opted out of European Union, then the prices of various goods went down, this impacted a decrease in the exchange rate, therefore, making the value of GBP weaker in comparison to USD. However, at the same time, there are indirect effects, that key to the hypothesis is of a request stream, alludes to the exchanging choices once the immediate impact has occurred and the market quote has been changed, subsequently permitting dealers to follow up on their genuine beliefs of the ramifications of the news. Evans and Lyons (2007) conducted a study to determine the correlation between news and the GBP/USD exchange rate change. The researchers collected data between 2000 and 2005 on news and GBP/USD exchange rate trends. The researchers concluded a positive correlation between news and changes in GBP/USD exchange rate. Further, the researchers found that 95% of the time negative news was released, the sterling pound dropped by 19% against the U.S. dollar within the period.

The increase in the exchange rate signifies that the currency has become stronger as compared to another currency like the Dollar or Yuan or any other currency. In this case, when the price of GBP increases as compared to Dollar, then it can be said that GBP has become stronger. The numerator and denominator of the currency pair include the base currency and the quote currency. When the currency with whom the exchange is made is the base currency or the denominator. In this case, GBP is the numerator and USD is the denominator.

Clarida and Waldman (2007) try to study and understand how the policy of a country’s central bank affects the transmission system by which inflation shocks are reflected in the foreign exchange data. The result of the study is that in inflation-targeting countries, as a financial backer, anticipate that the central bank should respond by expanding interest rates, bringing about more noteworthy profits from the domestic currency. Also, they find that an inflation shock’s impact is more articulated if the central bank has a standing for more forceful swelling targeting. Specifically, Clarida and Waldman (2007) found that 4% inflation rates increased the central bank’s exchange and processing fees by 2%.

Quang My and Sayim (2016) study the effect of macroeconomic elements on the exchange rates of the USA with four other countries (India, China, Mexico, and Brazil). The study finds that inflation and interest rate have the most effects contrasted with different components picked. The researchers collected data on the macroeconomic elements and the USA exchange rates between 2010 and 2015. The study found that a 4% inflation rate in the USA resulted in a 12% fall of the sterling pound against the U.S. dollar more than India, China, Mexico, and Brazil. Further, an increase of unemployment by 3.2% in the United States implied a 17% fall in the sterling pound against the U.S. dollar.

Ehrmann and Fratzscher (2005) find that if the announcement is of great significance for determining the exchange rate, its effect should show some level of tirelessness and ought not to quickly cease to exist in a few minutes. This is decent reasoning for utilizing daily data. The researchers conducted a study to determine the impact of macroeconomic announcements on the GBP/USD exchange rate within 1 and 15 minutes. The researcher collected data on the percentage changes in the value of the sterling pound against the U.S. dollar within 1 and 15 minutes of negative macroeconomic news in favor of the U.S. between 2000 and 2005. From the study, the researchers determined that negative news benefiting the U.S. reduced the sterling pound’s value by 35% within the first 1 minute. However, there was a 15% impact on the sterling pound after the 10th minute and 10% on the 15th minute of the macroeconomic news.

Monfared and Akın (2017) study the relationship between exchange rates and inflation rates in the Iranian economy using annual data and semi-annual data. They concluded that there is a direct relationship between exchange rates and inflation and that an increase in foreign exchange rates leads to increase inflation, including variable money supply and using the VAR model to test the effects of money supply and the rate of exchange on inflation, they found that the impact of the money supply on the inflation was greater than the impact of the exchange rate. The researchers collected data on the inflation rate and exchange rates in Iran between 2010 and 2015. The researchers concluded that an increase of 4% of the inflation led to a 15% fall of the Iranian rial against the U.S. dollar.

Ramasamy and Karimi Abar (2015) studied the influence of macroeconomic variables on exchange rates. The study found that many variables show opposite relationships. For example, interest rate, the balance of payments, and inflation rates should positively influence the exchange rate as per theory, but the result shows the opposite. The explanation may be that the countries that the study chooses because, in those economies, the inclusion of macroeconomic variables ignores the psychological factor, which is the confidence of investors and traders in the performance or stability of these economies.

I have looked at some previous studies that I can agree or disagree with, and I have used some of them to analyze our data. At the end of our study, we will come to conclusions that may be different or similar to those studies.

3. Overview

This section of the study explains various aspects of the study that affect the outcome. It also gives the direction of the flow of the study. First, this section defines the exchange rate and how it is affected by macroeconomic factors such as GDP, unemployment, and inflation. The section also discusses the macroeconomic variables that indicate the impact on exchange rates. We will also discuss the hypothesis of the study in this section. Finally, this section will also discuss the impact that Brexit and COVID -19 had on exchange rates.

3.1 What is an Exchange Rate?

An exchange rate (also called a foreign exchange rate, forex rate, or FX rate) between

two currencies is the rate at which one money will be traded for another. The exchange rate that is taken into consideration in New York is $/£ as the Dollar is the base currency and the Pound is the quote currency through which the exchange would be made. In London, the exchange rate would be £/$ as Sterling Pound is the base currency and the Dollar is the quote currency.

The exchange rate is what defines the value of a currency about another with the aim of conversion. Different countries have different currencies which weigh differently in the global market. To exchange the value of a currency to the next, one has to consider the index and the exchange rate. This ensures that when transitioning from one country to the next, the client receives the same value of the new currency as the old. This is achieved through Forex. The Forex market is one in which a nation’s currency is traded for another at a mutually agreed rate. It is run electronically within a network of banks, 24 hours, 5 days a week. Many aspects of the Forex market remain constant despite the electronic revolution. As has been true for decades, the markets remain decentralized with high liquidity and continuous trading (Lyons, 2001; Rime, 2003).

The Forex market assumes a fundamental part in modern economic relations. It associates worldwide enterprises, global banks, and government in a bound together worldwide network for purchasing and selling monetary forms. It is hard to imagine a modern economic system without this fundamental component of the folio. This market is planned as a stock trade. Like numerous other markets, the Forex market draws in critical investments to make a theoretical benefit in the present day.

The basic concept behind the Forex market is for trading currencies, one pair against another. It’s the world’s largest market, consisting of almost $2 trillion in daily volume, and is growing rapidly. The value of one currency is determined by its comparison to another currency via the exchange rate. The major currencies traded most often in the foreign exchange market are

the euro (EUR), United States dollar (USD), Japanese yen (JPY), British pound (GBP), and the Swiss franc (CHF) (Gaucan, 2010)

3.2 Macroeconomic variables description

Macroeconomic variables are the indicators that a country considers to understand its economic reality about other countries. Each of these variables generates essential information to promote a nation’s development based on its internal activities.

US Nonfarm Payrolls measures the change in the number of people employed during the previous month, excluding the farming industry (Investing.com).

US Unemployment Rate measures the percentage of the total workforce that is unemployed and actively seeking employment during the previous month (Investing.com).

US ADP Nonfarm Employment Change measures the monthly change in non-farm, private employment based on the payroll data of approximately 400,000 U.S. business clients. Two days ahead of government data, the release is a good predictor of the government’s non-farm payroll report. The change in this indicator can be very volatile (Investing.com).

US New Home Sales measures the annualized number of new single-family homes sold during the previous month. This report tends to have more impact when it’s released ahead of Existing Home Sales because the reports are tightly correlated.

US Building Permits measures the change in the number of new building permits issued by the government. Building permits are a key indicator of demand in the housing market.

US C.B. Consumer Confidence measures the level of consumer confidence in economic activity. It is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. Higher readings point to higher consumer optimism.

UK Claimant Count Change measures the number of unemployed people in the U.K. during the reported month. A rising trend indicates weakness in the labor market, which has a trickle-down effect on consumer spending and economic growth.

UK Retail Sales measure the change in the total value of inflation-adjusted sales at the retail level. It is the foremost indicator of consumer spending, which accounts for the majority of overall economic activity.

UK Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

UK Interest Rate Decision Bank of England (BOE) monetary policy committee members vote on where to set the rate. Traders watch interest rate changes closely as short-term interest rates are the primary factor in currency valuation.

UK Manufacturing Production measures the change in the total inflation-adjusted value of output produced by manufacturers. Manufacturing accounts for approximately 80% of overall Industrial Production.

3.3 An Overview about the effect of Brexit and Covid-19

The major events that are taking place in the country do affect economic development and GDP. When the U.K. was part of the European Union, the companies would buy and sell any products in the whole E.U. without any restrictions. Also, numerous facilities were available for the businesses, which resulted in many options for performing any business. However, after Brexit, the condition has changed, and although U.K. and E.U. have reached an agreement where they facilitate each other, some effect is felt on the GDP of the country (Barnes, 2021). According to the Financial Times (www.ft.com) analysis, Brexit resulted in less British income by 1.3%. Brexit had a 2.5% negative impact on the British economy as well.

Now that the U.K. is no longer part of the E.U., it can develop its trade policies and develop trade policies with other countries. Trade between the E.U. and U.K. is conducted as the trade of the E.U. with foreign countries. The economic impact of Brexit was a major concern during the referendum, and economists deduced that Brexit would reduce the per capita income of citizens of the U.K. However, people in favor of Brexit declared that the U.K. would save a lot of resources that it had to contribute in the E.U. funds, which will help balance the economy. The cessation of the net contribution to the E.U. is expected to bring positive changes to the U.K.’s economic development in the long run (Corsetti, 2021). According to Corsetti (2021), ever since Brexit, the U.K. has signed 38 trade agreements and policies with 96 countries to cover Brexit’s impact. Corsetti (2021) also states that the country’s economic status due to these trade agreements will increase by 12% by 2030.

The impact of Brexit that has been felt until now is the rising inflation and increased prices of goods, which have increased the average household’s budget. Also, due to the uncertainty that was present due to Brexit in the U.K., the investment rate was reduced. The average income of people has been reduced for the citizens of the U.K., and the trade between U.K. and E.U. has decreased which, has resulted in the loss of economy. European firms have stopped investing in the U.K. after the Brexit referendum, which is again a loss for the economy. The consumer trust in the market had substantially reduced. Economists agree that leaving the E.U. was the worst decision of the U.K., which will affect its economy negatively in the long future. After the full implementation of Brexit at the end of 2020, it is expected that it will take around 15 years for the U.K. to get back on its way to development (Feng, 2021). Feng (2021) conducted a study to determine the inflation rate since Brexit. According to Feng (2021), since Brexit, the U.K. has witnessed a 2.1% inflation rate, almost twice as high as before. The researcher also states that the average Brit’s salary was reduced by 1.3%.

One of the impacts of Brexit for the U.K. was that many firms shifted their business, assets, and offices from the U.K. towards continental Europe. Banks, assets management, and insurance companies transferred trillions of dollars outside the U.K. Most of the companies left the U.K. and moved to Dublin, Frankfurt, Paris, Amsterdam, etc. The impact that the U.K. felt after leaving E.U. was mostly negative except for some short-term volatile impacts. The economy of the United Kingdom shrunk after the announcement of Brexit, and the industrial activities suffered due to uncertain market conditions. The new tariffs imposed on the United Kingdom industries have resulted in a decrease in business activities. The supply chain of the U.K. businesses is threatened, and the imports of raw materials have increased the costs of goods and services. People are earning less, and many of them have lost their jobs and are claiming unemployment benefits which are a threat to the economy (Gunay et al., 2021). According to Gunay et al. (2021), the unemployment rate rose to 3.9% after Brexit. On the other hand, more than 400 businesses have moved from the U.K. to other countries and continents.

Apart from Brexit, the economy of the United Kingdom and the United States is affected by Covid, which decreased the GDP of the countries. Covid was first identified in Wuhan, China, and later spread in the whole world. It resulted in a decrease in economic activities, and businesses around the suffered from huge losses. The economy of the United Kingdom declined at a record rate of 9.9 percent, and numerous industries related to production, manufacturing, and construction experienced a downfall (Wang, 2020). The services sector also failed miserably due to Covid, such as the accommodation and food sector. Administrative and support services also suffered a decline, and some of the other industries affected by Covid were employment agencies, rental, leasing industries, etc. (Oliveira, 2021).

Overall, in the United States almost, all industries faced problems due to Covid, and the decrease in business activities resulted in a decrease in the GDP. GDP for January 2021 was 2.9 % less than its value in the year Feb 2020 (Too, 2020). All the contributors of the GDP remain less than their pre-pandemic levels. The magnitude of the recession due to Covid is unprecedented, and GDP dropped by record value after the 1948 recession. The United Kingdom is suffering from the shared effects of Covid, and Brexit and the economy are expected to decline in the future. With no support from European Union, it is difficult that the country will be able to steer the economy in the right direction. The rise in unemployment and poverty level is another effect of Covid. Covid has affected government expenditures, and tax revenues have decreased and government spending has increased. The budget deficit will reach a new level, and government loans have increased (Ramalho, 2020).

The conditions of GDP of the United States are not different from the U.K. as the businesses have suffered huge losses and the unemployment rate has increased. An important aspect of COVID’s impact in the United States is that there is a differential impact of the virus on the various racial and ethnic groups. Covid has affected the pattern of consumer spending, and people are around 8.7 percent less on retail spending, which has resulted in a decrease in GDP. The decrease in consumer spending has led to decreased industrial production, which is a challenge for the manufacturing sector, which employs 13 million workers (Reynolds,2020). The impact of the financial crisis on the workers varies in terms of their sector, and some sectors suffered more losses than others. However, the overall impact on the economy is negative, and the GDP has declined (Reilly, 2021).

To conclude, it can be said that the impact of Brexit and Covid on the financial conditions of the U.K. is negative. The economy has been affected by the combined effect of these two factors, and the GDP has declined. Moreover, the situation is not expected to improve soon and depends upon the life of the virus. Similarly, the conditions in the United States are no different from the U.K., and the GDP has declined. Investment in all fields is declining, and consumer spending has decreased, affecting the retail sector. Unemployment and poverty levels are rising, and although the government is trying to control the situation, but expected to be worse in the future.

4. Research Question and Hypothesis

4.1 Research Question

Is there a correlation between the macroeconomic announcements and the GBP/USD exchange rate?

4.2 Hypothesis

There is a statistically significant correlation between the macroeconomic announcements and the GBP/USD exchange rate.

A higher number than the forecast that announced from the report should be taken as positive for the USD, so that means that the GBP/USD exchange rate will decrease, while a lower than forecast should be taken as negative for the USD/USD will increase. We can see that in U.S. Nonfarm payrolls, US ADP Nonfarm Employment Change, U.S. New Home Sales, U.S. Building Permits, U.S. C.B. Consumer Confidence.

A higher number than the forecast announced from the report should be taken as negative for the USD, so that means that the GBP/USD exchange rate will increase, while a lower than forecast should be taken as positive for the USD/USD will decrease. We can see that in the U.S. Unemployment rate.

A higher-than-expected reading should be taken as negative for the GBP, so GBP/USD will decrease, while a lower-than-expected reading should be taken as positive for the GBP, so GBP/USD will increase. We can see that in U.K. Claimant Count Change.

A higher-than-expected reading should be taken as positive for the GBP, so GBP/USD will increase, while a lower-than-expected reading should be taken as negative for the GBP, so GBP/USD will decrease. We can see that in U.K. Retail Sales, U.K. Consumer Price Index (CPI), U.K. Interest Rate Decision Bank of England (BOE), U.K. Manufacturing Production.

5. Data and Methodology

5.1 Data

Our data set consists of high-frequency exchange rate and announcement data (Our exchange rate data consists of continuously 1-minute nominal spot data for GBP/USD). I collected a large number of real – times macroeconomic announcements from both the United States and the United Kingdom.

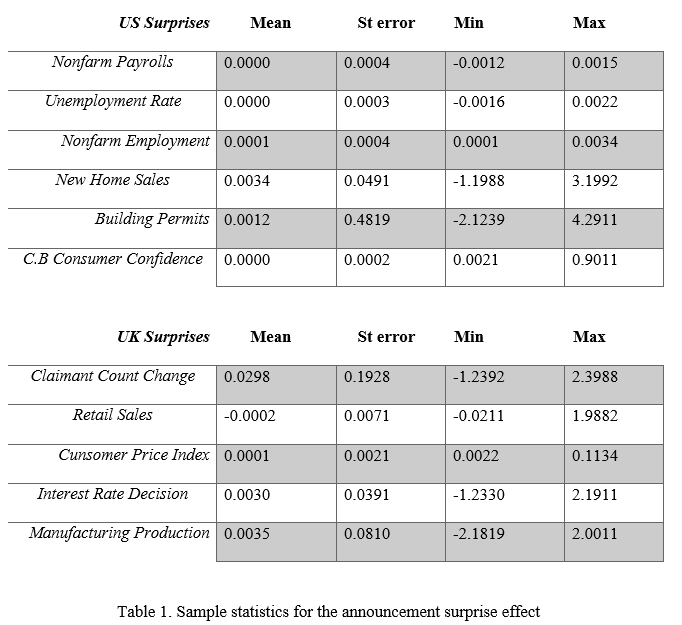

5.1.1 Macroeconomic Announcement Data

We define an announcement surprise as the difference between the market expectation for an announcement and the announced value. We arrange the data so that a positive surprise indicates that the data was higher than expected, while a negative surprise indicates that the data was announced lower than expected.

A variety of macroeconomic announcements have been used in the literature. My selection of macroeconomic announcements for the United States and the United Kingdom includes those typically used in the literature and closely watched by participants in the GBP/USD market.

There are many possible definitions of “news.” For our analysis, I define “news” as “surprises” as measured by the difference between actual values of macroeconomic variables and market forecasts.

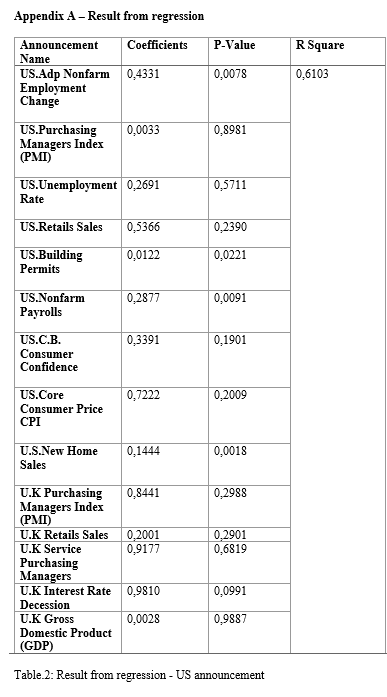

Following an approach familiar in the literature, I use the median of the survey data to measure market expectations. Using methods commonly used in the literature, we find evidence that these forecasts are consistent with the rational expectations hypothesis. Since both actual and predicted announcements are stationary, these tests are based on OLS. Table 1 reports the sample statistics of the measured surprises associated with the selected macroeconomic announcements.

The + and – in the surprises means that the value has either increased or decreased as per the value of the mean. The + sign means that it is positive and it is a good sign. The – sign means that the value is not good. It wouldn’t be a surprise if the value is less than 0 as it would only mean that there has been a decline in the overall value.

5.1.2 Variable Definition

The data used in this study consists of daily GBP/USD exchange rates (Graph 1) and one-minute exchange rates movements; the data were from two different sources: The daily exchange rate was obtained from investing.com, and the one-minute exchange rate are obtained from Backtesmarket.com. The macroeconomic announcement data was obtained from investing.com.

The period under study begins 01 January 2016 and ends 31 December 2020. This period was chosen because, in this period, we can see the macroeconomic announcement effect and the effect of the event that affects the world economy and take effect in the macroeconomic announcement.

Figure.1 GBP/USD chart for the period 2016-2020 (Source: Investing.com)

5.1.3 Dummy Variable

I added a dummy variable to the independent. Since dummy variables generally take on values of 1 or 0. The choice of 1 and 0 to identify a category is arbitrary.

D =

Here we use the notation D in place of X to denote the dummy variable.

5.2.1 Theory

In the present and existing models of systematic exchange behavior, several random walk-in models perform out-of-sample forecasting based on the realized values of the explanatory variables, which are used for comprehending the impact of differences, variations, and fluctuations in the exchange rate on the vital yet common measures of unemployment, inflation rate and so on. The research presents the impact of the dependent variable, which is the exchange rate over that of independent variables. Different theories are used for determining the exchange rate and its impact on the different areas. These theories include:

- Mint Parity Theory: It is one of the earliest theories of foreign exchange and it was pertained according to the value of metallic standards like silver and gold. The value of the currency as per the value of gold is determined as per the weight of gold. The price at which the currency of the country is converted is known as the Mint Price. The exchange rate in this case is determined on a weight-to-weight basis.

- Purchasing Power Parity Theory: This method is useful as it determines the rate of exchange between the two inconvertible paper currencies. This theory presents the equilibrium rate of exchange within two convertible paper currencies which is determined by the internal price levels that are running in two countries. There are two versions in this theory which are the active and the relative version.

- Balance of Payment Theory: This theory is also quite useful in determining the exchange rate according to the factors of the internal price level and the money supply of the country. The exchange rate in this case is determined according to the position of the balance of payments and the situation wherein the demand of foreign exchange is exceeding the supply at a specific exchange rate. The demand for foreign exchange has and the balance of payments has a big impact on the exchange rate.

- Monetary Approach to Foreign Exchange: Under this approach, the exchange rate is determined based on the flow of funds that are directed in the foreign exchange rate market and the monetary approach presents that the rate of exchange is determined based on the demand and supply of money in the countries. The determination of the exchange rate and its impact on the unemployment rates and the inflation rate opts from the following manner respectively.

- Portfolio Balance Approach: This theory specifically uses the trade explicitly for determining the rate of exchange through the use of domestic and foreign financial assets such as bonds, etc.

5.2 The Impact of Economic News on Financial Markets

The return on any security consists of two parts.

1) The expected or normal return: the return that shareholders in the market predict or expect.

2) The unexpected or risky return: the portion that comes from information that will be revealed.

Any announcement can be broken into two parts, the anticipated or expected part and the surprise or innovation:

Announcement = Expected part + Surprise

The expected part of any announcement is part of the information the market uses to form the expectation, of the return. The surprise is the news that influences the unexpected return U.

R= +U

Where

is the expected part of the return

U is the unexpected part of the return

The surprise is the news that influences the unanticipated return on the exchange rate.

Systematic risk is any risk that affects an exchange rate, each to a greater or lesser degree.

Unsystematic risk is a risk that specifically affects a single asset or a small group of assets. Unsystematic risk can be diversified away. Examples of systematic risk include uncertainty about general economic conditions, such as GNP or inflation.

We can break down the risk, U, into two components: systematic risk and unsystematic risk:

R= +U

becomes

R= +m+

where m is the systematic risk and is the unsystematic risk

The beta coefficient, , tells us the response of the return to systematic risk.

Our model is:

R= +m+

so

= ,

where the left-hand side Ri denotes exchange rate (dependent variable) returns within time t, and on the right-hand side, we have which is the Y-intercept. is the population slope coefficient. is the independent variable (unemployment rate, GDP, inflation rate). is the random error component. We will analyze the 5minutes, 15 minutes, and 30 minutes exchange rate, X,t is the surprise of macroeconomic news at time t.

I use multiple linear regression modeling to estimate coefficients for the independent variable in the model.

Y= a + ……….. + + i=1,…..,n (1)

Where Y denotes exchange rate, a denotes intercept, and X1, X2, ……. Xn denotes relative macroeconomics variables, D dummy variables in place of x.

5.2.1 Empirical Model

This study uses the following regression equation;

H0: b=0

H1:b 1

Z test =

Z test =

Z test = where S. =

- = GBP/USD exchange rate (dependable variable)

- = GDP, unemployment rate, and inflation rate (independent variable)

- a, b = coefficients

- i, t = indices for individual factors influencing GBP/USD exchange rate.

5.2.2 Calculate exchange rate return

If the announcement is published at time t, I examine the short-run effects, that is, I calculate the returns as the percentage change in the exchange rate between the five minutes before t and the five minutes after t

is the exchange rate five minutes after time t

is the exchange rate five minutes before time t

6. Results

Thus, the initial expression yields the following model for a single pressor;

=

The left-hand side Ri denotes the returns to the exchange rate (dependent variable) within time t, and on the right-hand side, we have which is the Y-intercept. is the population slope coefficient and D for the dummy variable. is the independent variable (unemployment rate, GDP, inflation rate). is the random error component. Therefore, the marginal elements ensure compliance with the mean function size and model derivation.

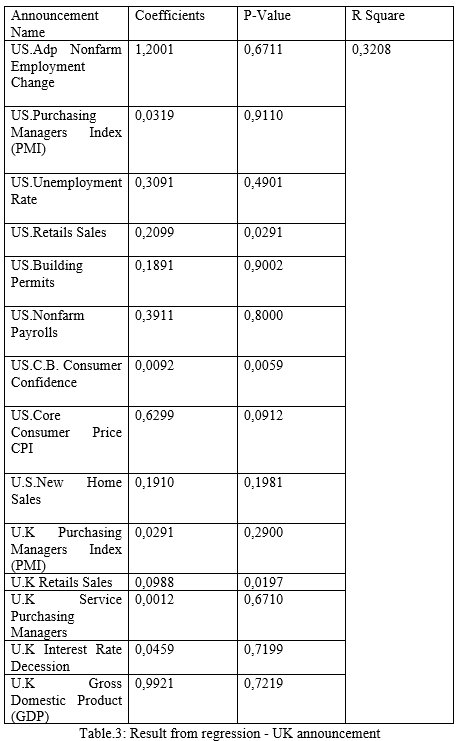

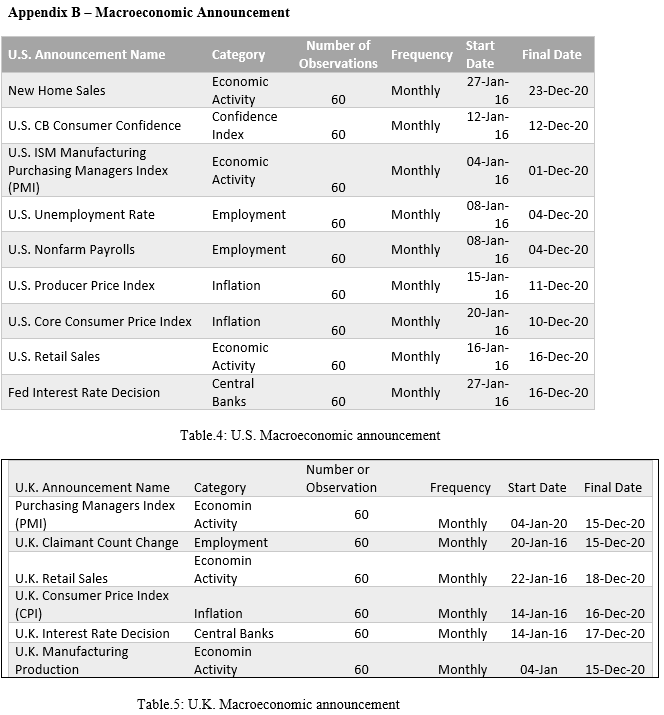

I ran two multiple linear regression analyses, one for the period 5 minutes before the announcement and 5 minutes after the announcement, to examine the surprise effect. I ran another regression for the period 24 hours before the announcement and 24 hours after the announcement to examine the effect when the surprise disappears and to see if the announcement still affects the exchange rate.

The findings indicate the relevant regression values R and R2. The R-value that I got from represents the simple correlation which is 0.575, which provides a notable relationship and regression indicating that there is a high degree of correlation. The R2 value (R Square) indicates how much of the total variation in the dependent variable (Exchange Rate) can be explained by the independent variable (Macroeconomic Announcements). In this case, 61.0% has been found.

Anova

The regression model predicts the dependent variable significantly well whereby the level of significance (sig) is less than (significance 0.05).” Again it indicates the statistical significance of the regression model (that was run). Here, p < 0.000, which is less than 0.05, and indicates that, overall, the regression model statistically significantly predicts the outcome variable, which is a good fit for the data and data presentation.

Coefficients

The Coefficients table provides the necessary information to predict price from macroeconomic announcements and determine whether macroeconomic announcements influence statistically significantly to the model. This is viewed with the help of sig.

7. Discussion and conclusion

The exchange rate is affected by the appearance of news and new data. This implies that macroeconomic events and announcements have significant effects on the exchange rate. Macroeconomics is the branch of economics that deals with capital formation, national income, price levels, growth rates, and changes in unemployment (Egert and Kocenda, 2014). The prices of currency pairs fluctuate depending on the demand in the market. The fluctuations are either upward or downward, where certain announcements can cause drastic movements that can last from a few minutes to several hours to months and even years. This can also be defined as the announcement effect (Egert&Kocennda, 2014). This study examines the impact of such news on financial markets. The news is defined as the difference between what the market expected and the reality or actual release. Different historical records are used to compare two currencies, the UK Sterling Pound and the U.S. dollar.

In this paper, I examined the extent to which the daily movements of the GBP/USD exchange rate were influenced by news about the macroeconomic situation in the United States and the United Kingdom during 2016-2020.

I also examined whether market participants reacted differently to the news depending on whether the news came from the United States or the United Kingdom and whether it was good or bad news.

I found that macroeconomic news has a significant correlation with the daily movements of the GBP/USD. However, there is considerable variation in this relationship over time. There is evidence of asymmetries in the response of the exchange rate to news, but to varying degrees at different times. Our rolling regression results also provide some evidence that the market appears to ignore good news at certain periods and remains fixated on bad news, as is often suggested in a market commentary.

References

Barnes, P. (2021). The use of contracts for difference (‘CFD’) spread bets and binary options (‘forbin’) to trade foreign exchange (‘forex’) commodities and stocks and shares in volatile financial markets.

Chakraborty, I., & Maity, P. (2020). Covid-19 outbreak: Migration, effect on society, global

environment, and prevention. Science of the Total Environment, 728, 138882.

Corsetti, G., Lafarguette, R., & Mehl, A. (2021). Fast trading and the virtue of entropy. Europe.

Égert, B., & Kočenda, E. (2014). The impact of macro news and central bank communication on emerging European forex markets. Economic Systems, 38(1), 73-88.

Feng, Q., Sun, X., Liu, C., & Li, J. (2021). Spillovers between sovereign CDS and exchange rate markets: The role of market fear. The North American Journal of Economics and Finance, 55, 101308.

Gunay, Samet. “Comparing COVID-19 with the GFC: A shockwave analysis of currency markets.” Research in International Business and Finance 56 (2021): 101377.

Ito, T. & Hashimoto, Y. (2009). Effects of Japanese Macroeconomic Announcements on

The Dollar/Yen Exchange Rate: High-Resolution Picture

Kočenda, E., & Moravcová, M. (2018). Intraday effect of news on emerging European forex markets: An event study analysis. Economic Systems, 42(4), 597-615.

Lyons, Richard K. (2001). The Microstructure Approach to Exchange Rates. MIT Press,

Cambridge, MA.

Mankiew, N. Georgy. (2010). Macroeconomics, 7th Edition. Harvard university

Minford, P. (2019). The effects of Brexit on the U.K. economy (No. E2019/1). Cardiff Economics

Working Papers.

Moravcová, M. (2018). The Impact of German Macroeconomic News on Emerging European Forex Markets. Prague Economic Papers, 27(5), 505-521.

Oliveira, T. M. D. L. C. S. D. (2020). How currency crises impact on stock markets: a cointegration analysis (Doctoral dissertation).

Parker, J. (2007). The impact of economic news on financial markets: ECONOMIC_NEWS_PAPER_VERSION_6_APR_07

Ramalho, D. R. V. (2020). Predictive performance of value-at-risk models: Covid-19 “Pandemonium” (Doctoral dissertation, Instituto Superior de Economia e Gestão).

Reddy, Y. V., Ingalhalli, V. B., & Sahay, H. (2019). The impact of macroeconomic announcements on financial market volatility in India. IUP Journal of Applied Finance, 25(2), 65-90.

Reilly, M., & Lee, C. Y. (Eds.). (2021). A New Beginning or More of the Same?: The European Union and East Asia After Brexit. Springer Nature.

Reynolds, B., Blake, D. P., & Lyddon, B. (2020). Managing Euro Risk. Available at SSRN 3619428.

Rime, Dagfinn (2003). New Electronic Trading Systems in the Foreign Exchange Markets.

Jones (ed.), New Economy Handbook, chap. 21. Academic Press, San Diego, pp. 471–504

Too, S. X., Chng, J. N., Sim, J. H., Soo, Y. Y., & Tan, Q. Z. (2020). Stock market reaction of selected E.U. countries to the Brexit (Doctoral dissertation, UTAR).

Wang, D., Li, P., & Huang, L. (2020). Volatility Spillovers between Major International Financial Markets During the COVID-19 Pandemic. Available at SSRN 3645946.